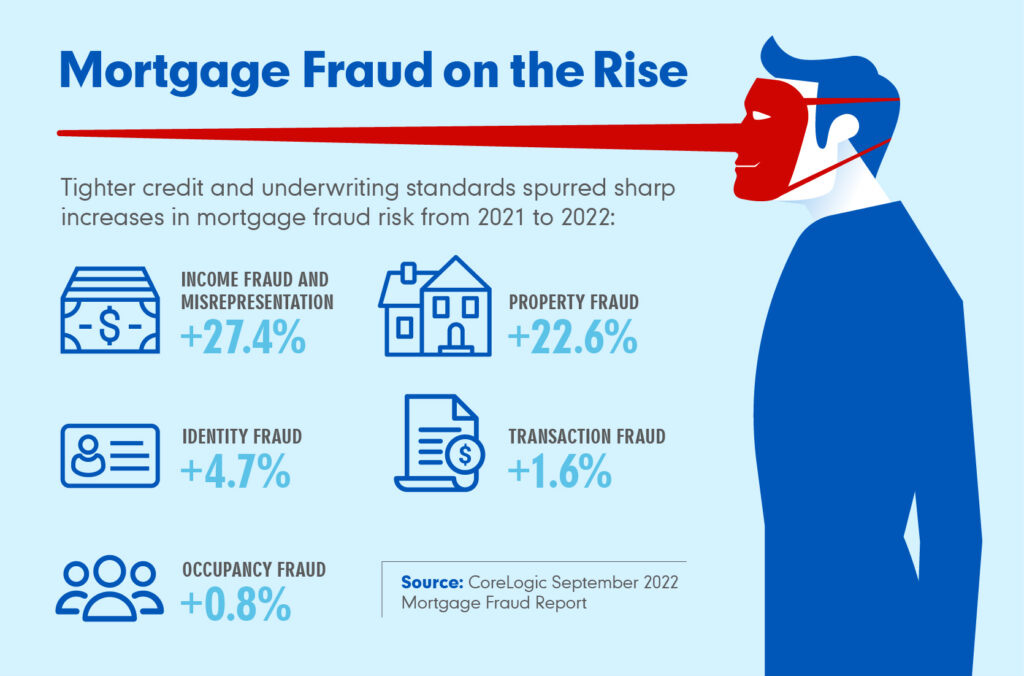

When mortgage market activity slows, fraud incidents increase. It’s a pattern security experts say is being repeated now as perpetrators get bolder and more creative in their efforts to misrepresent income, employment or identity in mortgage applications.

CoreLogic’s most recent “Mortgage Fraud Report” determined that 0.76% of all mortgage applications showed evidence of fraud in 2022. That’s 1 in every 131 applications — putting a heavy responsibility on loan originators to watch for the red flags signaling misrepresentations. Fraud is even more common with investment purchases, with 1 in 57 applications estimated to show indications of fraud.

Every $1 of fraudulent mortgage transactions costs lenders $5.34, according to a 2022 study by LexisNexis Risk Solutions.

Multi-Party Schemes Can Be Difficult to Detect

In general, falsifications range from low-tech doctored paystubs and W-2s to more sophisticated efforts involving outside parties who pose as employers — sometimes working with insiders such as loan officers or mortgage brokers. According to the CoreLogic report, more elaborate scams include seasoning bogus bank statements to show deposits over several months. At the same time, the rise in remote work has complicated employment verification processes.

FBI officials say half of the agency’s mortgage fraud investigations involve mortgage applications.

One in 34 Transactions

One factor spurring the upsurge in fraud is a decline in the volume of lower-risk refinance loans. “Purchase transactions have consistently shown higher risk levels,” according to the authors of CoreLogic’s Mortgage Fraud Report. “The 2- to 4-unit segment showed the highest risk, with 1 in 34 transactions estimated to have indications of fraud.”

In this environment, lenders are on the front line when identifying mortgage fraud. Freddie Mac’s Fraud Prevention webpage makes it clear that mortgage originators and servicers “play an important role in preventing, detecting and investigating potential mortgage fraud and other suspicious activity.”

There Are New Red Flags to Watch for

What are the red flags? Be watchful for inconsistencies, inaccuracies or missing pieces in the mortgage loan file. These should trigger questions and additional scrutiny but may not represent actual fraud. Fannie Mae’s six-page listing of Common Red Flags includes these high-level indicators:

- Social Security number discrepancies.

- Address differences.

- Verifications addressed to a specific person’s attention.

- Verifications completed on the day they were ordered — or on weekends.

- Deletions, use of correction fluid or other alterations.

- Numbers that appear to be “squeezed” due to alteration.

- Different handwriting or type styles within a document.

- An excessive number of automated underwriting system submissions.

Online lender Prosper has said 11% of the applications it verifies contain false or insufficient employment or income information.

Combat Fraud with Complimentary Training for Your Employees

As fraudulent applicants turn to more complex schemes to falsely meet tightening underwriting standards, now is a good time to ask your Arch MI Account Manager to schedule our Mortgage Fraud Red Flags training for your staff. The session covers all the latest fraud schemes and gives your team the tools they need to spot issues with applications or existing files.

In addition to training, Arch MI provides extensive resources and expertise lenders can rely on to fight fraud throughout the underwriting and claims processes. Arch MI’s Special Investigation Unit, or Special Investigation Unit (SIU), a team of investigation analysts, works with Underwriting, Claims, other company departments and external sources to identify potential fraud issues in files.

SIU findings are addressed with lenders and recommendations are made regarding future business relationships. As needed, results are reported to industry fraud databases and state insurance departments.

To learn more, visit archmi.com/mortgagefraud or connect with your Account Manager.