Two remarkable statistics emerged from a June report on mortgage insurance (MI). First, our industry has set a record: More than 2 million home purchases and refinances were backed by MI in 2020 — a 53% increase over the previous year, according to U.S. Mortgage Insurers (USMI), an industry trade group.

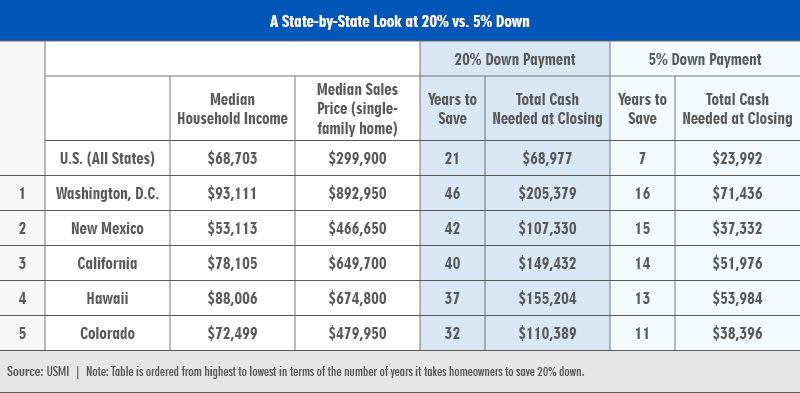

Secondly, a USMI analysis determined it could take 21 years for a family earning the median household income of $68,703[1] to save enough for a 20% down payment on a median-priced house.

But by financing their purchase with MI, which allows eligible borrowers to make just a 5% down payment, it takes only seven years for the same median-income family to buy a home —three times sooner than saving up for the full 20% down payment that lenders typically require.

(Note: Down payments of as little as 3% are available with MI for qualifying borrowers. USMI selected 5% for its analysis.)

The stats — reflecting both the increased demand for MI and why it’s so needed — are essential information for first-time homebuyers as they try to navigate today’s housing market challenges.

You can show your customers the relative costs of buying a home in your region by referencing USMI’s expanded report with years-to-save information on all 50 states.

Of course, many of the challenges homebuyers face result from a scarcity of homes for sale. According to a June National Association of Realtors® (NAR) report, the U.S. housing market is 5.5 million units short of long-term historic levels, and the single-family home market is underbuilt by 2 million units.

NAR officials say residential builders in the U.S. constructed, on average, 276,000 fewer homes per year between 2001 and 2020 compared to the period between 1968 and 2000. The report noted that it could take a decade to bring the market into balance with historical levels.

USMI’s analysis revealed some of the difficulties homebuyers face saving for a down payment, even when using MI, in high-cost areas like Washington, D.C., New Mexico and California.

In 2020, a record number of borrowers chose mortgage insurance. The 53% increase was driven by market conditions that continue to make saving for a down payment the most difficult part of homebuying.

On the positive side, low inventories coupled with rising home prices have increased the property values of many current homeowners — and those higher prices have also prompted more long-term homeowners to put homes on the market, potentially expanding inventory, according to published reports.

Homebuyers and loan originators have responded to the home shortage with new strategies, and there are numerous data points in the USMI report highlighting the approaches that leverage MI:

- Nearly 60% of home purchase loans with MI went to first-time homebuyers.

- First-time homebuyers using MI had an average FICO® score of 749 and, on average, took out a home loan of nearly $290,000.

- The average down payment for first-time homebuyers is 7%, while repeat buyers averaged 16%.

- Among homebuyers using MI, more than 40% had annual incomes of less than $75,000.

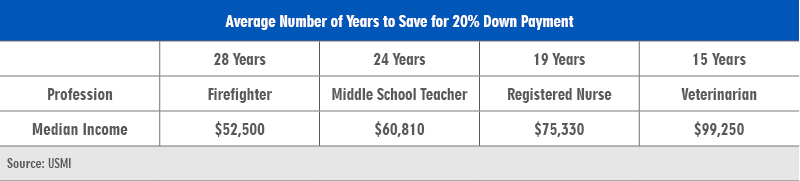

The USMI authors also provided a chart showing how long it would take workers in various professions to save to buy a home without MI.

The challenges these dedicated professionals face in buying homes near their workplaces led Arch MI to create the AMGC Community Program. Designed for portfolio lenders, AMGC’s Community Program allows modest down payments for eligible employees of law enforcement agencies, fire departments, medical providers and other processionals.

We’d love your feedback on current lending challenges for future updates to our Insights blog. Send us an email describing the questions you’re getting from prospective homebuyers and what MI solutions are most helpful in the current market.

[1] USMI’s analysis factored in elements that include the average savings rates, median household incomes and median sales prices.