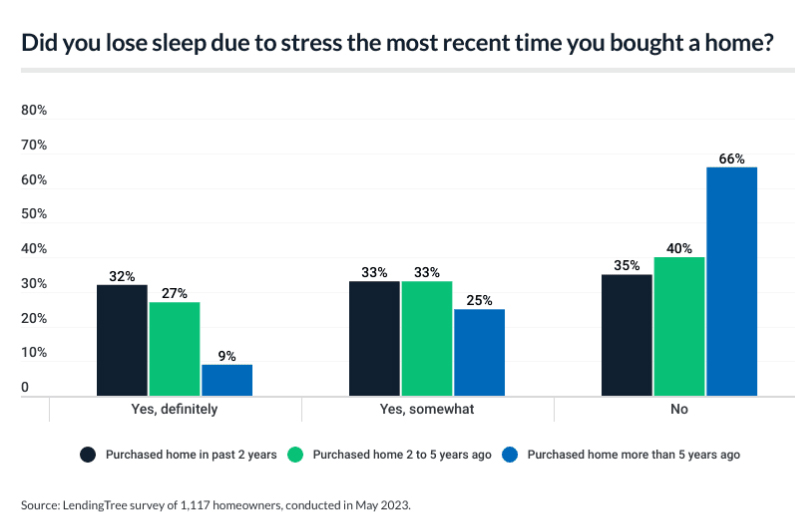

How difficult is today’s housing market? In a LendingTree survey, 65% of active homebuyers reported losing sleep during purchasing, and 42% of respondents said stress led to family arguments.

With homebuying anxiety affecting family relationships, mortgage loan officers are likely to encounter client behavior that reflects their stress and sleeplessness. Your borrowers may come in with unrealistic expectations, be indecisive or change their minds frequently — further complicating an already challenging mortgage process.

Another factor is first-time homebuyers in 2023 accounted for half of all purchases (up from 37% in 2021), Zillow reported in April. First-time buyers are more likely to be dissatisfied, according to Clever Real Estate’s Homebuyer and Seller Report. In addition to paying higher prices, 44% of buyers who purchased in 2023 said the process was harder than expected, up from 33% in 2022. The top difficulties are financial:

- Exceeding their budget: 45%.

- High mortgage rates: 42%.

- High home prices: 42%.

EquippedLO.com, which makes mortgage loan processing software, suggests several ways to handle clients dealing with big challenges:

- Proactive listening: Sometimes, people just want to be heard and understood. It can help to paraphrase their points and acknowledge their feelings.

- Maintain professionalism: Avoid taking things personally or getting defensive. Respond with respect and a willingness to assist.

- Provide options: Avoid disappointment by thoroughly understanding their financial situation and focusing discussions on the programs they’re most likely to qualify for.

- Focus on problem solving: Collaborate with clients, seeking their input and involvement in finding a way forward. This often increases their satisfaction with the outcome.

Homebuyer Challenges

- Redfin reports the median down payment for U.S. homebuyers reached $55,640 in February — up 24.1% from a year earlier.

- 93% of 2023 homebuyers compromised their priorities in selecting a home, a sharp increase from 80% in 2022, according to a 2023 Clever Real Estate survey.

- 45% of homebuyers wanted to find a home close to work, but 34% had to settle for a longer commute.

Arch MI offers a comprehensive tool kit to help new (and repeat) homebuyers understand the process from the beginning and establish a budget for their new home. The Roadmap to Homeownership includes an overview presentation on the homebuying process, budget worksheets and a guide to buyer assistance programs.

These tools can also help homebuyers prepare and organize their documents and financial information, highlight important milestones and detail the tasks they need to complete.

The Roadmap to Homeownership presentation can be co-branded with your logos and discussed with clients one-on-one, via a video conference call or in a group homebuying seminar.

Additionally, Arch MI offers:

- Homebuyer Education: Access GSE-approved pre-purchase required courses for borrowers financing their affordable loans with MI.

- LO Toolbox: This is your one-stop location for all the MI tools, products and solutions you need to originate, underwrite and close loans.

Using all these tools and even following the steps to work productively with difficult clients may not be enough. Feel free to call your Arch MI Account Manager or use our ASK Arch MI online knowledge base to answer your hardest questions.

If you have other tools, tactics or techniques you’ve used to deal with stressed clients, share them with the Insights blog’s editors. Email us ([email protected]) about your experiences with defusing overwhelmed homebuyers.