Although we’re only days away from the end of the year, there’s still an opportunity to finish 2021 strong and carry that momentum into 2022. Now’s the time to remind your customers — through social media posts, emails and e-newsletters — that several factors are in play to make this the right time for many customers to pursue a mortgage or refinance.

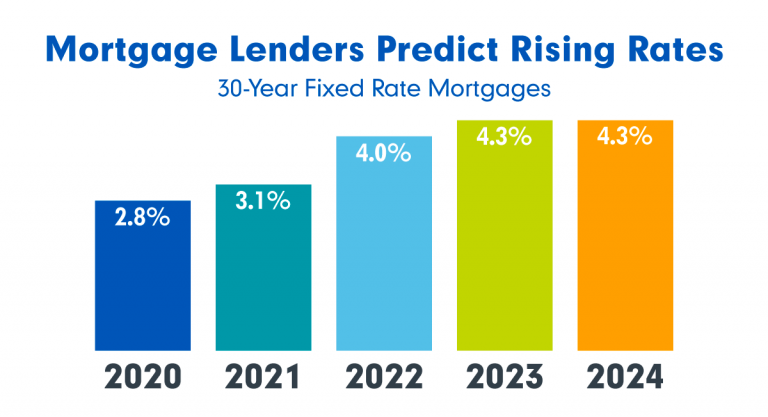

Interest Rates May Be Poised to Rise

Although interest rates are still historically low, some economists and mortgage experts predict that could change. While it’s impossible to predict the future, economic indicators and government actions are pointing to rising mortgage rates, including:

- Tapering of the Federal Reserve’s investment in mortgage-backed securities — which could begin before year-end — as the economy continues to recover. Rates will likely climb as Wall Street steps in to buy these mortgage-backed securities, according to the Association of Independent Mortgage Brokers.

- Inflation is driving prices higher. While the Fed keeps a close eye on the situation, and Chairman Jerome Powell said in October that an interest-rate increase isn’t being considered, a rate hike is certainly not off the table during 2022.

In your year-end customer messages, you can also remind homeowners to check their current interest rate — to avoid missing out on significantly lowering their monthly mortgage payment through refinancing. In a recent Bankrate.com survey, more than one-third of respondents didn’t know their interest rate, and 47% reported that they hadn’t given a thought to refinancing. Given current low mortgage interest rates, it’s likely that many could benefit from refinancing.

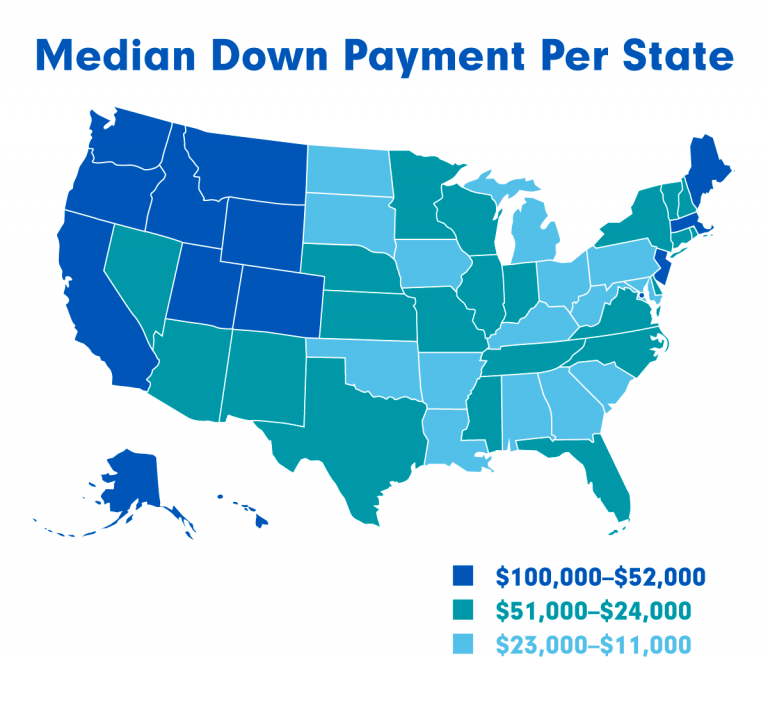

Clearing the Down Payment Hurdle

For several potential buyers — particularly first-time homebuyers — the down payment is often a significant challenge. In the chart below, note that many homebuyers are still paying quite a hefty sum even in those states with the lowest median down payments. Potential homebuyers remain on the sidelines because they don’t know that the down payment can be as low as 3%. Other potential buyers may not know that eligible first-time homebuyers may use gift funds from their family or friends to satisfy the down payment.

Lenders can also qualify more borrowers with our flexible AMGC Community Program, offered through Arch Mortgage Guaranty Company (AMGC). Developed to provide MI coverage for portfolio loans, it allows eligible essential workers in fields such as law enforcement, emergency response, teaching and health care to make modest down payments as low as 1%.

It’s estimated that at the median-income level for teachers, firefighters or nurses, it typically takes more than 15 years to save for a 20% down payment. The AMGC Community Program can help address this challenge.

Home Prices Will Continue to Increase

Homebuyers who are waiting for the market to cool may be in for a long wait. According to Zillow, it’s still very much a seller’s game even though more houses are coming on the market and demand will continue to outstrip supply in the year ahead. Zillow is also forecasting that the market will move — but only slightly — from “white-hot” to “red-hot” in 2022, with an expected 11.7% appreciation in home values over the next year. And while that would mark a dip in appreciation from 2021’s 17.7% increase in value, rising prices will continue to be a challenge for potential homebuyers.

Other real estate firms have forecasted a more modest increase, 2% to 5%, in 2022 home values. But it’s difficult to make solid predictions, as most analysts were confident that values would decline from the pandemic’s onset, April 2020 through April 2021. Instead, the market experienced a historic appreciation increase.

As the year closes, the authors of the Insights blog welcome your thoughts and comments on meeting current challenges and your outlook for the year ahead. Insights is designed as an interactive forum, so please send your thoughts in an email. We may share them in a future post.