Over the past decade, Hispanics accounted for more than 50% of homeownership growth, according to “The 2020 State of Hispanic Homeownership Report” published in April by the National Association of Hispanic Real Estate Professionals (NAHREP).

In 2020, more than 600,000 Latinos* in the United States purchased a home with a mortgage — up 13% over 2019, according to NAHREP’s April report.

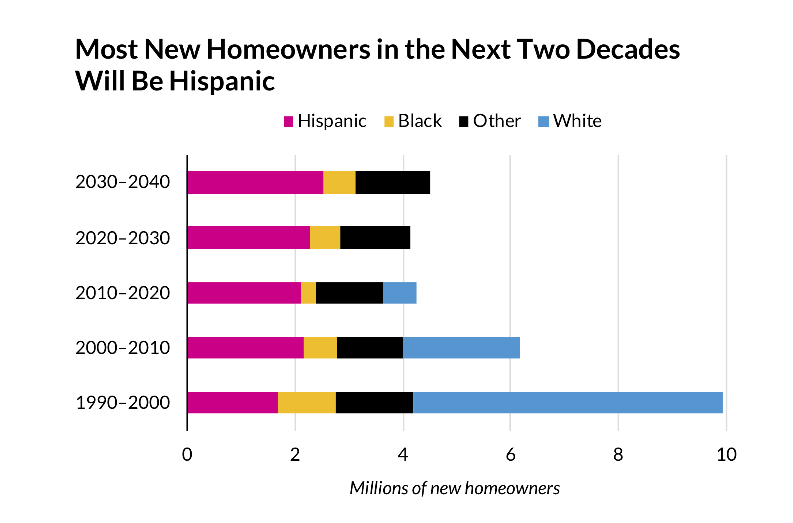

In June, forecasters at The Urban Institute predicted the Hispanic population will account for 70% of new U.S. homeownership growth between 2020 and 2040, while the white population and other demographic groups will see declines in homebuying over the same period.

There are 8.3 million “mortgage-ready” Hispanics aged 45 and under with credit characteristics that potentially allow them to qualify for a mortgage, says NAHREP.

According to NAHREP, “Homeownership is the single most powerful strategy for closing the racial and ethnic wealth gap,” pointing to the fact that in 2019 the net worth of Latino homeowners was 40 times that of Latino renters.

While a large gap in homeownership rates continues to exist between Hispanics and the general population, the gap is getting smaller. The Hispanic homeownership rate increased in 2020 for the sixth year in a row, the only demographic that can claim this positive record.

“To maintain a high level of homeownership, the mortgage and homebuilding ecosystem will need to evolve in a way that breaks down barriers and meets the needs of Hispanic homeowners,” according to the recent Urban Institute report.

With Latinos emerging as a force in homebuying, loan originators can prepare by understanding more about these homebuyers and the challenges they face.

- There are 8.3 million “mortgage-ready” Latinos aged 45 and under with the credit characteristics that potentially allow them to qualify for a mortgage, according to NAHREP.

- In 2020, 53% of Hispanic homebuyers purchased with a conventional mortgage loan (with FHA accounting for a 31% share and VA 8.7%), NAHREP reported, citing 2020 Home Mortgage Disclosure Act data.

- Hispanics occupy the sweet spot for forming families and seeking a home: Their average age is about 29, approximately 14 years younger than the general population. In 2020, nearly half (43.6%) of Hispanic homebuyers were under the age of 34, compared to 37.3 % of the general population, according to NAHREP.

- Nearly one in three Hispanics is currently in the prime homebuying years (24–44), according to U.S. Census Bureau data.

- The authors of the NAHREP report say many Latinos also favor multi-generational households, with two or three generations in the same home providing additional sources of income.

