Millennials are serious about buying their first homes and this creates opportunities for loan originators focused on the large number of college-educated, high-income young people who are ready to become first-time homebuyers.

In many cases, Millennials may buy their first homes while living with mom and dad. Due to the pandemic, the number of young people (18–29) living with family reached 52% in July 2020, the highest level since the 1930s, according to the Pew Research Center.

This is partly because most colleges and universities shut down in March 2020 because of COVID-19, sending home many undergraduate and graduate students to study virtually. In addition, some, having lost jobs or having had hours reduced because businesses closed or cut operations, returned home for financial reasons. These young adults will likely return to school and work, but some may stay with their parents for longer periods.

Millennials in Focus

According to the 2021 Home Buyers and Sellers Generational Trends Report, published in March by the National Association of Realtors® (NAR), Millennials (ages 22–40) view buying a home as a good investment — more than any other generation — and they represent the largest segment (37% in 2020) of homebuyers overall.

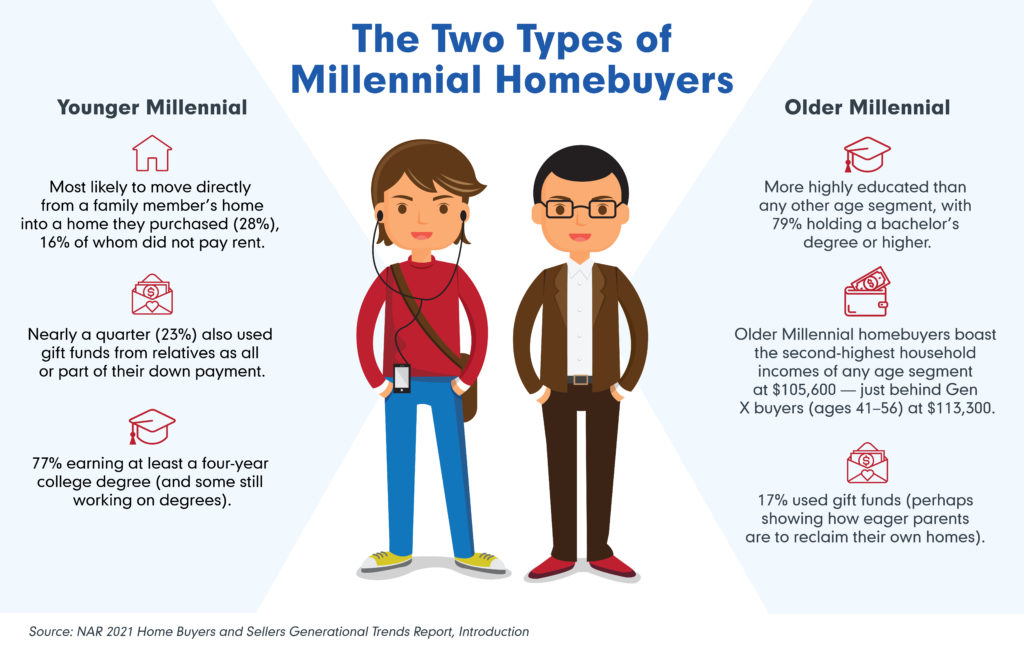

A statistical snapshot of how Millennial homebuyers stack up in the NAR survey segments the generation into younger (ages 22–30) and older (ages 31–40) sets because they present different profiles:

- Millennial homebuyers are more highly educated than any other age segment, with 79% of older Millennials holding a bachelor’s degree or higher. Younger Millennials are close behind, with 77% earning at least a four-year college degree (and some still working on degrees).

- Older Millennial homebuyers boast the second-highest household incomes of any age segment at $105,600 — just behind Gen X buyers (ages 41–56) at $113,300.

- Younger Millennials are most likely to move directly from a family member’s home into a home they purchased (28%), 16% of whom did not pay rent. Nearly a quarter (23%) of the younger group also used gift funds from relatives as all or part of their down payment. For older Millennials, 17% used gift funds (perhaps showing how eager parents are to reclaim their own homes).

Challenges:

- Many Millennials, especially the younger set in their 20s, are saddled with student debt and, if not living with their parents, high rents.

- Of all generations, Millennials say they are making the most sacrifices to save for a home, including cutting their spending on luxury items and entertainment, taking second jobs and moving in with friends and parents to save on rent. In this last category, 8% of younger Millennials and 4% of older members of the demographic moved in with parents or other relatives explicitly to save for a home.

- The NAR report shows that beyond the challenge of finding the right property in the first place, Millennials are more intimidated than any other generation by the challenges of buying a house. These include:

- The paperwork involved.

- Understanding the process and steps.

- Saving for the down payment.

- Closing on a mortgage.

- Getting an appraisal.

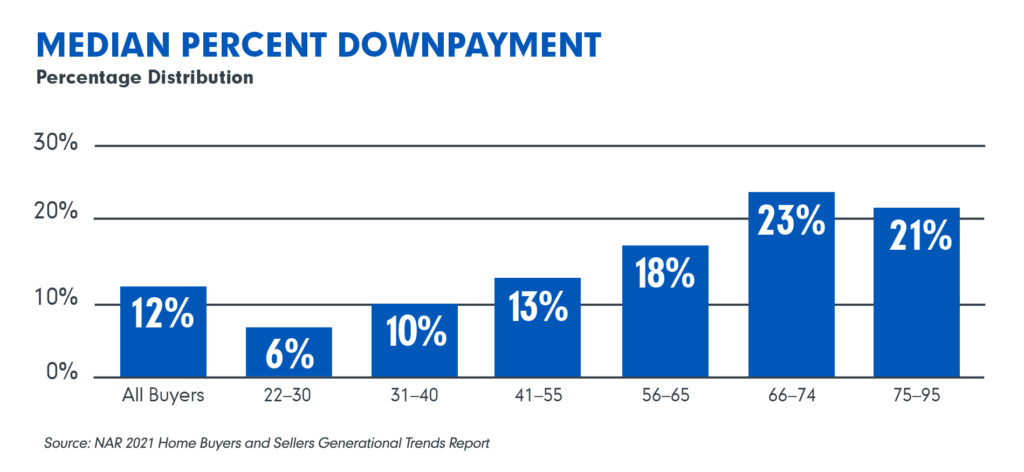

- While 11% of all buyers view saving for a down payment as the most difficult part of the process, 25% of buyers under 30 years old say it is the hardest part.

It’s clear younger Millennials are off to a much slower start on homeownership than previous generations. But, according to a national survey conducted last year by Jeffrey Arnett, a Clark University researcher, 74% of surveyed respondents 18–29 years old who are currently living with their parents say they’d prefer to live independently.

How to Reach Out to Millennial Homebuyers in 2021

Explain to potential homebuyers that lenders want to see a lower debt-to-income ratio and a history of making timely payments on bills to build a better credit report. Highlight the availability of lender and government down payment programs, even grants and tax credits. Show them how mortgage insurance works and how it allows for a lower down payment.

Must-haves: Arch MI’s comprehensive “Roadmap to Homeownership” materials are available to help you educate prospective first-time homebuyers on various strategies to speed their homeownership journey. Remember, Millennials love the internet and use your social media network to engage them and introduce yourself. Then invite them for a virtual or in-person “Roadmap to Homeownership” presentation that includes the step-by-step checklists they need. Bolster their confidence for managing the paperwork and process.

We plan to post periodic updates on this topic, and we’d love to include your experience working with Millennial buyers. Thoughts? Send us an email with strategies that have worked for you.