With generative artificial intelligence (AI) transforming the mortgage industry, loan officers who want to establish an edge are building their AI skills now — while also educating themselves to avoid career-damaging pitfalls.

1. AI and Generative AI

At the start, it’s important to define the difference between standard AI and more advanced generative AI. For more than three decades, most lenders have embraced the early beginnings of AI in underwriting rules engines like Fannie Mae’s Desktop Underwriter® and Freddie Mac’s Loan Product Advisor®. Both were introduced in the mid-90s to accelerate processing while ensuring compliance with GSE requirements.

Today, we see advanced generative AI tools powering new chatbots that consumers can use to learn about loan products, see what they may qualify for and start the loan process by interacting with an AI assistant Bankrate.com reports. Generative AI is also present on the backend, helping lenders more efficiently move applications from preapproval to underwriting and closing.

Examples of the advanced capabilities AI can provide was revealed by Rocket Mortgage in an April 2024 corporate announcement. The company stated its Rocket Logic AI Platform reduced turn times by 25% from August 2022 to February 2024. The resulting turn times are nearly two-and-a-half times faster than the industry average.

We’ll discuss other advanced mortgage industry applications next month in our next blog post, Succeed with AI Part 2. Stay tuned for our follow-up.

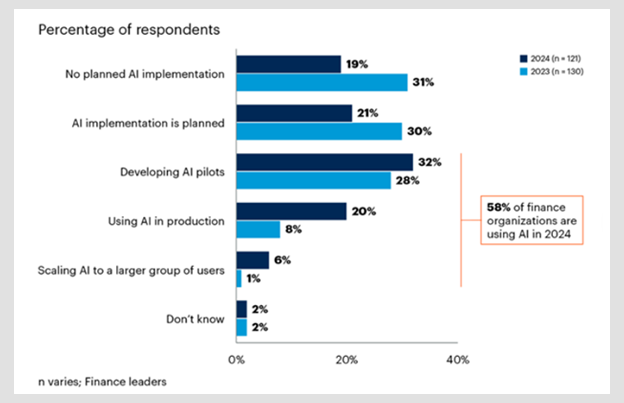

It’s clear the banking industry is excited about the potential for AI to boost efficiency and lower costs. In 2024, 58% of finance leaders surveyed by Gartner Group had already deployed AI or were planning AI initiatives, up from 37% a year earlier.

Lenders also have concerns that are holding back progress. In a 2023 Fannie Mae survey, mortgage executives said the chief barriers to adopting AI include the difficulty of integrating AI with existing systems, high costs and data privacy concerns. At the same time, banks worry that AI’s advanced ability to mimic human speech could increase fraud. According to Deloitte, bank fraud could reach $40 billion in the U.S. by 2027, up from $12.3 billion in 2023.

2. Challenges Loan Officers May Face with AI Integration

To stay ahead with new AI capabilities, many mortgage loan officers are familiarizing themselves with the tools their employers have already deployed and are seeking out training opportunities.

As referenced earlier, privacy and fraud concerns make many mortgage lenders cautious about AI. As a result, employees should use care and be mindful of:

- Personal Information: Avoid using identifying customer information (or company data) in any non-company approved generative pre-trained transformer (GPT) application, including web-based tools that help with writing or generating images. Information you submit may be used to train the AI, potentially exposing your information to other users.

- Company Policies: It’s crucial to check your company’s policies before using even widely available AI tools to ensure those apps are authorized or don’t have restrictions you aren’t aware of.

- Legal Considerations: Before using AI-based apps to record meetings or phone calls, check with your company’s legal team.

With those guidelines in mind, this is a good time for even long-time mortgage industry employees to take advantage of opportunities to learn more about the technology’s capabilities:

- Attend Webinars: Stay updated on the latest AI trends and applications in mortgage lending.

- Company Training: Participate in training sessions to learn how to integrate AI tools into daily workflows.

Use ChatGPT: Explore how to enhance your personal marketing plans and customer communications with AI-driven insights.

3. Will AI Replace Mortgage Loan Officers?

In terms of employment outlook, the U.S. Bureau of Labor Statistics projects that employment of loan officers will increase by 4% from 2021 to 2031.

Many people still want to talk to a person — not a chatbot —about their mortgage questions, according to Bankrate.com. AI can assist with data collection and finding patterns in borrower-provided data, but human loan officers excel at coaching borrowers through the process.

Recent surveys show many consumers are also wary of AI technology. In a 2024 J.D. Power survey, 54% of consumer respondents had used a generative AI tool, but only 27% said they trust AI for financial information and advice.

As AI becomes increasingly important in the success of mortgage lenders, it’s almost certain the Insights blog will be revisiting this topic in future issues, including our next post. We’d love to have you describe your recent AI experiences in an email, and we may use your comments in future issues.