Homebuying season accounts for 40% of home sales (or about 2.1 million homes in the May-through-August period of 2019), according to the National Association of Realtors® (NAR).

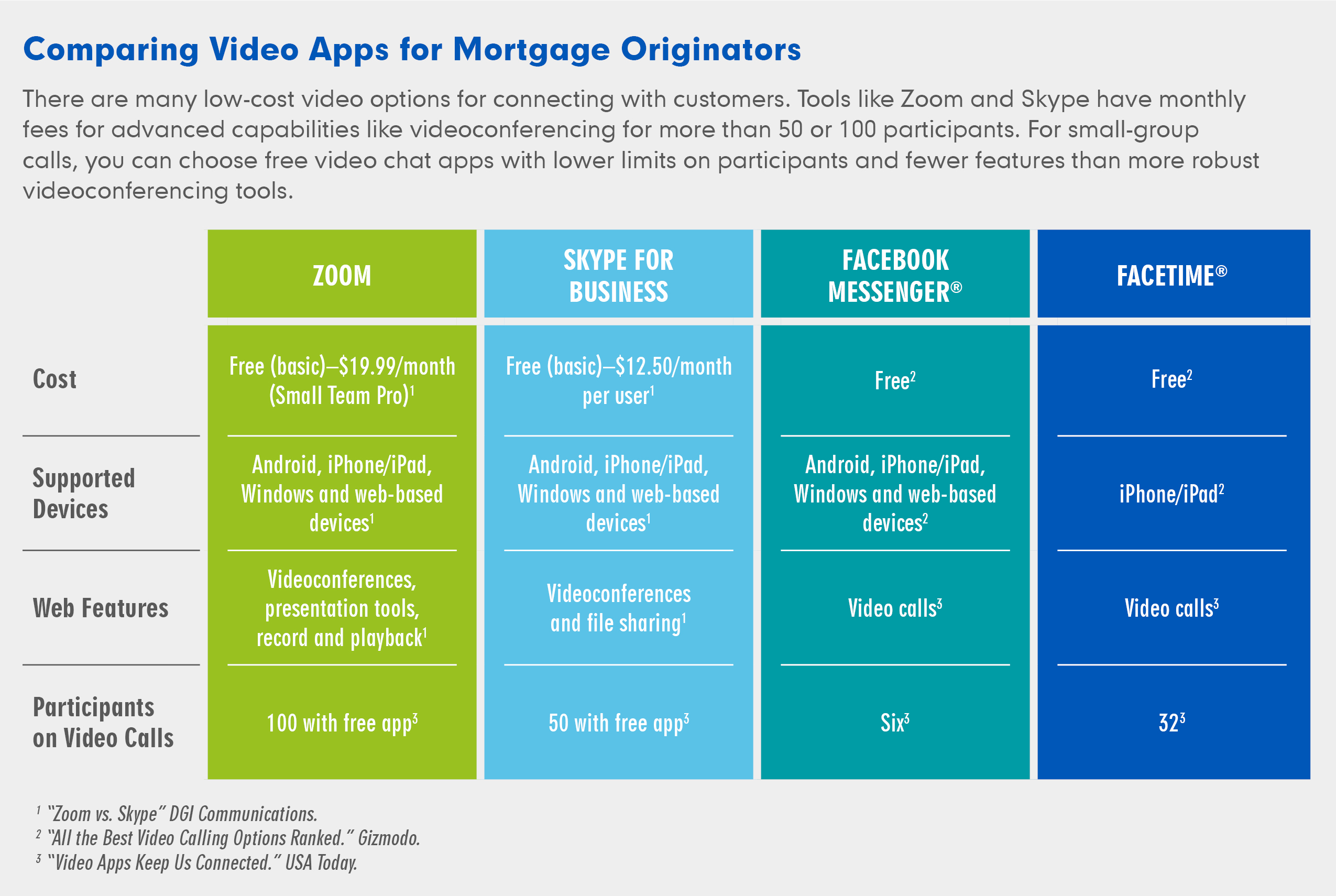

For originators focused on staying connected with customers during this important four-month span while remaining sensitive to health concerns, online meeting tools provide a way to communicate with current customers and prospects. You can even present spring homebuying seminars for first-time buyers that they can view at home when it’s convenient.

Deliver Our Seminar Presentation Live or as a Webinar

Arch MI provides a complimentary toolkit called the Roadmap to Home Ownership (RtHO), which includes an in-depth PowerPoint® presentation to help you guide prospective homebuyers to achieving affordable homeownership:

- It’s relatively easy to share the RtHO presentation as a live webinar using apps like Google Slides, PowerPoint Online or Facebook Live to allow multiple customers to log on from various locations to see your presentation with audio using most smartphones, tablets or home computers.

- Your webinar can also be recorded for families and individuals to view and hear at their convenience.

- You can also share the presentation one-on-one to smartphone users with low-cost apps like Zoom or Skype.

Arch MI is presenting a complimentary hour-long webinar for loan originators titled How to Set Up and Conduct Virtual Meetings with Your Borrowers. Registration is now open for two separate sessions:

- Tuesday, April 7, 2020

2–3 p.m. ET.

- Tuesday, April 9, 2020

11 a.m.–Noon ET.

RtHO makes it easy to co-brand the presentation and other resources with your company’s logos and contact information. The materials include worksheets and other resources to help borrowers prepare for a home purchase and determine an ideal mortgage amount for their budget. With social distancing and self-imposed quarantines in force, homebuyers can use the time at home to go over their options, complete the worksheets and emerge better prepared for the biggest financial decision of their lives.

Misconceptions about Mortgage Requirements Persist

The homebuying process can be confusing for first-time buyers, including those facing challenges like only having a small down payment or substantial student loan debt.

Your seminar can also address misconceptions a surprising number of potential buyers have about mortgage requirements. In a Borrower Insight Survey that Ellie Mae conducted two years ago, 48.6% of renters said buying a house requires a down payment of 20% or more. In fact, the median down payment was 5.4% in 2018, thanks largely to mortgage insurance (MI) that protects lenders in the event of borrower default.

MI Tax Deduction Boosts Affordability

Repeat buyers who haven’t shopped for a home recently can also benefit from homebuying seminars due to changes in the homebuying market. In December, for example, Congress restored the MI tax deduction for eligible buyers who itemize in a move that lowers the cost of homeownership for both new buyers and refi customers.

Facts about Spring Homebuying and Buyer Behavior

Spring still remains an important time for homebuying, but the home market has become less seasonal over time. While the academic calendar continues to lead many families to buy homes ahead of the start of the school year in the fall, first-time buyers in particular are starting their searches earlier than in the past.

Due to the scarcity of entry-level homes, home searches by first-time buyers are now often conducted over many months. June still stands out as the peak month of home-selling activity, but forecasters say prospective homebuyers are starting searches much earlier with every passing year in an effort to find homes within their budget.

According to Realtor.com, there were 9.5% fewer homes for sale in November than there were in the same period of 2018. The inventory of entry-level homes was even tighter, with 16.5% fewer homes priced at $200,000 or less than in November of the previous year.

While June is typically the peak month for home sales, May took the lead in 2019 with 542,000 sales of existing homes on a non-seasonally adjusted basis. Interestingly, December saw surprisingly strong sales with 434,000 homes sold — or just 19.9% fewer than in May.

Arch MI’s Insights blog is a forum for exchanging ideas. If you have started connecting with more customers via phone messaging or video apps, send us an email to tell us about it.