Just when you think there is finally a nationwide consensus about the need to build more homes to meet housing demand, someone lets the cat out of the bag that it just isn’t so.

- Or, in this case, a mountain lion. (More on that below.)

This issue of Arch MI’s Capital Commentary explores the topic of new housing stock from several different perspectives: housing economists, a Wall Street analyst, cutting-edge developers and the NIMBY (“not-in-my-backyard”) crowd.

1. Affordability Depends on More Homes

Housing affordability fell to a 10-year low in 2021, and supply shortages, coupled with rising interest rates, threaten to make 2022 even less affordable, concluded economist Rose Quint in a recent National Association of Home Builders (NAHB) “Eye on Housing” blog post.

- Just 54% of homes sold in the fourth quarter were affordable to families earning the U.S. median income of $79,900, according to the NAHB/Wells Fargo Housing Opportunity Index (HOI).

- The HOI found that the national median home price increased to a record $360,000 in the fourth quarter, up “a whopping $40,000” from the first quarter.

Looking for an affordable place to buy a home? Forget California.

- Southern California remained the least affordable large metropolitan area for the fifth consecutive quarter, with only 7.5% of homes meeting the affordable threshold.

- The top five least-affordable small housing markets were also in the Golden State.

- Instead, consider a move to Cumberland, Maryland, or one of the nearby towns across the state border in West Virginia. That’s where 94% of homes are affordable to families earning the median income of $60,800.

What is the solution?

- More homes, say the National Association of Realtors® and Freddie Mac.

A 2021 study produced by Rosen Consulting Group on behalf of the Realtors made the case that the nation has an “underbuilding gap” between 5.5 and 6.8 million housing units since 2001. According to the report:

- There is an “acute shortage” of available housing “to the detriment of the health of the public and the economy. The scale of underbuilding and the existing demand-supply gap is enormous … and will require a major national commitment to build more housing of all types.”

Freddie Mac’s economists agree we need more homes but put the figure a bit lower than the Realtors, suggesting there is a need for 3.8 million units to “not only meet the demand from the growing number of households but also to maintain a target vacancy rate of 13%.”

2. Are We Already Overbuilding?

Home shortage? Not so fast, suggests Wall Street equity analyst Ivy Zelman, CEO of Zelman and Associates. Her firm’s research paper, “Cradle to Grave,” indicates that we are on a pace to building too many homes to meet the needs of tomorrow’s buyers.

- Zelman told me on the latest Arch MI PolicyCast podcast, “Zelman the Contrarian,” that household formation is so slow that home supply will soon outpace demand.

The report drills down “to the sobering message that the United States’ demographics are going in the wrong direction,” said Zelman. “We see household growth has slowed to the slowest on record.”

- “We don’t currently believe we’re overbuilt,” she said, “but what we are trying to convey and help the industry navigate is that based on the latest 12 months (of homebuilding) and with what’s coming down the pike that would put us in an overbuilt situation when these homes get completed.”

Further complicating the issue, Zelman claims, home builders are building the wrong homes to meet the needs of today’s buyers:

- “We aren’t building the right product to get young adults out of their parents’ homes,” noting that both mortgage and rent payments exceed what most young adults can afford.

Zelman is no stranger to standing out from the crowd. She rose to fame by being the first equity analyst to predict the housing crash in the mid-aughts.

3. Innovations That Can Address Affordability

On the other hand, housing advocates are convinced the home shortage is real and suggest one way to solve it is by building smaller and smarter.

- One answer might be Accessory Dwelling Units, or ADUs. These can be converted garages or newly built structures on single-family lots.

In early February, the White House held a virtual webinar — led by Domestic Policy Advisor Susan Rice — on making it easier to build ADUs. Rice was joined by a bevy of housing experts, including urban planners, mayors and government officials, including Julia Joseph, Deputy Assistant Secretary for the Federal Housing Administration, and Sandra Thompson, Acting Director of the Federal Housing Finance Agency.

ADUs are attractive, said Rice, because they can:

- Serve as a multigenerational housing option to let families live closer together;

- Help homeowners generate income; and

- Increase density in single-family areas while using existing infrastructure systems.

Many communities restrict ADUs, and financing for them has been burdensome, but proponents are persuaded their benefits are significant.

- From a recent Urban Institute report: “ADUs tend to be inherently affordable (and) could play a major role in easing the rental shortage in urban and suburban areas. Several states now permit ADUs as a matter of right (e.g., California, New Hampshire, Oregon and Connecticut), as do many localities; we recommend all states do this.”

The biggest barrier to constructing more ADUs is financing, said Karen Chapple, Professor Emeritus at UC Berkeley.

- “Our surveys have found that almost half of homeowners are building [ADUs] from cash or credit cards. We’ve had a hard time getting conventional loans to work because banks don’t want to count the future income stream from the ADUs,” she told attendees of the White House webinar.

A second solution might be technology, such as 3D printing.

Habitat for Humanity recently completed its first 3D-printed home.

