1,496 words. Six-minute read.

Or, perhaps it will turn out to be election week as votes are tabulated over the coming days. Regardless of the results, housing will continue to be a critical driver of the nation’s financial well-being. This issue of Capital Commentary peers into some of the current events and proposals shaping America’s housing economy.

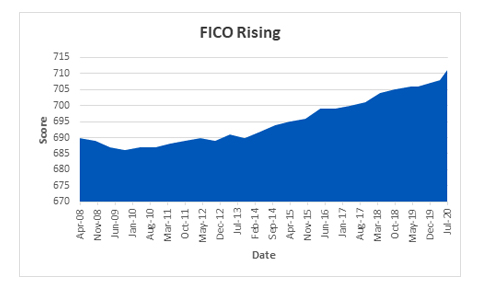

1. Pandemic Worsens, Credit Scores Improve

Some things can be expected in these days of the coronavirus pandemic: Stubborn unemployment numbers, struggling small businesses and consumers worried about their next mortgage or rent payment. (And, oh yes, long lines of mask-clad citizens waiting for their opportunity to vote.)

And then there is an unexpected feature: Rising credit scores.

The average FICO™ score of 711 is five points higher than a year ago, FICO reports. It is higher than at any time since the Great Recession of 2008.

Source: FICO

At first glance, it is difficult to make sense of that trend but let FICO’s Vice President for FICO Scores and Analytics Ethan Dornhelm explain:

“Those surprised by this latest figure may have thought that the FICO score is an indicator of where the economy is headed. But in fact, there is a bit of a lag between when a major macroeconomic event occurs and when the FICO Score reflects that event on an aggregate basis.”

Dornhelm cites several factors for the uptick: Government stimulus programs that reduce the incidence of missed payments; falling consumer debt (average credit card balances fell nearly $1,000 between January and July 2020); and loans in forbearance being considered current rather than delinquent by credit-rating agencies.

Nevertheless, the confluence is confounding lenders’ ability to judge risk, reports The Wall Street Journal:

“During the last downturn, loan delinquencies rose along with unemployment, and credit reports reflected missed payments in short order. That hasn’t happened this time, yet millions of Americans are still out of work and surviving on unemployment benefits. The disconnect has scrambled lenders’ underwriting models and sent them in search of new ways to evaluate applicants’ creditworthiness.”

The perilous state of the economy, a new all-time high in COVID cases and Congress’s inability to enact additional financial assistance has credit experts worried.

“We’re afraid that in a couple months there could be real damage to credit reports,” Francis Creighton, Chief Executive of the Consumer Data Industry Association, which represents credit-reporting firms, told the WSJ.

FICO will tackle the topic during a three-day webinar this week. Registration is free.

2. But Not Everyone Has a Credit Score …

Sure, credit scores are improving and that’s led to increasing home sales. But what about consumers who don’t have a credit score?

It has been estimated that up to 45 million Americans fall in this category. They are disproportionately minority and low-income consumers. As a result, their ability to borrow from banks and credit unions at prime rates is severely impaired.

Products such as VantageScore and Zest Finance are aiming to persuade lenders and housing agencies like Fannie Mae and Freddie Mac to consider their alternative credit scoring technologies during the underwriting process. They include payment histories on items such as rent, utilities and even Netflix bills.

But the loudest voice for change is Brian Brooks, Acting Comptroller of the Currency, the regulator of national banks.

Under his Project REACh (Roundtable for Economic Access and Change), Brooks would like to create a “synthetic credit score” to enable those forgotten borrowers to enter the mortgage market.

“It turns out that you can’t really build household wealth in this country if you don’t own a home,” Brooks said. “And you can’t really buy a home unless you have a credit score so you can qualify for a mortgage. So, when we find out that 45 million Americans don’t have a credit score, and that that population of people skews more heavily minority than the population at large, that’s an example of a structural barrier to wealth building. And we can fix that.”

Brooks well understands the benefits of homeownership. From 2014 to 2018, he served as General Counsel at Fannie Mae.

3. Black and Poor? You’ll Pay More

Another goal of Project REACh is to address the growing “Poor Tax” that Brooks sees confronting the nation’s unbanked population. It’s far worse than drawing a $15 poor tax card in the classic Monopoly game.

“The poor pay more for everything” in financial services, Brooks told attendees of a recent conference hosted by MIT’s Golub Center for Finance and Policy.

Brooks cited bank minimum balance requirements, credit card exchange charges and transaction fees on remittances that disproportionately hurt lower-income households.

He is hoping that new technologies, coupled with an emerging consensus of banking executives and community advocates, will drive change and improve outcomes. He is turning to his fellow REACh members, comprised of bankers, technologists, consumer advocates and civil rights leaders, for answers.

