Whether it’s the NFL, NBA or countless other sports, coaches and strategists are hyper-focused on a key measure — strength.

All the major sports have specialized strength coaches, “strength of schedule” weighs heavily on teams’ prospects and “arm strength” is often the difference between winning and losing.

At Arch MI, we take pride in the financial strength of our company and see it as a key differentiator for lenders to consider. Here are some of the strength measures that separate Arch MI from the rest of our industry:

- In June, S&P Global Ratings changed its rating for Arch MI to A+ (from the A rating we had previously). S&P and Moody’s rate us at least one notch higher than any other U.S. mortgage insurer.

- Regarding the GSEs’ required Private Mortgage Insurer Eligibility Requirements (PMIERs), Arch MI has the industry’s highest PMIERs sufficiency ratio — which stands at 205% as of March.

- We are the leader in mortgage insurance-linked notes (MILN), a form of risk transfer that provides substantial protection in stress scenarios.

Arch MI was the first mortgage insurer to issue a MILN after the crisis in 2008 and during the COVID-19 era.

Strength Often Determines Close Games

The sports world focuses on strength because of the difference it can make when rain, wind or other adverse conditions make games harder to win.

In the same way, many of us in the housing industry can remember how the strongest companies were better positioned to weather difficult business conditions such as the 2008 financial crisis or economic turbulence in the 80s and 90s.

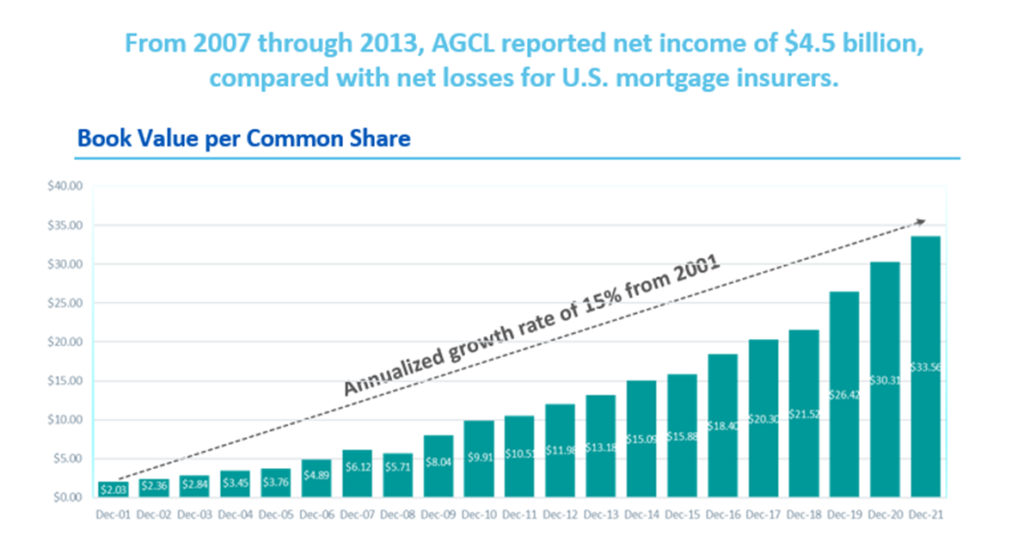

A Strong, Diverse Parent

Arch MI is part of a larger team and our parent company, Arch Capital Group Ltd. (ACGL), is a strong diversified company focused on specialty insurance, reinsurance and mortgage insurance. From 2007 through 2013, AGCL reported a net income of $4.5 billion — compared with net losses for U.S. mortgage insurers.

In its most recent rating report, S&P noted Arch MI’s growth and the increased importance to ACGL’s “overall strategy … We believe U.S. MI is now a core and integral part of (ACGL’s) strategy … We expect (ACGL) will support the U.S. MI business in any foreseeable circumstances.”

Effective Risk Transfer

The uncertainty created by COVID-19 has highlighted the value of having an effective program for transferring risk. One method for accomplishing this is mortgage insurance-linked notes (MILNs), which provide substantial protection in stress scenarios.

Arch MI was the first mortgage insurer to issue a MILN after the crisis in 2008 and during the COVID-19 era. In a MILN transaction, the mortgage insurer purchases fully collateralized protection that reimburses the mortgage insurer for losses above a deductible (usually 2% to 3% of RIF) subject to a limit (6% to 12%).

As of March, Arch MI’s MILN coverage in force was $4.3 billion, while this measure for other U.S. MIs ranged from $1.2 billion to $2.3 billion.

It’s clear mortgage lending will become more competitive as we head into the final quarters of the year. It’s when even last season’s most successful teams are taking steps to build strength for the challenges ahead. What are you doing to strengthen your mortgage lending business and build for success?

At Arch MI, we’d look forward to speaking with you about the advantages of partnering with a strong, diversified MI provider. To get started, contact your Arch MI Account Manager. As always, thanks for your business.