One of the newest trends impacting the real estate market is what Travel and Leisure magazine calls “workations” — working vacations that offer a change of scenery for homeowners who can do their jobs from almost anywhere.

These getaways can include a long weekend or staying multiple weeks in a short-term rental. Increasingly, affluent buyers are leveraging low mortgage interest rates to purchase second homes for longer-term stays in the scenic communities they enjoy visiting.

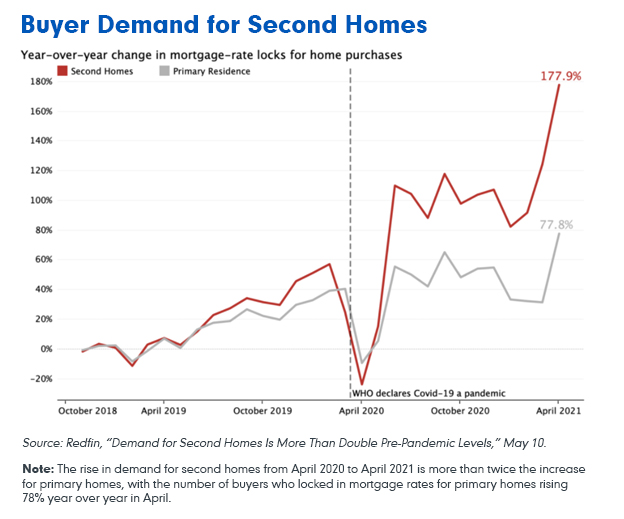

Redfin recently reported the number of buyers who locked in mortgage rates for second homes in April jumped 178% over the same month in 2020.

Redfin officials caution that the 178% figure was likely exaggerated by the impact of COVID-19 in April 2020. The firm’s researchers noted that April marked 11 straight months that rate locks for second homes were up 80% or more.

… eligible borrowers can purchase a second home with a down payment as low as 10% by using mortgage insurance.

It’s clear that rising vacation home sales create a need for loan originators to refresh their knowledge of mortgage financing options for second homes to answer questions from those unfamiliar with the purchase process and requirements.

As sales of second homes set records, Fannie Mae adjusted its annual forecast for all home sales, saying “continued tight inventories would lead to a slowing pace of existing home sales as the year progresses.”

The combination of remote work and low mortgage rates is “creating an ideal environment for affluent Americans to buy vacation homes,” said Redfin Chief Economist Daryl Fairweather. “As long as the economy continues to grow, I don’t foresee demand for second homes slowing down anytime soon.”

According to a Gallup poll released in early May, 72% of white-collar workers continue to work from home. Tech giants like Amazon, Facebook and Google have announced extended work-from-home plans into the summer months.

The workation trend can also be a fun topic for loan originators to highlight on social media to let followers know that vacation homes can be attainable for homeowners with the financial means to take on a second mortgage. The National Association of Realtors® reports that the average down payment on a second home is 20%. However, eligible borrowers can purchase a second home with a down payment as low as 10% by using mortgage insurance.

Of course, buying a second home is a big step and borrowers need to assess whether they’re ready for all of the additional expenses of purchasing a vacation home — including maintenance, taxes, insurance, utilities, furniture and travel expenses.

Potential buyers are motived to act quickly on vacation getaways as costs rise in the communities Redfin categorizes as seasonal towns — where home prices rose 27% year over year in April to $450,000.

We will likely return to this topic for updates as the trend gains strength, and we’d love to include your experience working with second-home buyers. To share your insights on strategies that have worked for you, send us an email.