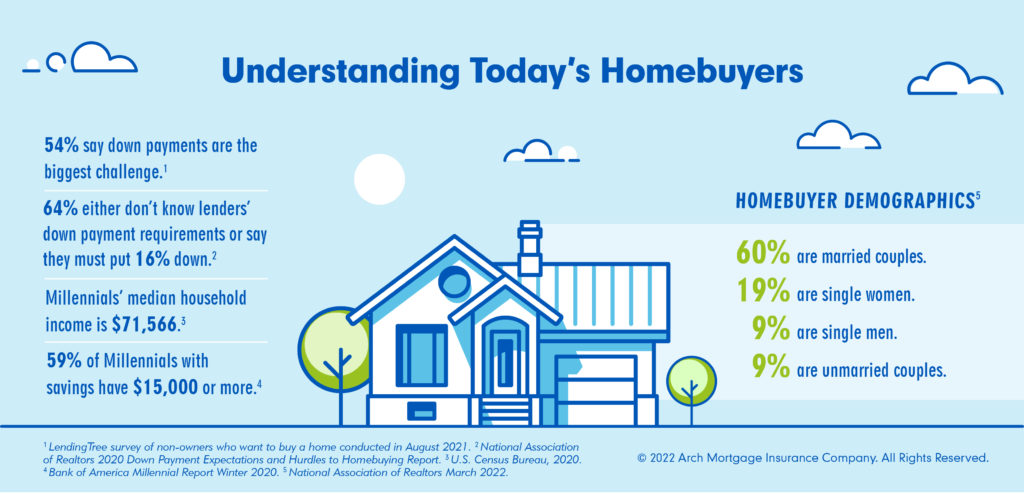

Imagine yourself as a typical Millennial — you’re 33 years old, your household income is $71,566 (the median) and you pay $2,065 in rent, the national average for a two-bedroom residence.

You’re also typical in believing that lenders require a large down payment — which is incorrect, but in a National Association of Realtors survey, 64% of respondents said lenders require down payments of 16% or more or didn’t know how much is required up front.

In truth, first-time homebuyers pay an average 7% down — and eligible borrowers may qualify for down payments as low as 3%, 1% or even less with mortgage loans insured by programs available through Arch MI and Arch Mortgage Guaranty Company (AMGC).

Rising rents — up by 25% in the past year — make a fixed-rate mortgage with a predictable payment even more attractive. Another reality for many Millennials is they’re working from home — at least part of the time. The lack of a daily commute helps expand the pool of homes they can consider to include distant, more affordable towns or suburbs.

Millennial pet lovers are likely to be most interested in the prospect of a low down payment. In a Realtor.com survey of more than 2,000 buyers who plan on purchasing a home in the next 12 months, 82% were pet owners — 61% have at least one dog and 45% are cat parents.

MI Home from Arch MI: Making Homeownership Affordable

Helping these renters become homeowners faster than they ever expected is possible with MIHome from Arch MI’s full range of solutions, products and resources aimed at helping lenders structure and insure low-down-payment loans.

As an originator, you can help Millennials escape future rent increases, invest in a home and build wealth over the long term by solving the down payment issue.

Borrowers who choose private MI also avoid FHA’s upfront payment of 1.75% of the loan amount and are typically able to close more quickly with less paperwork.

MIHome from Arch MI has everything lenders need to serve high-income renters with expanded options:

- Manufactured homes, condos, co-ops, single-family and construction-to-perm are all eligible.

- Flexible Arch MI guidelines that work with down payments as low as 3%; gifts and grants are allowed.

- Coverage through the AMGC Community Program allows down payments of 1% and even 0% for qualified borrowers.

- Competitive MI pricing with RateStar® and customized MI premium payments with RateStar BuydownSM.

- Appraisal gaps? Use our MI strategy to eliminate the need for extra cash at closing.

- Free GSE-approved homebuyer education for loan programs via our website.*

- Free Roadmap to Homeownership toolkit contains everything for your own homebuyer seminars.

*Limited to borrowers with loans insured by Arch MI or AMGC.

Private MI Beats FHA, Too

Millennial borrowers can see additional monthly savings by choosing a conventional loan insured with Arch MI over FHA. Over the long term, one major advantage is that private MI is cancelable[i], but for FHA borrowers who make down payments of 10% or less, FHA’s coverage remains in place for the life of the loan.

Borrowers who choose private MI also avoid FHA’s upfront payment of 1.75% of the loan amount and are typically able to close more quickly with less paperwork.

The Opportunity is Clear

Whether your borrower’s number is 5%, 3% or even less, learn more about MIHome from Arch MI’s options by visiting archmi.com/MIHome or contacting your Arch MI Account Manager.

[i]See the Homeowners Protection Act of 1998 for more information.