Fraud is detected in one in every 123 mortgage applications (which is an 8.3% increase over the previous year, according to the 2024 Cotality (formerly CoreLogic) Mortgage Application Fraud Index.

While technological advancements provide new means for fraudsters to create fake documents and manipulate information, lenders are constantly working to stay one step ahead by verifying and cross-checking borrower information. However, the rapid pace of technology changes affords fraudsters new ways to exploit the system.

Technology and the Human Factor

AI could cause U.S. fraud losses to grow by 32% each year, reaching $40 billion by 2027, according to a 2024 study from Deloitte, an investment management firm. “The ready availability of new generative AI tools can make deepfake videos, fictitious voices and fictitious documents easily and cheaply available to bad actors,” said the report.

Lenders “should consider coupling modern technology with human intuition to … preempt attacks by fraudsters,” Deloitte said. “There won’t be one silver-bullet solution, so anti-fraud teams should continually accelerate their self-learning to keep pace” with fraud attempts.

Identifying and Investigating Red Flags

As Arch MI’s Senior Trainer and a former mortgage loan officer, I emphasize the human element in fraud prevention discussions. Fraud attempts are often discovered because there’s something in the file — a red flag —that simply doesn’t make sense.

Red flags are typically discrepancies that trigger questions that must be addressed, but these questions don’t necessarily represent actual fraud. Fannie Mae’s online mortgage fraud training course highlights why reviewing each loan file for inconsistencies and confirming information through third parties “rather than relying upon unverified information provided by the borrower” is necessary.

A good resource for lenders is the Potential Red Flags for Mortgage Fraud document, which Fannie Mae regularly updates. When you suspect suspicious activity, you should escalate the issue based on your company’s policies regarding possible misrepresentations.

Taking a few minutes to research the business or re-verify a W-2 can save a lot of heartburn, reputational damage and money. The “True Cost of Fraud Study” released by LexisNexis® in 2024 determined that each $1 in fraud costs the financial institution $4.45, including the costs for investigating the incident, efforts to recover the lost funds and expenses related to stricter fraud detection technology.

Identifying Fraud

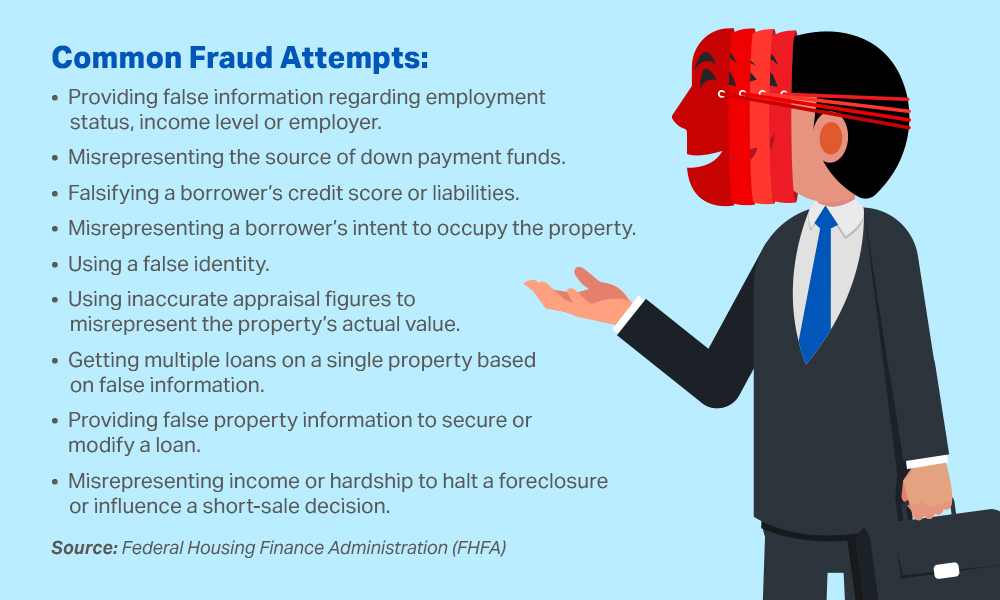

There are two distinct types of fraud: Fraud for profit typically involves insiders — such as appraisers, real estate agents and buyers — colluding to sell a home they don’t actually own or inflate a property’s value in a flipping scheme. Based on investigations and mortgage fraud reports, the FBI estimates that 80% of all reported fraud losses involve collaboration or collusion by industry insiders.

The second type of housing fraud usually involves borrowers falsifying information on loan applications to secure or maintain homeownership under false pretenses. This can include borrowers misrepresenting income, falsely claiming owner-occupancy status for better loan terms and using false identities to buy or sell properties.

With housing costs rising, housing fraud is on the rise as people misrepresent their income thinking that will improve their chances of being approved for the loan. Often, these attempts are discovered because lenders routinely cross-check multiple pieces of information. For example, lenders verify the borrower’s income several times during the mortgage process, including a re-verification just before closing.

Woman Pleads Guilty in $161 Million Case

Sometimes, mortgage schemes are discovered only after the loans go into foreclosure. In January, a Hampton, Georgia, woman pleaded guilty to a three-year scheme involving the approval of more than 400 mortgage loans (worth $161 million) based on fabricated documents and false information. As part of her plea, the 55-year-old woman agreed to pay restitution to the victims, including the U.S. Department of Housing and Urban Development, according to a U.S. Justice Department announcement.

The FBI investigates mortgage fraud, which is punishable by up to 30 years in federal prison, a $1,000,000 fine, or both.

Mortgage fraud may always be a threat, but it can be mitigated with increased awareness and proactive measures. Understanding the common types of fraud, leveraging technology for verification and fostering a culture of vigilance can help prevent fraudulent activities and ensure the integrity of the mortgage process benefits your customers.