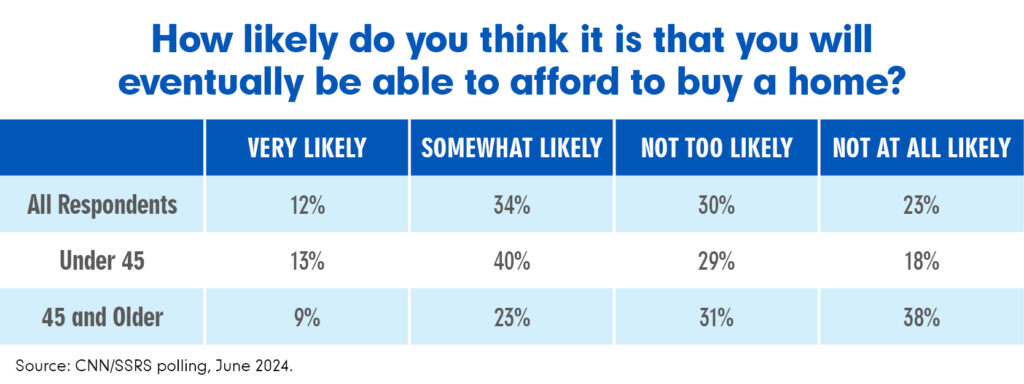

In a July CNN poll, 54% of current renters said they’re “unlikely to ever own a home,” with 40% saying the down payment is the biggest obstacle to becoming a homeowner.

Sadly, younger renters (45 and younger) are more likely to think homeownership is out of reach due to the myth that lenders require large down payments. Nearly half (45%) of the respondents surveyed by the National Association of Realtors® believe lenders require down payments of 16% or more — double the actual 8% average down payment for first-time buyers.

Good News: Many Renters Already Have Sufficient Savings to Buy Now

Tell potential buyers that whatever they’ve saved may be enough, especially with mortgage insurance. Earlier this year, we introduced Arch MI’s Buy with MI — a comprehensive suite of solutions, products and resources to help you structure and insure low down payment loans for your borrowers. Whether they have 5%, 3%, or even less to put down, you can find the right MI option with Arch MI.

In addition to enabling many renters to become homeowners, Arch MI’s Buy with MI delivers clear benefits for you and your borrowers:

- Eligibility for a wide range of property types, including manufactured homes, condos, co-ops, single-family and construction-to-perm.

- Flexible Arch MI guidelines that accept down payments as low as 3%; gifts and grants are allowed.

- For portfolio lenders, access to the Arch Mortgage Guaranty Company® (AMGC) Community Heroes Program allows down payments of 1% for qualified borrowers.

- Competitive MI pricing with RateStar®, the industry’s leading risk-based pricing tool, and customized monthly MI premium payments with RateStar BuydownSM.

- A smart MI strategy to address appraisal gaps and eliminate the need for extra cash at closing.

- Free GSE-approved online homebuyer education for loan programs via our website.*

- Free Roadmap to Homeownership toolkit contains everything you need to host your own homebuyer seminars.

*Limited to borrowers with loans insured by Arch MI or AMGC.

By choosing private MI over FHA, your borrowers can save money by avoiding the upfront payment of 1.75% of the loan amount and enjoy faster closing times with less paperwork.

Don’t miss this opportunity to grow your business and help your borrowers achieve their homeownership goals. Learn more about Arch MI’s Buy with MI by visiting archmi.com/BuyWithMI or contacting your Arch MI Account Manager.

If you’ve succeeded in helping renters become homebuyers, the Insights blog would love to hear about it. Send us an email to share your experiences so we can share them in a future issue.