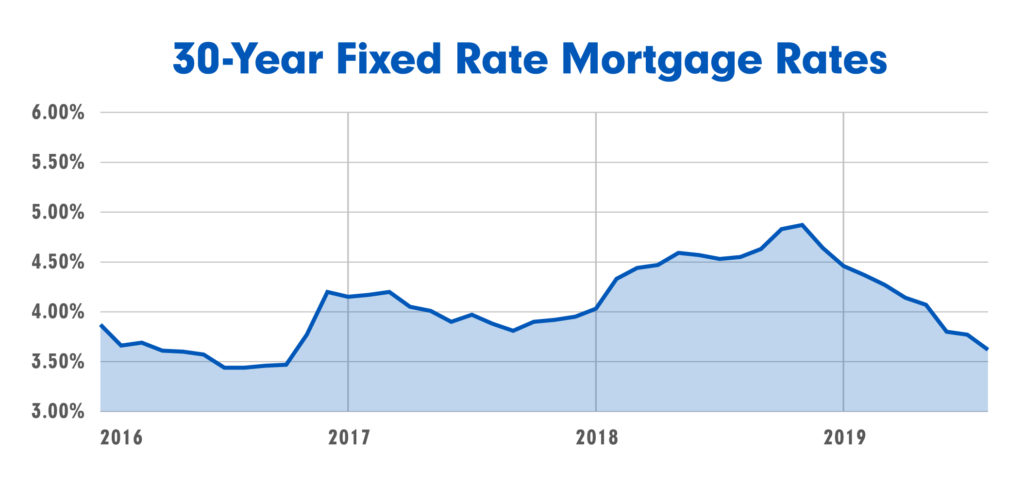

Two remarkable things happened in August. First, rates for 30-year fixed mortgages fell to a three-year low — after years of industry analysts predicting sharp increases in mortgage rates.

“Millennials Drive Mortgage Refinance Boom and Lenders are Scrambling” is how CNBC described the situation in an Aug. 9 headline.

Also in August, Arch MI introduced our RateStar Refinance Retention Program, which helps lenders capture more refinance business by offering reduced borrower-paid MI premiums for eligible borrowers refinancing Arch MI-insured loans.

“We’re in the unique position of having amassed immense amounts of critical data through an ever-changing market and being able to combine that with experienced and talented people to turn the data into insights.”

The requirements are simple:

- The borrower’s current loan must be insured with an active Arch MI certificate (either borrower-paid or lender-paid MI).

- The new loan must be a rate-and-term refinance insured only with Arch MI’s monthly borrower-paid MI (BPMI) premium.

These two remarkable events — the unexpected downturn in rates and the debut of a new Arch MI solution to help lenders maximize this new market opportunity — shine a bright spotlight on the flexibility and resilience of the RateStar platform.

Arch MI RateStar® revolutionized the MI industry a decade ago with the introduction of risk-based pricing, an innovation that established a new standard for the industry. RateStar℠ is the platform we used to develop the industry’s only buydown tool, RateStar Buydown℠, which launched last year. Now, with RateStar Refinance Retention, it’s providing lenders a unique tool to close more loans while helping borrowers save even more on refinances.

In a recent conversation, Arch MI President and CEO Michael Schmeiser put all of this in context, saying “We’re in the unique position at Arch MI of having amassed immense amounts of critical data through an ever-changing market and being able to combine that with experienced and talented people to turn the data into insights. Our powerful RateStar platform gives us flexibility through a variety of market conditions and enables us to support lenders by creating innovative solutions that best meet their needs.”

Of course, we also listen to the input of forecasters on the direction of interest rates according to their best assessments of economic factors and trends, but recent history shows the housing market can move in unpredictable directions. Over the past five or more years, many of the industry’s top economic forecasters had been predicting increases in mortgage rates. Among the headlines:

- The Days of 3.5% 30-Year Fixed Mortgages Are Over — CNBC.com, Dec. 11, 2013.

- Mortgage Rates Are Headed to 5%, But Don’t Blame the Fed — The Washington Post, Oct. 29, 2014.

- Mortgage Rates to Increase Past 4.5% in 2018 — HousingWire, Jan. 3, 2018.

- Zillow Predicts 5.8% Mortgage Rate in 2019 — National Mortgage Professional, Nov. 28, 2018.

The fact those forecasts were proven wrong this year by unexpected events illustrates how important it is for mortgage lenders (and MI providers) to stay flexible and to pivot quickly to make the most of new, unexpected opportunities

Developing RateStar Refinance Retention required a lot of work over just a few short months by our developers and teams who work hand-in-hand with lenders to understand their needs and identify emerging opportunities.

Not all of the innovative tools we develop will become full-fledged products. I really applaud Arch MI’s teams for recognizing this particular opportunity and developing the new RateStar Refinance Retention product even before it became clear how low rates would dip or how long this refinance boom would continue.

As always, our Insights blog is designed as a forum for sharing ideas. Please send us your thoughts on whether the refinance boom has created challenges for you and what tools could help you close more loans.

Predictions in chart:

- Milwaukee Journal Sentinel (February 2016): Rates could reach 4.5% in 2016 and 5% in 2017.

- Wall Street Journal (January 2017): Rates for conforming loans to hit 4.5% by the end of 2017.

- Bankrate.com (December 2018): Experts agree rates will stay north of 5% throughout 2019.