Hispanic Consumers Will Account for 70% of First-Time Homebuyers over the Next 20 Years

National Hispanic Heritage Month, which runs from Sept. 15 to Oct. 15, is a time to recognize the many contributions of the Hispanic population (20% of Americans) to the social, cultural and economic life of the United States.

For mortgage lenders, there’s another reason to celebrate: Hispanic homeownership has been growing for eight years straight, according to the National Association of Hispanic Real Estate Professionals (NAHREP), achieving a new record in 2023 as the Hispanic homeownership rate reached 48.6% — up from 46.1% in 2013.

In 2021, the most recent data available showed that Hispanic homebuyers purchased more than 735,000 homes (PDF) with a mortgage, an increase of 42.5% from 2018.

7.9 Million Mortgage-Ready Consumers

In March, NAHREP reported 7.9 million Hispanic consumers (aged 45 and under) are considered mortgage-ready — more than any other racial or ethnic group (PDF). According to Freddie Mac, 33% of Hispanic potential borrowers meet the credit requirements to apply for a mortgage and the figure rises to 39% for those under age 45 who don’t already have a mortgage.

Industry trends show real estate agents and lenders are making headway in improving the homebuying experience for the Hispanic community. Despite a challenging environment of higher interest rates and low inventory on top of economic and cultural barriers, Hispanics are successfully pursuing the dream of homeownership.

Big Demographic Shifts

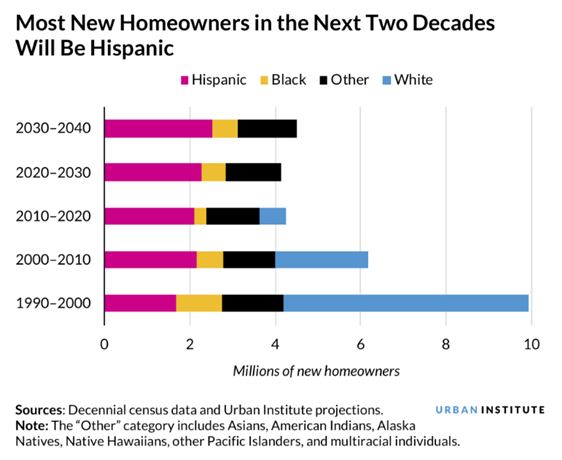

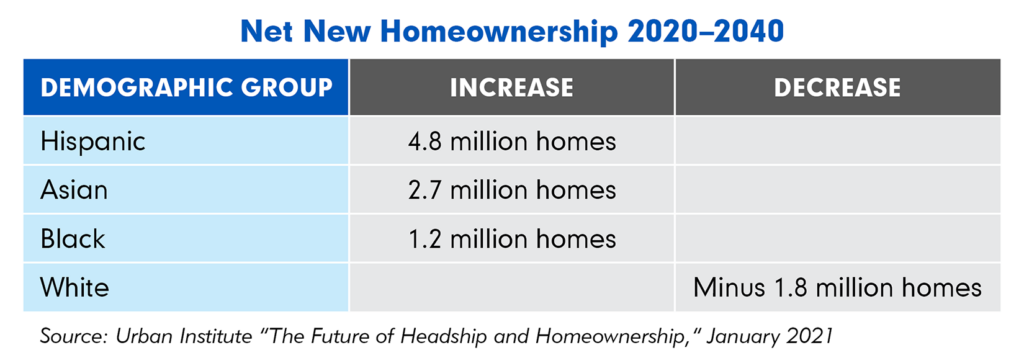

According to the Urban Institute, the growth trend for Hispanic homeownership is poised to accelerate and outpace other demographic groups. The Urban Institute projects there will be 6.9 million net new homeowners from 2020 to 2040 — a 9% increase — with Hispanic homebuyers accounting for 70% of net new homeownership over the 20-year period.

One effort that has spurred Hispanic homeownership is NAHREP’s Hispanic Wealth ProjectTM (HWP). The primary mission of the 10-year, multi-pronged project is to help prospective Hispanic homebuyers across the country improve their financial well-being and increase their personal wealth by helping them buy homes.

Since its launch in 2014 by the nonprofit American Center for Economic Advancement, HWP has had a stated goal to “increase home equity wealth by achieving a Hispanic homeownership rate of 50% or greater” over 10 years. The homeownership goal is a key component of HWP’s larger objective to triple Hispanics’ median household wealth by 2024, and since HWP’s last survey report in 2022 (PDF) indicated the ownership rate was 48.6%, or roughly 49%, they are on track to reach the long-term goal of 50% by next year.

With Hispanic buying power growing and expected to continue to grow, it makes sense for the entire mortgage industry — and loan originators in particular — to focus on ways to better serve these customers who are driving the demand for homes. What are the unique needs of these buyers?

Connect with Your Customers: Know the Demographic

Some key characteristics differentiate Hispanic homebuyers from the general population. According to NAHREP’s annual report for 2022 (PDF) released in March 2023:

- By attaining higher incomes and education levels, Hispanic borrowers are more prepared than ever to jump into the housing market. Education levels are rising with 19.7%, almost one in five Hispanic adults having a bachelor’s degree or higher. Hispanic median household income currently stands at $60,566 after increasing 49.9% over the past 10 years — far outpacing overall income growth of 35.7%.

- Young and buying at an earlier age.

The median age of Hispanic homebuyers is 30, eight years younger than the median age of the general population. These homebuyers also have the highest share of purchasers under the age of 25, and 70.6% of Hispanics purchasing a home with a mortgage were under the age of 45.

- Only 13% of all Realtors® and even fewer loan officers are Hispanic.

NAHREP reports that among its member Realtors, more than 60% of their closed customers in 2022 were Hispanic. Having more Hispanic real estate leaders in place “would bring a better understanding of cultural nuances that would better serve consumers,” the report states.

- Tailor your marketing approach.

According to NAHREP, Hispanic families don’t typically discuss personal finances at the kitchen table. As a result, potential buyers may benefit from effective educational and marketing materials that include the wealth-building benefits of owning a home, the importance of good credit, the available options for financing a home and an explanation of the importance of pre-approval.

Rising housing costs have spurred an increase in multi-generational living (31.7% of households), so potential buyers would likely welcome relevant solutions, such as the ability to have multiple borrowers on a loan.

- Small business owners.

Hispanic adults own 13% of small businesses in the United States and are 1.7 times more likely to start a business than other demographic groups. NAHREP’s latest report states many successful small business owners are attracted to flexible financing opportunities and programs for borrowers with non-traditional income sources.

Private Mortgage Insurance Can Help Bridge the Gap

Over the past year, Arch MI has steadily built a set of Spanish-language materials, including flyers that mortgage originators can co-brand with their logos to reach new prospects. There are flyers on MI basics and MI cancellation and a video explaining how MI enables eligible borrowers to purchase homes with modest down payments.

The Insights blog encourages discussion about important topics for loan originators. Send us an email telling us what you’re doing to celebrate Hispanic Heritage Month. We would like to share your experience in a future blog post.