Five Reasons Your Borrowers Still Benefit from Buying a Home

It’s almost June, the month when historically a record number of new homeowners close on homes. Although mortgage rates were down slightly at the beginning of May (the average 30-year fixed-rate mortgage was 6.17% on May 11, as reported by businessinsider.com), inventory is still tight.

We don’t expect June closings to be back to normal this year, but some experts say the housing market later this year looks brighter for prospective homebuyers than it has been over the last few months. National Homeownership Month is a great time to examine trends and consider how to make homeownership more accessible to those who desire it.

The American Dream Is Alive and Well

June has celebrated homeownership every year since 1995, when President Bill Clinton declared a National Homeownership Week, which President George W. Bush expanded to a whole month in 2002. It recognizes the importance of this pillar of the American economy and homeownership as a primary goal for most Americans. Homes represent financial security and freedom.

The first year a majority of Americans owned a house was 1950. Seventy-three years later the percentage of American homeowners stands at 66% — or 220 million residents — as the U.S. Census Bureau reported in May.

Many current renters (the other 34%) already have a positive view of homeownership, according to an April TD Bank survey of adults planning their first home purchase:

- 39% of respondents believe that now is a good time to buy.

- 54% say they’re better off financially than they were two years ago.

- 85% say homeownership is a good long-term investment.

- 40% of respondents say rising rents are prompting them to move forward with plans to buy during 2023.

Now is a good time for loan originators to share compelling data with clients on the fence about jumping into the market. The perception of higher interest rates may have some potential first-time homebuyers feeling uncertain and stuck on the sidelines rather than focusing on the clear advantages of owning a home.

Five Positives in Today’s Market

What are the factors that can boost buyer optimism and maybe also move the homeownership rate? We can’t predict the future, but if borrowers have decided on a location where they want to live for at least a few years and their savings and income are stable, the various financial puzzle pieces can come together for them:

1. Homeownership is often less expensive than renting over the long term.

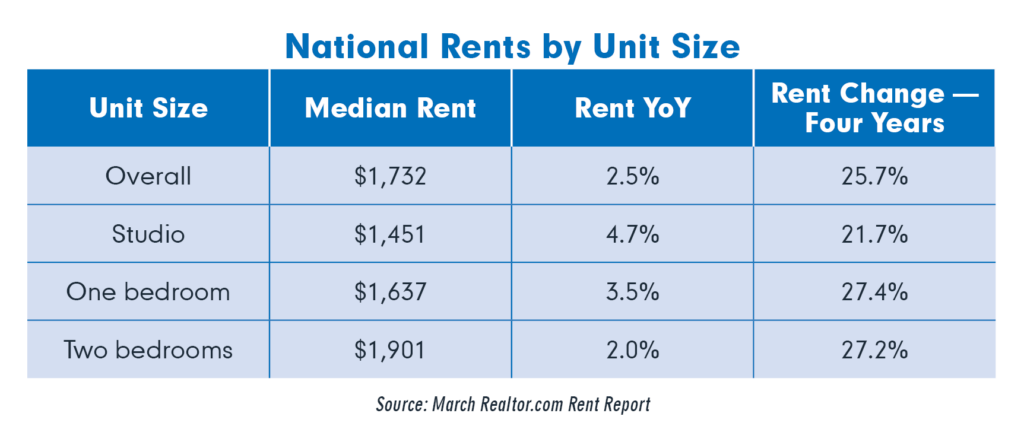

With four out of 10 participants in the TD Bank survey expressing concern about rising rents, a key focus of outreach to potential homebuyers should be locking in a consistent monthly mortgage payment. With a fixed-rate mortgage, principal and interest remain stable for 30 years (360 months). It’s because of rising rents that many financial experts continue to say homeowners who stay in their home for five years are generally better off than renters.

In several parts of the country, median rents exceed the median mortgages paid by new homeowners, Realtor.com reported in January. The list includes major metros like Memphis, Tennessee, where the median monthly cost for a starter home is $847 vs. a median monthly rent of $1,258. Other cities where the monthly costs of starter homes beat renting include Pittsburgh, Pennsylvania; Birmingham, Alabama; St. Louis, Missouri; and Baltimore, Maryland.

For current renters, owning is an opportunity to control monthly housing payments. With homeownership, there are no unpredicted and unbudgeted rent increases. With fixed-rate loans, principal and interest stay the same for the life of the loan. Down the road, if rates drop, these new homeowners may be able to refinance and lower their monthly mortgage payments.

