This homebuying season is expected to be extremely competitive, especially for first-time buyers who face the challenge of saving for a down payment.

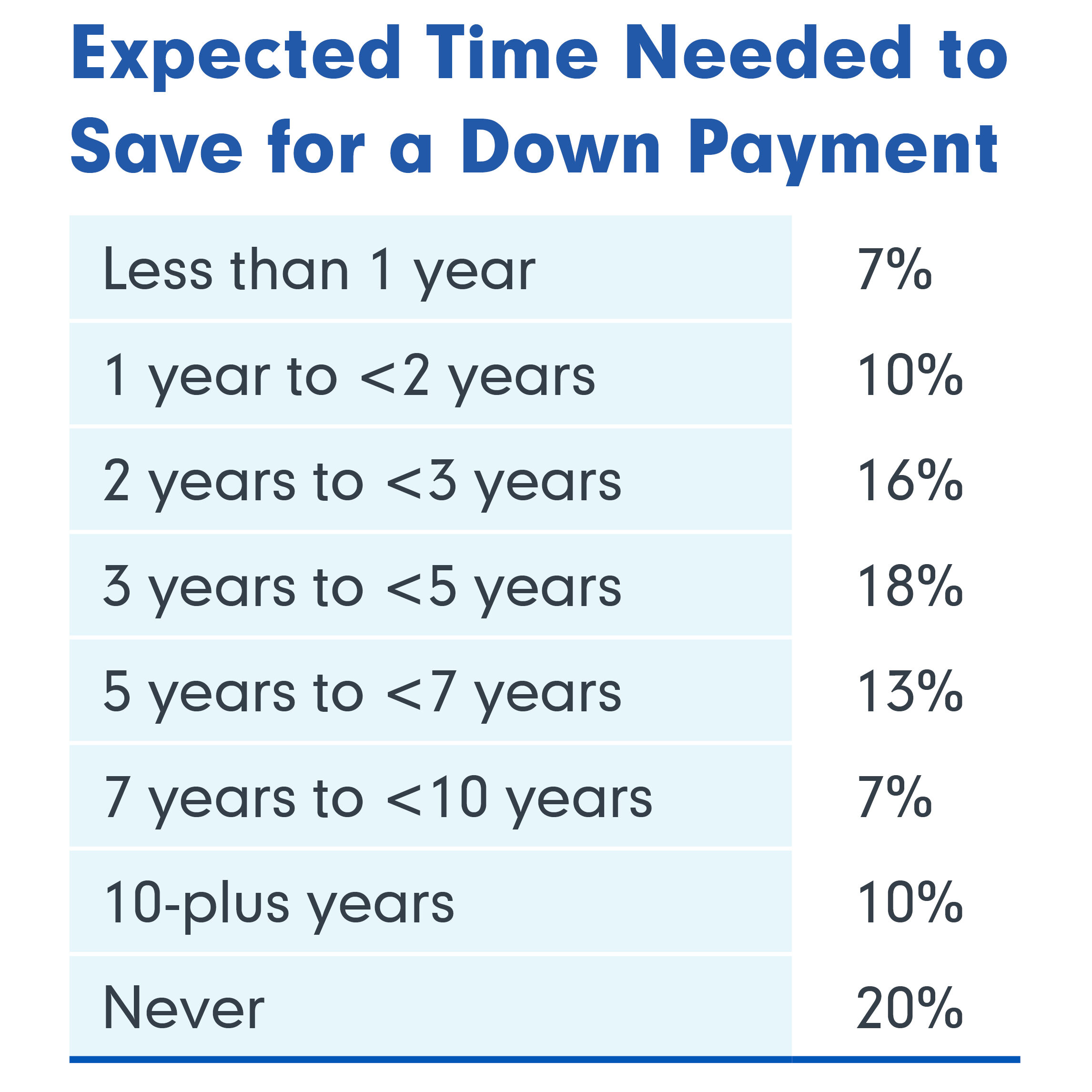

According to a 2024 Bankrate survey, nearly one-third of aspiring homeowners (30%) say it will take at least five years or longer to save enough money for a home, while 10% say it will take a decade or more.

In a 2023 National Association of Realtors® survey, 38% of respondents ranked saving for a down payment the most difficult step in the homebuying process at a time when home prices are expected to rise.

- According to a February Harris Poll, 81% of renters said they would prefer to own a home in the future, but only 38% said they were currently saving for a down payment.

- NAR reports the median down payment for first-time buyers is 8%, which translates to $28,000 for a median-priced $350,000 home.

- Nearly one-quarter (23%) of first-time buyers used a gift from friends or family for their down payment.

- First-time buyers accounted for 32% of home sales, according to NAR’s 2024 Home Buyers and Sellers Generational Trends Report, up from 26% the previous year.

Zillow’s latest Rent Report states rent nationwide averaged $1,983 in March, meaning renters spent more than $23,700 a year on rent alone — not including utilities, maintenance and other fees. In 2022, the median monthly cost of homeownership was $1,775 per month, according to the U.S. Census Bureau.

Mortgage loan officers will most likely get questions about down payment requirements during the spring and summer homebuying seasons. Home prices and competition are higher during this period, making it even harder for first-time buyers. As a result, many first-time buyers either postpone their purchase, settle for a less desirable home or stop searching.

As a mortgage loan officer, you can provide the practical advice your clients need to overcome this hurdle and achieve their homeownership dreams. Here are three ways to help first-time buyers save for a down payment this year and boost your business and client satisfaction.

Tip #1: Encourage Buyers to Automate Their Savings

By setting up a separate savings account for their down payment fund, borrowers can have money automatically transferred to it monthly. This helps them avoid spending money on other things and builds their savings habit. You can also suggest some apps or tools to track their progress and motivate them to reach their goal.

Tip #2: Educate Clients about Low-Down-Payment Options

Many first-time buyers are unaware of the various low-down-payment options available, including mortgage insurance that enables qualified borrowers to qualify for a mortgage with a modest down payment. Arch MI provides down payment options as low as 3% of the purchase price. Arch Mortgage Guaranty Company (AMGC) also offers special programs like Community Heroes that makes homeownership more affordable for first responders, medical providers and current and former military members with down payments as low as 1%.

Tip #3: Recommend Down-Payment Assistance Programs (DPA)

In many areas, eligible first-time homebuyers can qualify for down payment help with grants, loans or tax credits. State and local governments offer some of these DPA programs, while others are available from nonprofits or employers. You can help your clients find and apply for these programs by using online resources or contacting local housing agencies.

Arch MI’s Roadmap to Homeownership is another resource you can use to educate your borrowers. It includes an in-depth presentation covering every stage of the homebuying process, and you can share it in person or via video. It includes worksheets for setting a budget and identifying the right home for your borrowers.

By using these tips, first-time buyers can approach the down-payment challenge more strategically and make the most of the homebuying season. They’ll appreciate your suggestions, and you can establish yourself as a trusted and knowledgeable mortgage professional who provides clients value and guidance.

Hopefully, this post inspires you to dig into Arch MI’s LO resources, starting with our LO Toolbox, a set of MI tools, products and solutions for originating loans insured by Arch MI. We’d love your input on how you’ve worked with first-time homebuyers to find effective down-payment solutions that move them from renting to homeownership. Email us, and we may use your comments in a future insights.archmi.com post.