“The One-Minute Manager,” first published 40 years ago, is still regarded as one of the most important leadership books of all time with its simple message for executives: Ask employees to report their weekly goals in 60 seconds (or less than 250 words).

It’s sold more than 15 million copies and has inspired a growing set of newer self-help articles on the benefits of “30-second accomplishments.” These quick achievements — like making your bed or immediately responding to a colleague’s message — reduce stress and shorten your daily to-do list.

For loan originators, few 30-second accomplishments deliver a better return on your time than comparing Arch MI vs. FHA.

Big Savings: Monthly Over the Life of the Loan

Use RateStarSM for your 30-second check. You’ll get not only our most competitive loan rate but also the better rate for your borrower — since RateStar usually beats FHA, both in terms of the monthly payment and over the life of the loan.

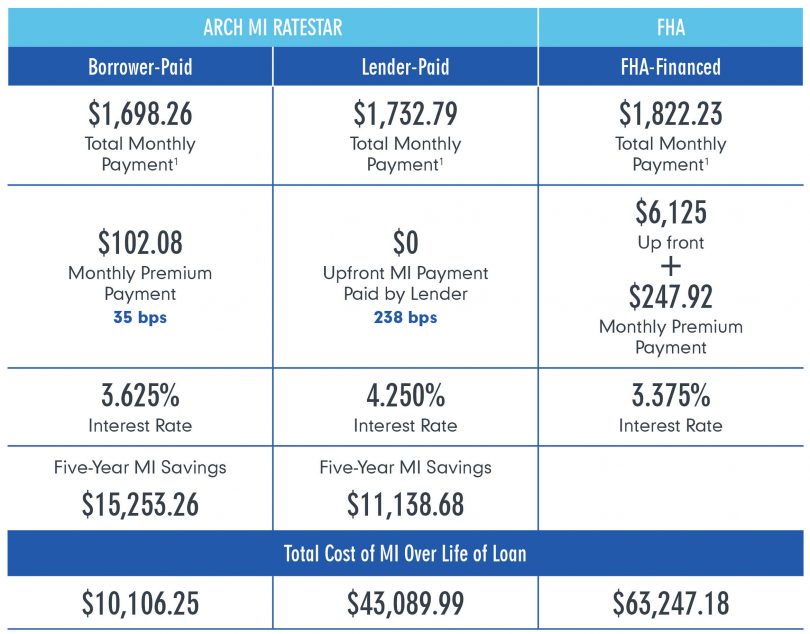

As you can see in the chart below, taking a half-minute to compare Arch MI to FHA would save a typical pair of borrowers with good credit (720) more than $145 per month when purchasing a median-priced home with a 5% down payment.

Compare the Numbers*

That’s a solid 30-second accomplishment. Next, tell your borrowers the good news about their monthly savings and (from the example above) the $15,353 they’ll save over the initial five years of homeownership.

FHA may be the best choice for some borrowers, depending on their credit score and other factors, but with the large potential savings from Arch MI, it makes sense to compare us to FHA every time before you lock the loan.

For loan originators, few 30-second accomplishments deliver a better return on your time than comparing Arch MI vs. FHA.

Long-Term Savings

Borrowers can save even more over the full life of the loan by choosing Arch MI. One major advantage is that private MI is cancelable[1] , but for FHA borrowers who make down payments of less than 10%, FHA’s coverage remains in place for the life of the loan. The total cost of MI for a typical borrower over the life of an Arch MI-insured loan would be $10,106.25 vs. FHA’s total life-of-loan cost of $63,247.18.

Let’s look at some other differences between FHA and private MI. A major point of comparison is that FHA requires an initial payment of 1.75% of the loan amount. Typically, the amount is folded into the loan amount, which can mean borrowers don’t build equity as quickly. However, Arch MI’s monthly options don’t require an upfront premium payment at closing.

Here are some other important advantages:

- Arch MI allows higher LTVs than FHA.[2]

- There’s less paperwork, faster originations and free MI underwriting help from our ASK Center.

- RateStar BuydownSM allows you to further buy down the MI premium for qualifying borrowers. FHA has no comparable MI buydown tool.

- Borrowers have more premium payment options: single, monthly or lender-paid.

- And unlike FHA, we’ll cover eligible second homes.

We’d like to hear about your experiences checking Arch MI against FHA. Send us an email ([email protected]) to tell us how long it took you to make the comparison — and how much your borrowers saved.

[1] See the Homeowners Protection Act of 1998 for more information.

[2] For additional details, refer to Arch MI’s Underwriting Manual.