Housing industry economists and forecasters are predicting a dip in home sales this year as new buyers confront affordability challenges and extremely limited inventory in many areas.

Many potential homebuyers lack knowledge about mortgage requirements and nearly half of current renters have bought into false, but persistent, myths about down payments, according to news reports.

This uncertainty about mortgage requirements can drive novice buyers to respond to online “Click to See If You Qualify” advertisements that funnel them into completing a mortgage application with an Internet-based lender, bypassing traditional mortgage originators.

For traditional mortgage lenders, hosting homebuying seminars continues to be a proven strategy for educating first-time buyers and making them comfortable with the mortgage process. For 2019, it’s important that the seminar content reflect the changing base of first-time buyers, who tend to be more diverse and more female.

32 percent of Americans plan on purchasing a home within the next five years…

With that in mind, here are 10 recent news stories to draw upon as you speak to first-time buyers in the coming months:

- According to a Zillow.com study:

- Among first-time buyers, 38 percent say they’re “somewhat concerned” about whether they qualify for a mortgage.

- Seven percent say they don’t know what to expect from the mortgage process.

- When seeking a mortgage, 54 percent will contact two or more lenders.

- Thirty-seven percent of first-time buyers make a down payment of 9 percent or less.

- Currently, 49 percent of renters believe the myth that a down payment of at least 20 percent is required to purchase a home, according to Bank of America’s 2018 Homebuyer Insights Report. (This despite Zillow’s findings that well over a third of first-time buyers put down 9 percent or less and 59 percent made a down payment of 19 percent or less.)

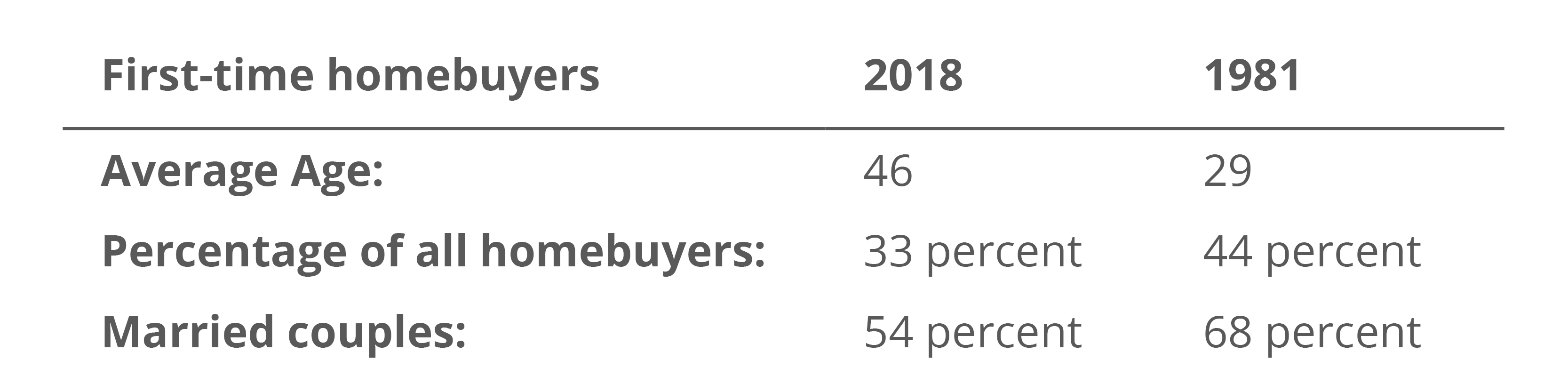

- New numbers from the National Association of Realtors® show the first-time buyers of today are significantly different from those of 38 years ago when NAR started tracking key statistics.

- Forbes magazine reports that Hannah, Alexis and Taylor were among the fastest-growing names on home sale deeds in 2018. The names signal a rise in purchases by single women — who now account for 18 percent of home purchases (up from 12 percent in 1981).

- Some economists are expressing rising optimism for the spring homebuying season due to continuing job growth and the 3.2 percent increase in hourly earnings recorded during 2018, according to The MReport. “With rising wages and slowing home price growth, [first-time buyers] may be in a better position to make homeownership a reality as we enter the spring buying season,” said Danielle Hale, chief economist at Realtor.com.

- According to NerdWallet’s 2018 Home Buyer Report, 32 percent of Americans plan on purchasing a home within the next five years, citing “it will be a good investment” as their primary motivation for buying.

- At a time when cable shows like “The Property Brothers” and “Hometime” are scoring high ratings, 68 percent of Millennials say they would buy a fixer-upper, according to CNBC.com, citing a survey of 1,000 individuals searching for a home.

- LendingTree.com recently picked the best cities for first-time buyers with a ranking that included average credit scores and the size of down payments. The top locations include:

- Pittsburgh, Pennsylvania

- Cleveland, Ohio

- Oklahoma City, Oklahoma

- Cincinnati, Ohio

- Birmingham, Alabama

- A recent analysis by the Urban Institute found that older adults who purchased homes while they were in the 25–34 age range accumulated the most housing wealth by their 60s — a median of around $150,000. Those who waited until age 45 to buy, accumulated much less housing wealth — about $44,000 — by their 60s.

- The top mistake made by first-time buyers is finding a property before contacting a lender, according to Forbes. The February report says meeting with a lender ahead of shopping gives first-time buyers a more realistic sense of the time required to close a loan, the mortgage programs available to new buyers and down payment options.

As always, this blog is designed to be a space where we exchange ideas. We’d love to hear your feedback on ideas for connecting with first-time homebuyers and counseling young families who have concerns about the mortgage process.

Bookmark insights now and check back as we revisit this topic and include your input.