Videos

Refresh your knowledge of our products and services by watching our quick, easy-to-grasp clips. Browse the library for in-depth information in video format on MI basics (in English and en espanõl) and other topics.

From Arch MI

Customers Are Talking About the Power of Arch MI

Watch what mortgage professionals have to say about how Arch MI has powered possibilities for their businesses….

Watch now

From Arch MI

Arch MI RateStar®

Find out how RateStar℠ and RateStar Buydown℠ deliver the most competitive Arch MI rate for your borrower’s loan….

Watch now

From Arch MI

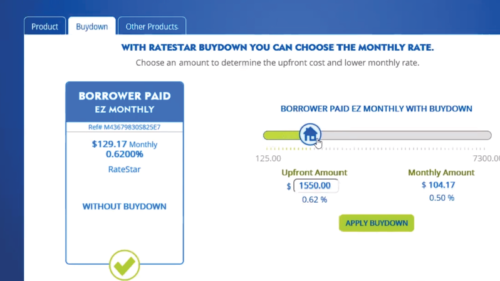

Arch MI’s Ratestar Buydown℠

Get the lowest monthly MI premium for your borrower with RateStar Buydown℠….

Watch now

From Arch MI

RateStar Buydown Instructional Demo

Video demonstration of how to get a RateStar BuydownSM….

Watch now

From Arch MI

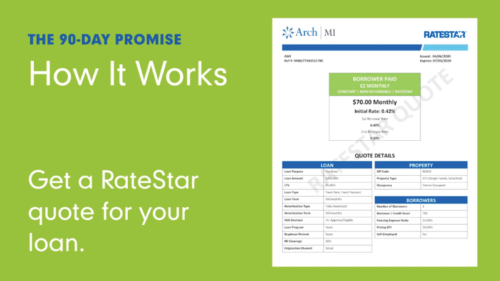

The 90-Day Promise from Arch MI’s RateStar

Find out how your RateStar quote is automatically guaranteed under our 90-Day Promise….

Watch now

From Arch MI

AMGC Community Heroes Program

Learn how the AMGC Community Heroes program helps teachers, police, firefighters and first responders qualify for mortgages with only modest down payments….

Watch now

From Arch MI

Before You Lock with FHA: Check Your Borrower’s Savings with Arch MI

Saving your customers money is time well spent. And you can check Arch MI’s rates against FHA faster than you can tie your shoes. Here are three reasons to compare Arch MI’s saving vs. FHA….

Watch now

From Arch MI

Video for Lenders: Overview of MI Cancellation

Learn the facts about canceling mortgage insurance and the lender’s responsibility for automatic termination when certain conditions are met….

Watch now

From Arch MI

Video for Borrowers: A Guide to MI Cancellation

If you currently have mortgage insurance on your home loan, this quick video explains how it can be canceled when certain conditions are met….

Watch now

About Arch MI’s Insights Blog

Arch MI’s Insights blog provides commentary from company experts on challenges and opportunities for mortgage loan originators.

Our primary focus is spotlighting solutions to help you close more loans for qualified borrowers, and we’ll cover a wide range of topics to fulfill that mission – including housing policy, generational trends, technological innovation and more.