Hispanic Heritage Month (Sept. 15–Oct. 15) is a time to reflect on how Spanish-speaking people with Latin American roots enrich our culture and increasingly contribute to economic vitality and purchasing power in our communities.

This is especially true for the housing industry. Since 2017, Hispanic families and individuals have accounted for 20.6% of homeownership growth; since 2014, they have added 1.9 million owner households, according to the 2021 State of Hispanic Homeownership Report. It is published by the National Association of Hispanic Real Estate Professionals (NAHREP®).

The Urban Institute also predicts that 70% of homeownership growth through 2040 will come from Hispanic homebuyers.

Recently, the National Association of Realtors® published a profile of Hispanic homebuyers that presents a clearer picture of this important homebuying segment:

- The U.S. Hispanic population reached 62.1 million in 2020, a 23% increase from the 2010 Census.

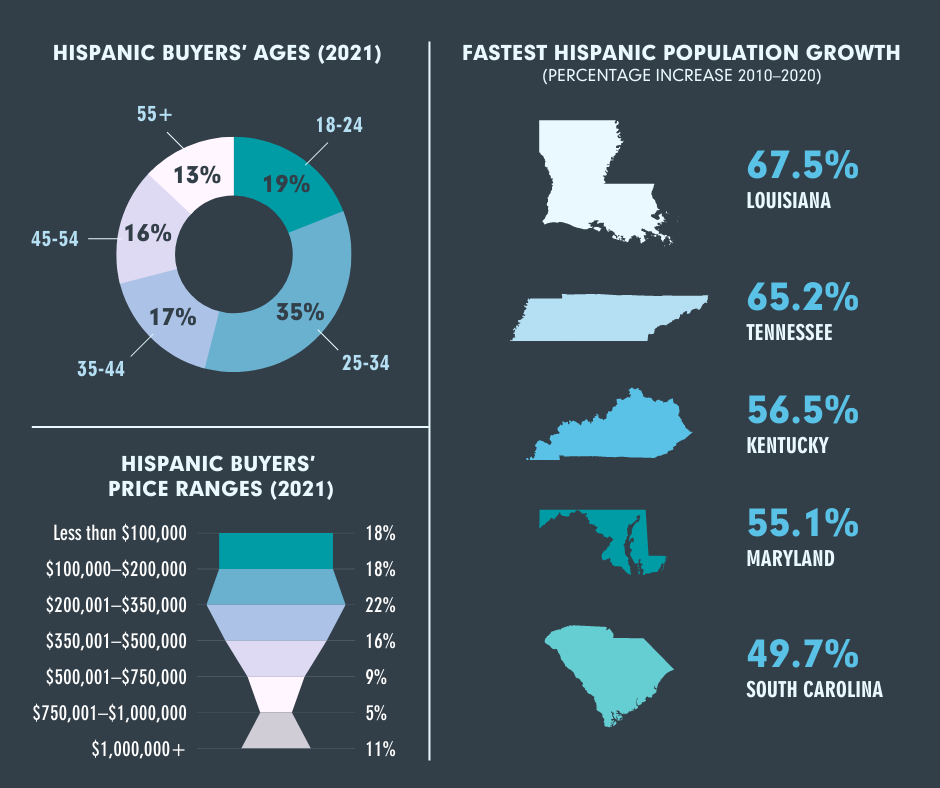

- Today’s Hispanic homebuyers are young, with 55% under 35.

- 47% reported incomes over $50,000 a year, with 21% earning over $100,000 a year.

- Mirroring broader trends, Hispanic buyers are searching for a three-bedroom home with 2.5 bathrooms.

- Almost half (49%) of Hispanic homebuyers live in urban areas, while 42% live in suburban communities.

- Close to 60% of Hispanic buyers seek homes priced at $350,000 or less.

- 60% of Hispanic homebuyers plan to move away from their current city or town.

- In 2021, the Hispanic homeownership rate reached 48.4% and is on track to reach 50% by 2025.

Hispanic buyers added 657,000 owner households between 2019 and 2021, according to NAHREP, a network of more than 40,000 professionals.

The Hispanic population’s purchasing power is growing and is driving a significant share of homebuying in numerous major metro areas.

8.3 Million Mortgage-Ready Adults

Hispanic homebuyers represent a huge opportunity for the housing finance industry. One of the most attention-grabbing statistics in NAHREP’s State of Hispanic Homeownership Report is that 40.8% of Hispanic adults aged 45 and under are mortgage-ready in terms of credit score, debt-to-income ratios and related measures. That’s a total of more than 8.3 million potential homebuyers, according to the NAHREP report released in March.

The growth of Hispanic homeownership has happened despite significant challenges in the wake of the pandemic, including the shortage of homes for first-time buyers, higher real estate costs in states with large Hispanic populations and bidding wars that put families without generational wealth at a disadvantage.

At the same time, the Hispanic population’s purchasing power is growing and is driving a significant share of homebuying in numerous major metro areas.

NAHREP CEO Gary Acosta recently stated that companies proficient in working with first-time buyers and that have relevant, low down payment loan products do well in the Hispanic market.

“Real estate is still a relationship-driven business,” Acosta wrote in an August RISMedia column. “You don’t have to be Hispanic to serve Hispanic consumers, but companies that are culturally competent and who have employees who mirror the customer will have an advantage.”

The Mortgage Industry’s Response

Over the past year, Arch MI has steadily built a set of Spanish-language materials, including flyers that mortgage originators can co-brand with their logos to reach new prospects. There are flyers on MI basics and MI cancellation and a video explaining how MI enables eligible borrowers to purchase homes with modest down payments.

In addition, Arch MI’s Buy with MI provides the mortgage products, solutions and resources to support affordable homeownership with down payments for qualified borrowers as low as 3% or even less.

Across the industry, there’s a growing awareness of the opportunity this important demographic represents. A large fintech firm recently introduced a mortgage platform that enables lenders and borrowers to complete an entire mortgage application in Spanish or English — or switch between the languages throughout the process.

Several large banks and credit unions have been succeeding with a focus on serving Hispanic communities. One California-based lender that currently makes a fifth of its loans to Hispanic homebuyers has pledged to originate $25 billion in new mortgages to Hispanic borrowers by 2025. The mortgage bank also plans to educate 5,000 real estate professionals on the cultural nuances of the Hispanic community and will host 70 homebuyer events across the nation.

The Insights blog encourages discussion about important topics for loan originators. Send us an email telling us what you’re doing to celebrate Hispanic Heritage Month. We would like to share your experience in a future blog post.