Now is the time to get ready for June’s National Homeownership Month. There’s so much to celebrate following our industry’s record-setting 2021 and the continuing robust demand for homes.

For mortgage originators, June is a prime opportunity to remind current renters and other potential homebuyers why so many families and individuals are eager to purchase homes:

- Cost-conscious buyers want a stable, fixed mortgage payment that won’t increase over the life of the loan. This is especially true after landlords increased rental rates by 22% over the past 12 months, according to an April 2022 Rent Report by Rent.com.

- Homeownership stands out as one of the best tools for building wealth. The Federal Reserve’s 2020 Survey of Consumer Finances found the median net worth of homeowners is $255,000 — far more than the $6,300 median net worth of renters. While other investments can contribute to a person’s net worth, a home is the largest asset most people own.

Benefits of Homeownership

In addition to building equity over time, homeowners can see additional gains through property price appreciation and realize big savings with tax-deductible mortgage interest and property tax payments.

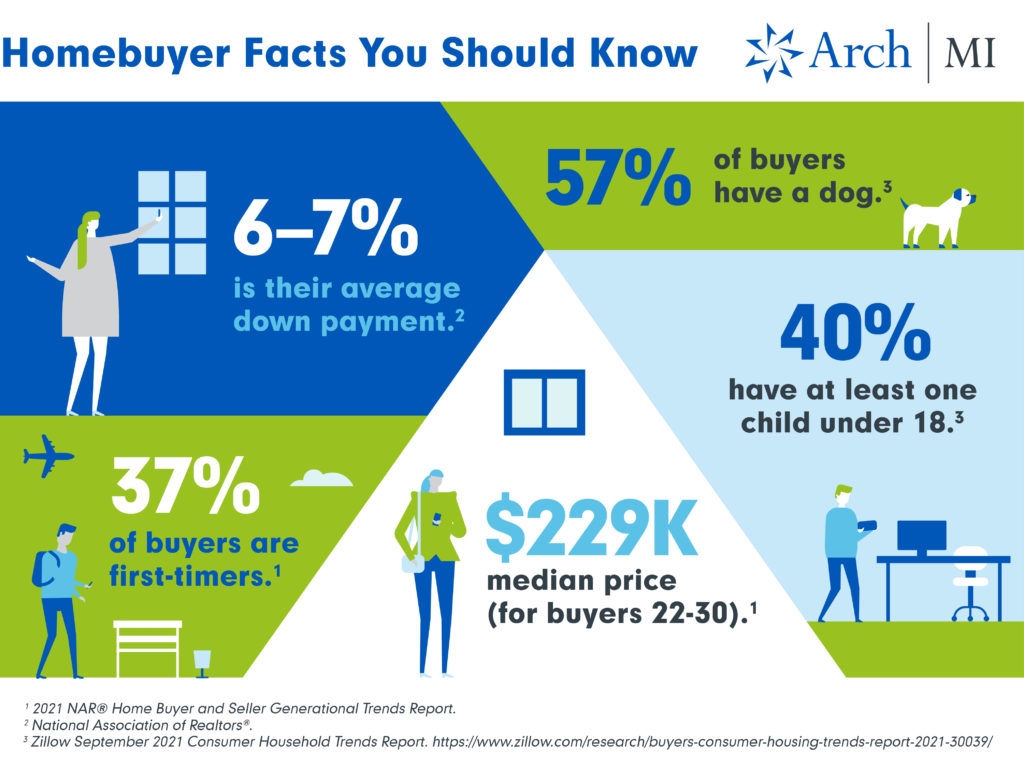

After spending more time at home over the past two years, many of us have also gained appreciation of a home that meets a variety of needs, including work and outdoor space. Being able to spend time outside is particularly valuable to the 57% of recent homebuyers who have a dog, according to Zillow, which also reports that 40% of new homebuyers have a child under 18.

Answering Questions from Potential Homebuyers

So, how can originators motivate potential homebuyers to start benefiting from a home purchase?

One tried-and-true way to energize potential homebuyers is to host a first-time homebuyer seminar. Arch MI makes educating customers with in-person and online Zoom events easy using our Roadmap to Homeownership presentation and toolkit.

… three-fifths (62%) of Americans think lenders require a 20% down payment — while, in reality, first-time buyers typically pay about 6% down and 3% down payments are available for eligible borrowers.

With June approaching rapidly, it’s relatively simple to co-brand the Roadmap to Homeownership presentation with your company’s logos and start promoting a homebuying education session to your customers.

The comprehensive Roadmap presentation is designed to answer most homebuyer questions. The Roadmap toolkit also includes worksheets borrowers can use to calculate an affordable mortgage payment. Customers also get a full overview of the entire mortgage process to help them understand what to expect.

The 20% Down Payment Myth

The need for buyer education is clear from NerdWallet’s 2020 survey indicating three-fifths (62%) of Americans think lenders require a 20% down payment — while, in reality, first-time buyers typically pay about 6% down and 3% down payments are available for eligible borrowers.

The Roadmap to Homeownership provides potential buyers with accurate facts on modest down payments, the increasing use of gift funds and other ways potential buyers can overcome the most common challenges.

For homebuyers who are already engaged in the process and know some of the typical obstacles, Arch MI also offers solutions focused on helping eligible borrowers become homeowners, including:

- Originators can customize lower monthly MI payments to fit each borrower’s budget using RateStar BuydownSM — the industry’s only buydown tool. Lowering the MI premium can enable more loans to meet GSE loan requirements.

- Lenders are also using our effective Bridge the Appraisal Gap strategy to reduce or eliminate borrowers’ need for extra cash at closing.

- To qualify more essential workers and degreed professionals, Arch MI offers flexible MI coverage through Arch Mortgage Guaranty Company (AMGC). The AMGC Community Program allows modest down payments for eligible borrowers, including teachers, medical workers, police and firefighters and professionals in fields ranging from accounting to architecture.

To get started with a Roadmap to Homeownership seminar event or other customer outreach during National Homeownership Month, visit our one-stop hub for loan originators, the Arch MI LO Toolbox. Or contact your Arch MI Account Manager for more information and resources.