One glaring area that needs to be addressed is the tax paid by Black homebuyers, suggests a new study by MIT.

In “The Unequal Costs of Black Homeownership,” researchers conclude that Black households pay a significant “tax” to become homeowners.

“The overall differences in mortgage interest payments ($743 per year), mortgage insurance premiums ($550 per year) and property taxes ($390 per year) total $13,464 over the life of the loan, which amounts to $67,320 in lost retirement savings for Black homeowners. These inequities make it impossible for Black households to build housing wealth at the same rate as white households.”

The authors conclude that “nearly a quarter of the disparity in homeownership costs for Black homeowners is due to local property tax assessments.”

The primary causes for the Black tax? According to MIT:

- Blacks pay higher mortgage rates at origination.

- Blacks pay more for mortgage insurance.

- Blacks pay more in property taxes.

Among their recommended solutions are tax credits for first-time homebuyers that could be used as a down payment “to reduce the effect of risk-based pricing and the need for mortgage insurance,” as well as “a government-supported insurance program that makes mortgage payments in the event of unemployment or disability.”

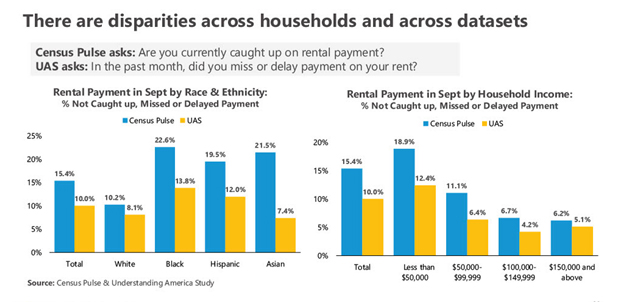

4. Will the Rental Market Trigger Catastrophe?

Homeowners have been largely spared from disaster thanks to aggressive moves by the nation’s housing agencies to provide extensive forbearance options for borrowers hurt by the coronavirus. Renters and their landlords, however, might not be as fortunate.

Renters are falling behind in their payments at an alarming rate and eviction moratoriums are due to expire soon after the new year. Renters will not only have to resume payments but — in order to stave off eviction in many locales — will need to pay past-due rent. This burden is sure to wreak havoc for many renter households. Lower-income, Black, Hispanic and Asian borrowers are at significant risk, according to recent surveys.

The potential ramifications are breathtaking. From The Wall Street Journal:

“A study of unemployed workers released last week by the Federal Reserve Bank of Philadelphia calculated outstanding rent debt would reach $7.2 billion before the close of 2020. Moody’s Analytics estimates that it could reach nearly $70 billion by year-end if there is no additional stimulus spending. The economic-research firm calculated that 12.8 million Americans would then owe an average of $5,400 from missed payments.”

An expected 30 to 40 million Americans, reports WSJ, are at risk of being evicted after the end of the moratoriums. Most landlords are unlikely — or unable — to forgive missing rent payments, which could financially strap these renters for years to come. Landlords, themselves, are fearful for their financial futures:

“It’s a really hard situation all around, because there’s no money coming in,” landlord Stacey Golia told New York City’s ABC News affiliate. “And you still have to provide basic services. It becomes a major financial struggle.”

She worries monthly about not being able to pay her mortgage and also her property taxes. She says she pays about $100,000 per year, and the city needs money from real estate taxes to help operate.

“There are rent pauses, there are court pauses,” she said. “But there are no pauses on property taxes.”

Election Day marks the end of the voting and the beginning of the political speculation. Mark your calendars for Nov. 9 to watch my Arch MI PolicyCast video podcast with two of the nation’s best analysts working at the intersection of financial services and politics, Jaret Seiberg of the Cowen Washington Research Group and Isaac Boltansky of Compass Point LLC. They will offer their perspectives on what we can expect for housing policy over the next two to four years. Sign up to receive notice of new Capital Commentary newsletters and PolicyCast podcasts.

Do you think Capital Commentary offers valuable information on housing policy and its potential impacts? If you do, share your comments with us. Your feedback will help ensure Capital Commentary covers the stories that have the most impact on your business.

About Arch MI’s Capital Commentary

Capital Commentary newsletter reports on the public policy issues shaping the housing industry’s future. Each issue presents insights from a team led by Kirk Willison.

About Arch MI’s PolicyCast

PolicyCast — a video podcast series hosted by Kirk Willison — enables mortgage professionals to keep on top of the issues shaping the future of housing and the new policy initiatives under consideration in Washington, D.C., the state capitals and the financial markets.

Stay Updated

Sign up to receive notifications of new Arch MI PolicyCast videos and Capital Commentary newsletters.