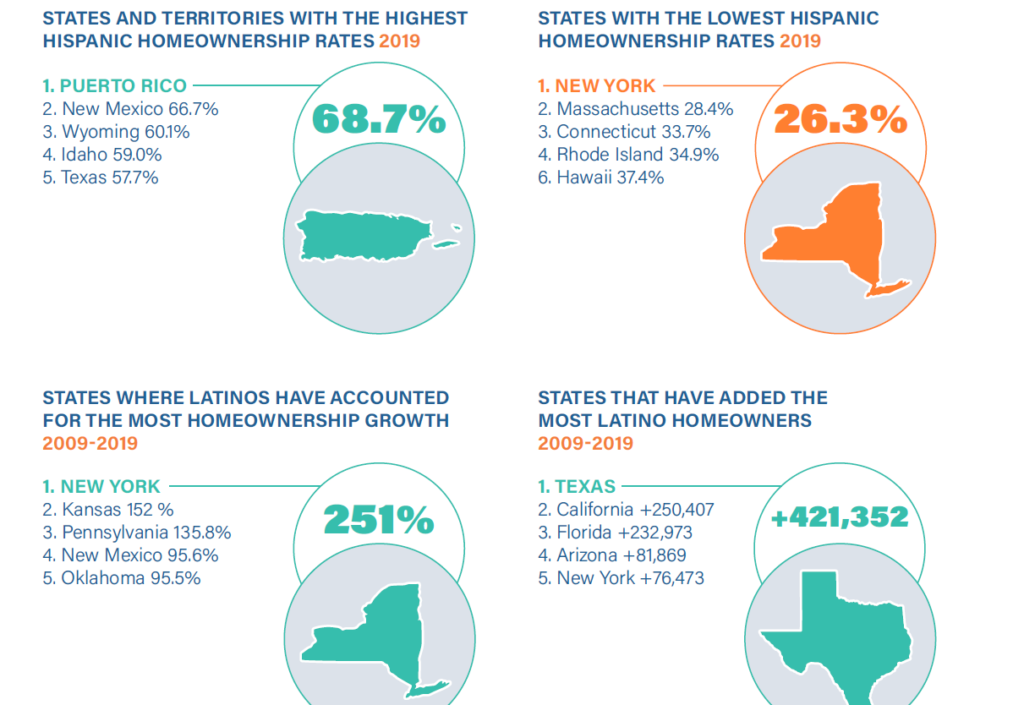

- In 2019, the top two fastest growth markets for Hispanic homebuying were Durham/Chapel Hill, North Carolina, and Boise, Idaho, both with a year-over-year growth rate of more than 40%. Other fast-growing locations, where Hispanics have a substantial share of the mortgage market, are in New Mexico, Texas, California, Florida, Arizona, Nevada, Illinois, Colorado and New Jersey, according to recent National Community Reinvestment Coalition analysis.

For mortgage lenders, Hispanic clients unite the concerns of most first-time homebuyers with the specific needs of their demographic:

- For nearly all prospective homebuyers, a lack of knowledge about the mortgage process is a significant hurdle. This creates opportunities for LOs to provide homebuying seminars and other outreach, both in person and using social media.

- Arch MI offers LOs a Roadmap to Homeownership, a comprehensive educational package to help you guide first-time homebuyers through the homebuying process, including information on credit, financing, taxes, etc. and handy checklists for borrowers.

- According to NerdWallet.com, as many as three-fifths of all prospective homebuyers think a 20% down payment is required. Lenders can correct this misperception and explain how loan programs can accommodate much smaller down payments.

- As first-time buyers and, in many cases, first- or second-generation immigrants, some Hispanic homebuyers may not be knowledgeable about down payment options, according to mortgageloan.com’s “Guide to Housing and Mortgages for Hispanics.” Many prospective first-time buyers may be unfamiliar with the increasing use of gift funds by first-time homeowners. This is an opportunity for lenders to educate their customers through outreach on social media and homebuying seminars.

For borrowers who are not highly proficient in English, NAHREP offers resources and referrals to Spanish-speaking Realtors® and other professionals important to the homebuying process.

The Department of Housing and Urban Development (HUD.com) also provides a Fair Housing for All Brochure and a Fair Lending Guide in Spanish. The Federal Housing Finance Agency offers Spanish translations of borrower education materials.

The Insights blog is designed to encourage discussion about important topics for loan originators. If you’ve had success reaching out to Hispanic homebuyers in your community, send us an email. We would like to share your experience in a future blog post.

Note: The “Other” category includes Asians, American Indians, Alaska Natives, Native Hawaiians, other Pacific Islanders and multiracial individuals.

* NAHREP and the Urban Institute use Hispanic and Latino interchangeably in their recent reports. “When it comes to Hispanics and real estate, it’s important not to generalize and stereotype,” recommends Mortgageloan.com’s housing market guide for Hispanics. “The term ‘Hispanic’ is an umbrella term that almost unrealistically groups together an enormous and diverse population of people that includes Ecuadorans, Puerto Ricans, Dominicans, Hondurans, Mexicans, Argentineans and people from many, many other countries.”