Owning a home is one of the biggest drivers of wealth creation, and it’s a topic many homebuyers don’t hear enough about.

What does it mean to be “equity rich?”

Earlier this month, Bloomberg awarded that label to the 30% of current homeowners with a home valued at twice as much as the underlying mortgage.

In September, CoreLogic reported the average family with a mortgage had $194,000 in home equity in the third quarter.

How do potential homebuyers hear about this? The media is filled with reports on low mortgage rates and the slow pace of homebuilding, but it’s rare to see coverage like this about the strong link between homeownership and household wealth.

It’s even more rare to see advertising by mortgage lenders highlighting one of the biggest advantages of homeownership — the idea of investing in your future by paying your monthly mortgage and benefiting from increases in property values. During 2020, the national median home price increased 13%, according to Attom Data Solutions.

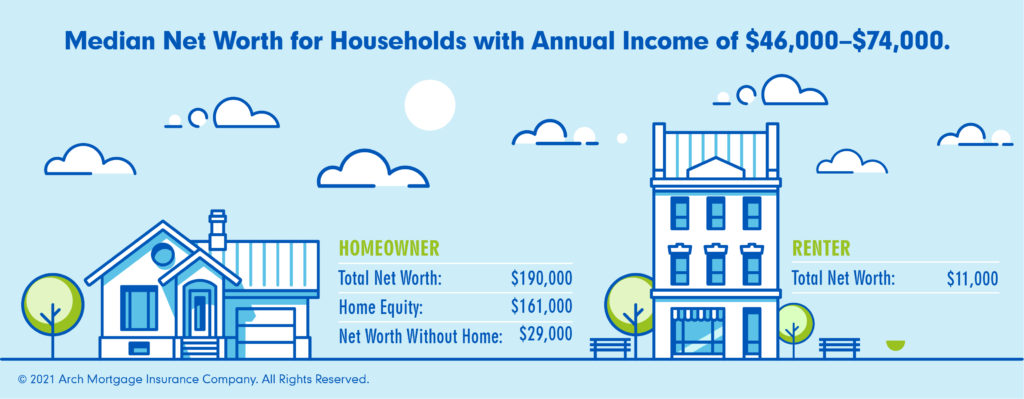

Comparing the Assets of Homeowners vs. Renters

An analysis by First American shows the median homeowner has 40 times the wealth of an equivalent renter. The median homeowner’s wealth — including home value, investments and savings — totals $254,900, compared to $6,270 for a renter with a similar income.

The report calls homeownership “one of the biggest positive drivers of wealth creation.”

Yet the connection between homeownership and wealth is a complex discussion with lots of caveats — starting with the fact that equity can only be fully tapped by the actual sale of the home. Relatively recent history also demonstrates that home values can decline sharply due to economic conditions. In addition, a lack of home maintenance or a shift in the character of a neighborhood can also have a negative impact on home prices.

Still, it’s frustrating to see topics like home equity and appreciation receive only cursory attention. For example, home equity is frequently left out of the discussion in news stories comparing the cost of renting versus buying a home. Unfortunately, those articles rarely explain how monthly mortgage payments act as a type of savings mechanism, helping responsible homeowners acquire full ownership of their biggest financial asset when the mortgage is paid off.

Resources for LOs

With so little discussion about the topic, unsophisticated consumers can get in trouble by tapping home equity for unnecessary spending rather than continuing to invest in their house.

Thankfully, there are great resources out there to help guide your discussions with potential homebuyers on the benefits of acquiring, building and preserving home equity.

Arch MI’s Roadmap to Homeownership toolkit has a comprehensive presentation for first-time homebuyers, including a section on homeownership benefits like building equity. With the presentation and other Roadmap to Homeownership materials, you can host virtual meetings with potential homebuyers via Zoom or Facebook Live. You can also co-brand the presentation with your business’s contact information and logo.

Freddie Mac has also published a borrower-focused overview that you can refer potential homebuyers to. Understanding Your Home’s Equity includes a great description of the benefits of home equity: “Homeownership … [provides] families with a place that is their own and an avenue for building wealth over time. This ʽwealth’ is built, in large part, through the creation of equity … Building equity through your monthly principal payments and appreciation is a critical part of homeownership that can help you create financial stability.”

In 2021, one of the goals of our Insights blog is to feature more feedback from readers like you. To share how you address home equity with borrowers, send us an email describing your approach and how your customers respond. We look forward to hearing from you.

*Infographic sources: Keeping Matters Current/First American

Note: The U.S. median household income in 2019 was $68,703, according to the Census Bureau.