2. Homes Appreciate in Value over Time

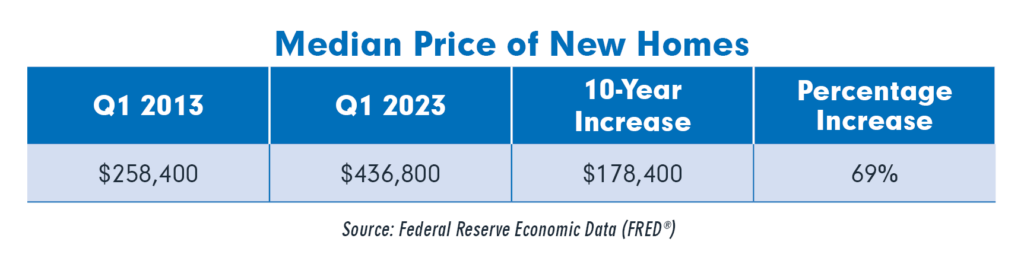

Financial experts agree that for many buyers, home equity builds wealth more quickly than most other investments.

The National Association of Realtors® reported that the median home price in March 2023 was $375,700, compared to $379,300 in March 2022, a 0.9% decline. But growing home value and the associated equity over an extended period of time continues to be a solid financial strategy: Homes are excellent investments.

“U.S. homeowners with mortgages (which account for roughly 63% of all properties) have seen their equity increase by a total of $1 trillion since the fourth quarter of 2021, a gain of 7.3% year over year,” according to CoreLogic’s home equity report for 4Q 2022. “As U.S. home price growth continued its slow, steady decline in the final months of 2022, home equity trends naturally followed suit. In the fourth quarter of 2022, the average borrower earned about $14,300 in equity year over year, compared with the $63,100 gain in the first quarter of 2022.”

But the report reiterates that U.S. homeowners, on average, still have about $270,000 in equity, nearly $90,000 more than they had at the outset of the pandemic. Black Knight, with similar data to CoreLogic, reported in mid-2022 that the average homeowner had gained $92,000 in equity since the beginning of the pandemic, while at the same time, home values in the country’s 50 largest metro areas have increased by between 19% and 66%.

3. Look Forward to Lower Rates

Mortgage rates are higher in terms of recent history, but the average mortgage rate over the past 30 years is 7.75%, according to mortgagereports.com.

In April, National Association of Realtors® Chief Economist Lawrence Yun was optimistic that in the near future, rates appeared heading down. “With overall consumer price inflation calming and rents expected to decelerate from robust apartment construction, the Federal Reserve’s monetary policy will surely shift from tightening to neutral to possibly loosening over the next 12 months. Therefore, home sales will steadily rebound despite several months of fluctuations.”

4. Homeownership Has Potential Tax Benefits

Tax rules vary across states, localities and personal circumstances, so advise your clients to consult with a tax expert to find out their eligibility for the following:

Mortgage interest deduction: In addition to the benefit of having a predictable monthly housing payment and a set yearly expense, owning a home allows taxpayers to itemize interest expenses (up to $750,000 of mortgage debt) when they are higher than the standard deduction. Homeowners pay more interest in the early years of the mortgage, so this benefit declines over time.

Mortgage points deduction: First-time homebuyers may deduct the entire cost of points to the lender for the year the home is purchased.

Property tax deduction: Homeowners may also deduct state and local property taxes up to $10,000 per year.

5. Borrowers Don’t Need Huge Down Payments

Solve a key challenge for homebuyers by showing them how to qualify for down payments they can afford by applying for mortgage loans structured with mortgage insurance (MI) and the flexible down-payment options available with MIHome from Arch MI.

The program offers a comprehensive set of MI products and solutions with down payment options as low as 3% of the purchase price. And with coverage from Arch Mortgage Guaranty Company (AMGC), homeownership is possible with even lower down payments.

For basic MI concepts, point to our easy-to-understand introductory video and use our Roadmap to Homeownership toolkit’s presentations, checklists and forms to help you explain the buying process to first-time homebuyers.

Celebrate homeownership and share positive news with your prospective buyers this June!

Thanks for reading this Insights post. We’d love to hear about successes you’ve had in helping renters become homeowners. Send us an email and we may include your comment in a future post.