While many experts predict lower rates in the coming months, the wild swings we saw in late 2024 and continuing uncertainty about the Federal Reserve’s 2025 direction mean nothing is settled.

Loan officers must stay informed and adaptable to handle the daily market ups and downs. By using the latest technology, they can proactively guide potential homebuyers on the smartest moves in a volatile market.

1. Keep up with the Market

It’s vital to monitor economic news, housing trends and market changes, especially when it comes to conditions likely to cause mortgage rates to rise or fall.

- Research the Housing Market: Set aside a few minutes each day to read economic news, including employment, construction and local and nationwide inflation trends.

- Get Timely Updates: Arch MI’s HaMMRSM Digest newsletter summarizes the latest economic and housing data weekly. This easy-to-read resource from our Economics Team provides actionable insights into how key economic indicators affect your business. It’s co-authored by Arch Chief Global Economist Parker Ross and Assistant Vice President of Global Real Estate Economics Leonidas Mourelatos, who also present our popular Housing Update webinars quarterly.

2. Adapt Your Sales Strategy

Flexibility is key in a changing market. Emphasize wealth-building opportunities and options your customer may not be aware of.

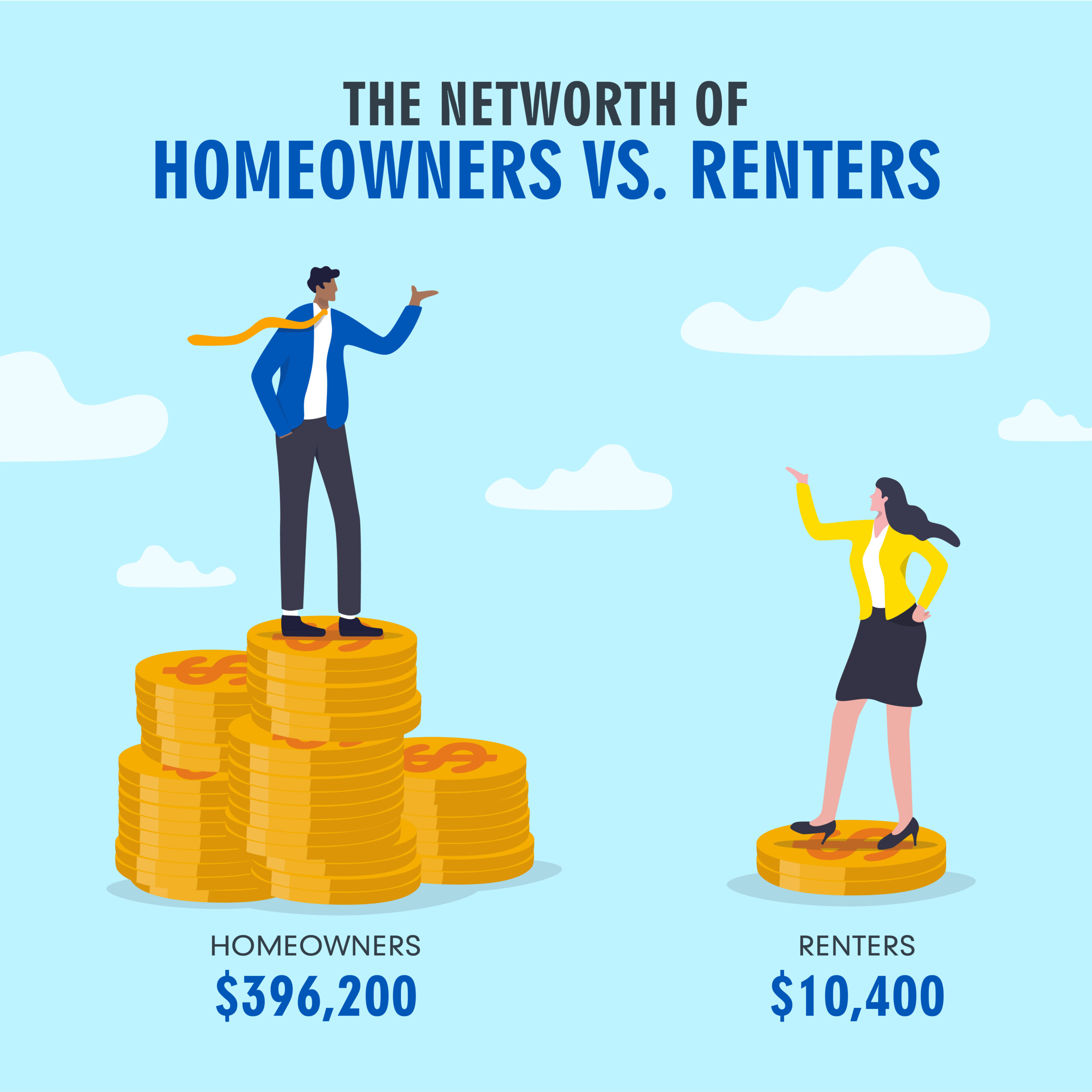

- Focus on Long-Term Value: Frame the conversation around homeownership’s lasting benefits. The Federal Reserve’s most recent Survey of Consumer Finances found that a homeowner’s median net worth is $396,200 — far more than the $10,400 median net worth of renters. Delaying homeownership often means missing out on building wealth by accumulating home equity and benefiting from potential increases in home values.

- Offer Alternative Loan Products: Educate clients on adjustable-rate mortgages (ARMs) and other loan types. Arch MI Equity Secure®, available through Arch Mortgage Assurance Company (AMAC), can expand your lending opportunities and lower risks with coverage for eligible HELOCs and closed-end home equity loans.

3. Educate Buyers about Down Payment Options

According to BankRate’s 2024 Down Payment Survey, 51% of aspiring homebuyers said not having enough savings for a down payment was a top barrier. In many cases, renters can qualify for a mortgage without needing substantial savings.

- Arch MI’s Buy with MI offers a comprehensive set of products and solutions that support down payment options as low as 3%of the purchase price. And with Arch Mortgage Guaranty Company (AMGC) coverage, homeownership is possible with even lower down payments.

- Gift Funds: Don’t overlook the value of telling clients about gift funds, grants and down payment assistance programs. According to a National Association of Realtors® survey, 12% of homebuyers relied on down payment help from friends and family as of April, up from 9% the previous year.

- Prepare First-Time Buyers: To reach more aspiring buyers, consider hosting seminars, webinars or one-on-one consultations. Arch MI’s Roadmap to Homeownership includes a presentation you can share in person or virtually.

- Setting Expectations: Provide actionable tips and tools, such as budgeting guides or checklists, to help clients feel prepared. For example, aspiring homeowners can use worksheets in our Roadmap to Homeownership to calculate a comfortable monthly mortgage payment and develop a budget for their new home.

4. Leverage Technology

Streamlining your workflow frees you to focus on customer outreach and strengthening your relationships with referral partners.

- Learn to Use Tech Tools More Effectively: During slower periods, take the opportunity to learn or optimize using customer relationship management (CRM) tools. A CRM can help you stay organized, track client interactions and follow up more effectively.

- Automate Routine Tasks: Use technology to handle routine tasks such as emails, rate alerts or personalized messages for milestone events.

- Stay in Touch: Increase your use of social media, email campaigns and video content to share updates, tips and success stories. Not only does this showcase your expertise, but it also keeps you top of mind with your audience.

Thriving in Any Market

In 2025, the Insights blog would like to incorporate more reader feedback. If you’ve had success with helping clients with recent mortgage challenges, send us a message describing how you overcame some of them. With your permission, we’ll include your thoughts in a future blog post on this subject.