Accounting for nearly one in five home purchases, single women are a quiet force in the housing market. We dug into the research to uncover five important facts for mortgage originators to know about women who are buying homes for themselves.

1. Impact on the housing market. Nationwide, 18% of homes were purchased by single women in 2019 — the second-largest homebuyer segment after married couples, according to the National Association of Realtors® (NAR). Purchases by single women are up sharply from 11% in 1981 when NAR started keeping records on the measurement.

- Women far outpace single men (who account for 9% of home purchases).

- As reported in a survey for the Bank of America’s 2018 Homebuyer Insights Report, 73% of single women prioritize owning a home (vs. 65% of men).

- In the survey, single women ranked buying a home above other life events, such as getting married (41%) and having children (31%).

2. Independence motivates single female buyers: When asked about buying a first home, single women told Bank of America’s survey team a purchase would make them feel independent (57%), successful (47%) and empowered (31%).

While those responses could form the outline of a lender’s marketing campaign for women, other studies reveal hurdles for mortgage originators when it comes to translating the desire for a home into action. According to a 2019 LendingTree.com survey, single women who are first-time buyers lag behind repeat female buyers in terms of their familiarity with the following subjects:

- The different types of mortgages available: First-time buyers (21%). Repeat buyers (47%).

- The mortgage process: First-time buyers (17%). Repeat buyers (60%).

- Cash required at closing: First-time buyers (26%). Repeat buyers (55%).

- Down payment requirements: First-time buyers (33%). Repeat buyers (60%).

3. Women are outpacing men in education and in the workforce: According to Pew Research, 29.5 million women in the labor force have a bachelor’s degree — slightly higher than the 29.3 million men with four-year degrees. Women now account for 50.2% of the college-educated workforce — an 11% increase since 2000. It should be noted that college-educated women earn a median $51,600 versus $74,900 for men. That’s reflected in home purchases, with single women buyers paying a median $189,000 for a home compared single men at $215,000, according to NAR.

Home purchases by single women have increased impressively over the past four decades — as market share among married couples and single males has declined. There may be untapped potential when it comes to women buyers, but surveys show growth is being curtailed by a lack of knowledge about the requirements for getting a mortgage.

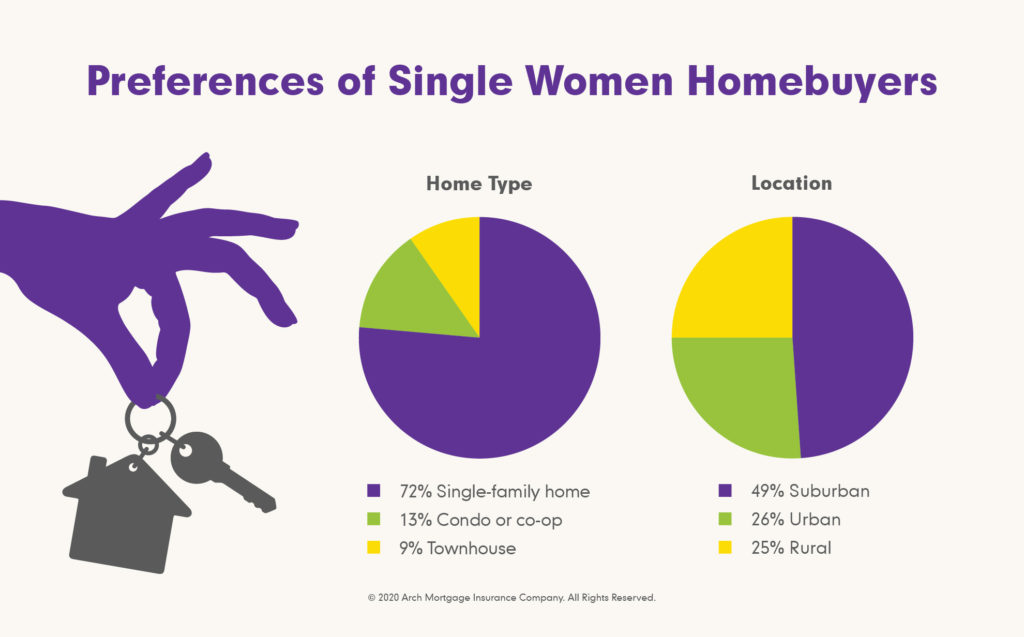

4. Typical purchases: Single women tend to buy condominiums and homes in developments with added security and gated access, according to a 2019 article in The Balance citing statistics from the Joint Center for Housing Studies. Other preferences include cities more than rural areas and homes with two bedrooms — to accommodate a child or an adult parent they’re caring for.

5. Financing a home: With a median age of 54, single women homebuyers include both those who were never married and those who need a new home following divorce or other life events. As a result, women homebuyers are less likely than other buyers to tap into their savings accounts for down payments, with 52% using savings to cover the initial cost of home ownership and 39% using the proceeds from the sale of a previous residence, according to NAR figures.

Conclusions

Looking at these five facts together, it’s clear there’s a strong desire among many single women to buy a home. However, a lack of knowledge about mortgage requirements is likely keeping some prospective buyers from actively taking steps toward a home purchase.

The recent LendingTree.com survey on this knowledge gap seems to point toward solutions such as homebuying seminars and other education programs for first-time buyers. But are today’s busy professionals likely to make time for a lengthy presentation on homebuying?

Arch MI’s Roadmap to Home Ownership (RtHO) is a complete toolkit to help you guide current and prospective homebuyers to achieving affordable home ownership. The RtHO is complimentary and includes resources to assist new homeowners with common concerns.

Has borrower education been effective for your lending business? We’d love to hear your thoughts on inspiring single homebuyers (both female and male) to pursue the benefits of home ownership. Send us an email with strategies you’ve used to help these potential buyers meet their goals — whether it’s offering one-on-one advice, holding homebuying seminars for unmarried borrowers or other outreach initiatives.

We look forward to hearing from you.