“The three-bedroom, two-bath concrete structure, which can withstand hurricanes and tornadoes, is a 1,200-square-foot technological triumph in Virginia whose exterior was constructed in just 28 hours,” reported Architectural Digest. A time-lapse video of making the home can be found here.

4. More Homes? OK, but Not Near Me.

California politicians might have thought they had found the perfect solution to creating more housing in the nation’s most expensive state when the legislature overwhelmingly passed, and Gov. Gavin Newsom signed S.B. 9 and S.B. 10, enabling more homes to be built on single-family lots. S.B. 9 allows up to four units to be built on a property zoned for a single-family home.

- The only thing more innovative than the policy solution has been opponents’ efforts to block the law.

The Los Angeles Times’ housing affordability reporter Liam Dillon tweeted out the most brazen attempt by a city to keep its population in check: declare it a mountain lion sanctuary.

Alas, the big-cat strategy didn’t have nine lives. It died — for the first and last time — about a week later. Faced with the prospect of endless and costly litigation, Woodside reluctantly has begun accepting applications for duplexes.

- As Dillon later tweeted, “In like a lion, out like a duplex.”

Woodside isn’t alone in trying to skirt the law, though.

- Three cities in the state’s South Bay area, Carson, Redondo Beach and Torrance, aim to persuade courts that the law violates the state constitution “by removing local control over land-use and failing to specifically tailor the bill’s provisions to address the state’s housing crisis.”

- The LA Conservancy complains that the measure will have “serious implications for heritage conservation efforts.”

- According to the San Jose Mercury News, Cupertino, California — home to Apple’s headquarters — passed an ordinance limiting “S.B. 9 homes” to 2,000 square feet, a restriction questioned by housing advocates.

- All told, 200 cities voiced opposition to the bill before it was enacted.

Meanwhile, the median price of buying homes in the state soared more than 20% in 2021 to an all-time high of $734,612, according to Zillow.

5. Who Reads Capital Commentary?

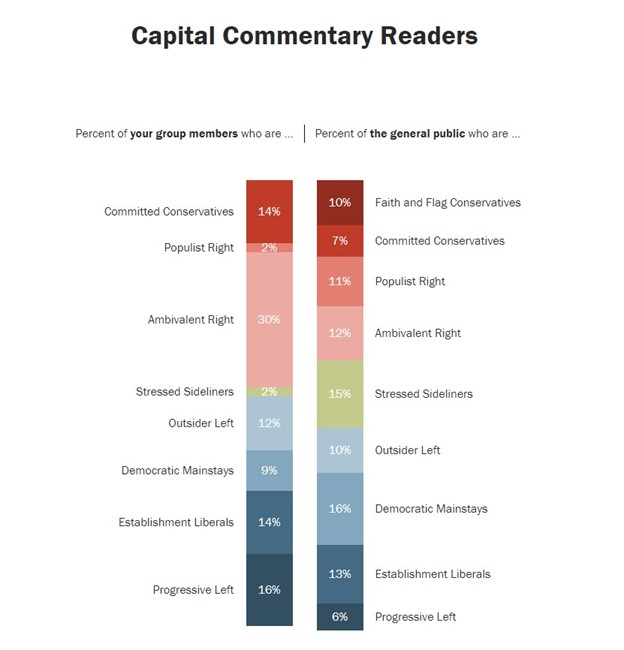

Late last year, I asked readers to take the Pew Research Center’s Political Typology Quiz and share where they fell along the political spectrum. I thought I’d reveal the results.

- In sum, readership generally reflects the political views of the nation, although the “ambivalent right” (Pew says that is a group that is “Young and politically cross-pressured: Conservative on economics and issues of race and gender, less so on immigration, social issues) is overrepresented among the newsletter’s readership.

If you haven’t yet taken the quiz, click here, and your result will be added to these totals.

6. Contest #22: Solving Affordable Housing

You might recognize your political typology, but where are you along the lines of solving the nation’s affordable housing challenge?

For Contest #22, I ask you to select the response that best represents your preferred course of action in your community. And feel free to share your reasons.

- Option 1: Build more affordable housing through government infrastructure investments.

- Option 2: Eliminate land-use restrictions such as single-family-only zones.

- Option 3: Incentivize home builders to use new technologies to reduce construction costs.

- Option 4: There is no affordable housing shortage.

- Option 5: I have a better idea (then share it).

Send your response to [email protected] by midnight Feb. 25. I will select winners of the Capital Commentary mug and saucer from each option listed above.

About Arch MI’s Capital Commentary

Capital Commentary newsletter reports on the public policy issues shaping the housing industry’s future. Each issue presents insights from a team led by Kirk Willison.

About Arch MI’s PolicyCast

PolicyCast — a video podcast series hosted by Kirk Willison — enables mortgage professionals to keep on top of the issues shaping the future of housing and the new policy initiatives under consideration in Washington, D.C., the state capitals and the financial markets.

Stay Updated

Sign up to receive notifications of new Arch MI PolicyCast videos and Capital Commentary newsletters.