In a recent survey, many single women homebuyers, who account for almost one-quarter (24%) of first-time purchasers, voiced serious complaints about their mortgage loan officers (MLOs) and the mortgage process (Single men only comprise 11% of first-time homebuyers).

As the number of women buying homes grows, originators can add to their pipelines by addressing complaints women have voiced, including providing more education upfront about what homebuyers should expect.

Increasing Trust in the Mortgage Process

In a study focused on women homebuyers, more than one-quarter of respondents said, “they don’t trust their loan officer” and 18% were unhappy with their mortgage experience. The report is based on a survey of 1,000 single women who had each completed a mortgage application in the previous five years and was published in 2024 by Maxwell Mortgage Software.

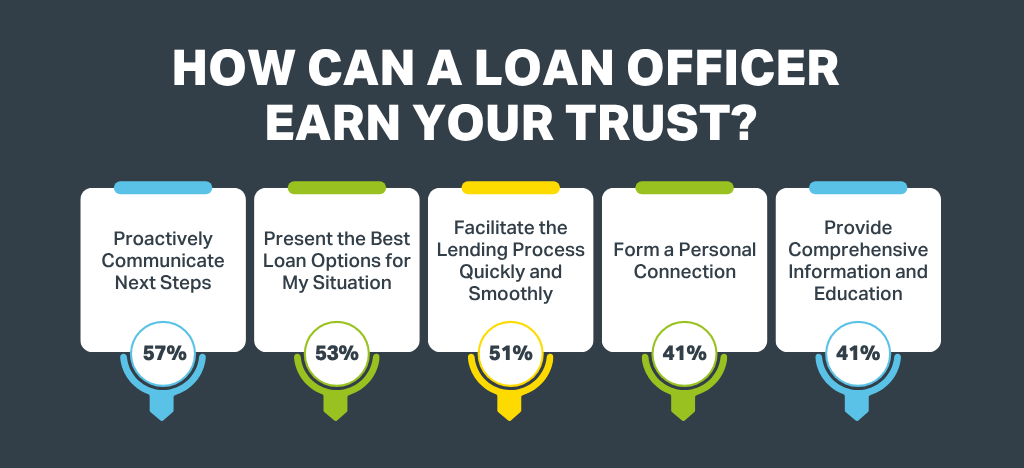

The study’s authors also asked respondents how MLOs can build trust, prompting a range of suggestions for originators.

It’s clear from similar research studies that virtually all demographic groups can benefit from more mortgage process education. According to a survey published by JW Surety Bonds in February, 76% of homeowners lacked homeownership literacy until after buying their home. One in eight buyers are unable to define what a “mortgage” is accurately and 43% are unsure of the meaning of “mortgage rate.”

Educating Homebuyers

Helping first-time buyers feel more comfortable with the mortgage process — and setting realistic expectations — are goals of Arch MI’s Roadmap to Homeownership presentation and toolkit. Whether you’re presenting to a small group or an individual, the Roadmap presentation, geared toward prospective first-time homebuyers, provides a comprehensive overview of the mortgage process; including calculating a budget, mortgage options and homeownership benefits.

The Roadmap toolkit includes worksheets for calculating an affordable mortgage payment and comparing lenders’ offers and checklists of documents needed to support the application. Arch MI’s homebuyer presentation can be co-branded with your logo for holding first-time homebuyer seminars online or in person.

What Motivates Single Homebuyers?

Financial security is a key factor driving single women to purchase homes. Homeownership provides a sense of stability and an opportunity to build equity over time.

“As homeowners, women remove the unknowns from their living situation ― such as whether the rent increases or they must move due to a landlord selling the property in which they reside,” said Jessica Lautz, NAR Deputy Chief Economist and Vice President of Research.

Opportunities for Mortgage Loan Officers

By understanding the unique needs and motivations of women homebuyers, loan officers can tailor their services to meet their needs. Surveys indicate women homebuyers prioritize personalized financial advice, exploring various loan options and resources for down payment assistance.

For most homebuyers, the down payment remains a significant hurdle, especially for buyers relying on a single income. Arch MI’s Buy with MI offers a comprehensive set of products and solutions that support down payment options as low as 3% of the purchase price. And with coverage from Arch Mortgage Guaranty Company (AMGC), homeownership is possible with even lower down payments for eligible borrowers.

Building trust and fostering long-term relationships with single women customers can lead to repeat business and referrals.

By recognizing the motivations and challenges faced by this demographic and using Arch MI’s tools, loan officers can provide valuable support and guidance, ultimately helping valuable customers achieve their homeownership dreams while growing their own businesses and reputations.

Contact your Account Manager to discuss how to increase originations by putting these ideas into practice soon.

Emerging Trend: Baby Chasers

Another demographic shift is the rise of so-called “baby chasers” — grandparents who are relocating to be closer to their adult children and grandchildren.

A 2024 Zonda survey shows that 25% of Baby Boomers plan to retire near their sons and daughters.

For MLOs, this creates opportunities to market their services to older homebuyers and to young homebuyers with children who may also be searching for nearby communities for the grandparents. Older people often prefer features like one-story layouts, low maintenance and amenities that cater to an active senior lifestyle.

In April, the National Association of Realtors® announced that Boomers have overtaken Millennials as the largest group of homebuyers, with those aged 60–78 accounting for 42% of all homebuyers in 2024. In the past year, Millennials dropped from 38% to 29% of all buyers.