1,498 words. Six-minute read. See Item #5 for the Capital Commentary Contest.

“No one dreams of being a renter,” says Ed Gorman, Chief Community Development Officer of the National Community Reinvestment Coalition (NCRC) in Washington, DC.

And Gorman should know. He runs GROWTH by NCRC, the community group’s for-profit arm that builds and rehabs homes for low- and moderate-income buyers throughout the country. He sees the transformation homeownership creates when families acquire a piece of the American Dream.

But Gorman also sees that far too many Americans are destined to be “involuntary renters” unless we substantially increase home construction in the U.S. His advice (see item #4) is to dream big. This Capital Commentary issue looks at the home shortage crisis: Why it exists and what can be done to rectify it.

1. Everybody Knows We Need More Homes

Getting them to do anything about it is the challenge.

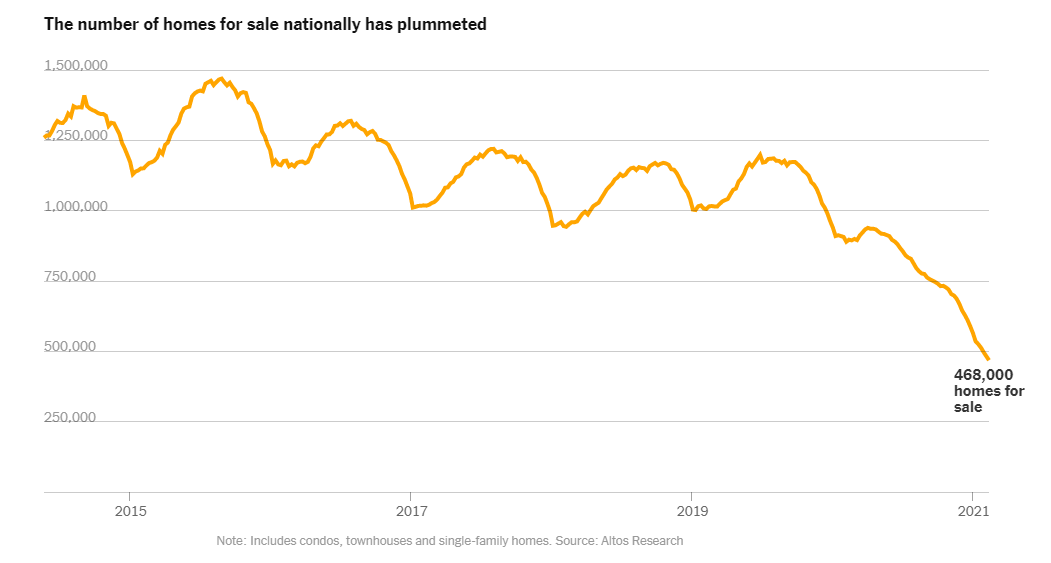

- Why it matters: The number of homes for sale is plummeting. Prices for homes are skyrocketing. It is a classic case of supply and demand. Unless more homes are built, prices will continue to escalate and the yawning gap in family wealth between the haves and have-nots will widen.

“Where have all the houses gone?” asks The New York Times, noting that the pandemic is one reason for the home shortage but that the problem goes much deeper.

“Much of the housing market has gone missing. On suburban streets and in many urban neighborhoods, across large and mid-size metro areas, many homes that would have typically come up for sale over the past year never did. Even in cities with a pandemic glut of empty apartments and falling rents, it has become incredibly hard to buy a home.”

— New York Times

For prospective buyers, “the pickings are slim in today’s real estate market,” reports Realtor.com.

- Overall, housing inventory fell 43% in January compared to the same month a year ago.

- Prices are soaring. CoreLogic reported that January home prices were 10% higher than a year ago, the largest year-over-year increase for the company’s Home Price Index since November 2013.

What are some of the reasons for the dearth of homes available for sale?

- During the pandemic, many homeowners have been reluctant to list their properties.

- Americans are staying in homes longer. Older Americans, for instance, are increasingly aging in place rather than moving in with children or to warmer locales.

- Tens of thousands of homes have been purchased by investors and converted from owner-occupied to rental units.

- Zoning rules restrict the number and types of homes that can be placed on lots.

2. California Shows What Not to Do

No state’s housing crisis is as severe as California, where the typical home value reached nearly $625,000 in January. Some experts say the state’s supply has fallen more than 3 million housing units behind what is needed for existing household demand.

- “Punishing rents and the increasingly prohibitive cost of homeownership have turned housing into the foremost symbol of inequality and an economy gone wrong,” read the cover notes of Conor Dougherty’s book “Golden Gates,” about the state’s affordable housing challenges.

- “California has the dubious distinction of having somehow managed to produce some of the highest wages in America as well as the highest state poverty rate once the cost of housing is figured in,” writes Dougherty, an economics reporter for the New York Times.

Dougherty, a recent guest of the Arch MI PolicyCast video podcast (click here to see the episode), points to a number of pressing problems contributing to the crisis of affordability, including cities that prefer to lure jobs and businesses (and the taxes they pay) but leave housing needs to be addressed by other communities in the region.

- Case in point: Cupertino, California: The city of 60,000 landed Apple’s circular 2.8-million-square-foot headquarters in 2018. Then-CEO Steve Jobs provided detailed information to Cupertino city leaders about the building designed to hold 12,000 staffers, but “missing from his presentation was where those employees would live,” reported the San Francisco Chronicle.

“Look at the way they (Cupertino officials) made that decision and then multiply it by all the little cities around the country in all the big metro areas … and you can see how we are not thinking about our housing problem the way we should be thinking,” Dougherty told PolicyCast.

“Golden Gates” primarily focuses on the San Francisco Bay Area but as Dougherty writes in a recent New York Times article, “The Californians Are Coming. So Is Their Housing Crisis,” similar problems are being spotted in places such as Boise, Idaho; Denver, Colorado; Nashville, Tennessee; and Austin, Texas.

3. Small Towns Need More Homes, Too

The housing squeeze isn’t only affecting thriving metropolitan areas such as the ones Dougherty discusses in his book and in the New York Times. Suburban, exurban and rural areas are feeling the pains, too.

- Three major employers are expanding operations in Salina, Kansas, but there is no place for the workers to live. Destiny Williams drives more than an hour to get to work in Salina. She found a new place in McPherson, Kansas, closer to work but still 40 minutes away. One problem the town faces is that bringing construction supplies into a non-metro area comes with a high price tag. “Those construction costs are high as well, so you know it doesn’t mean that someone doesn’t want to build $150,000 or $200,000 houses, but the numbers just don’t pan out,” said Lauren Driscoll, Salina’s Community and Development Services Director.

- There are only 74 homes on the market in Lincoln, Nebraska (population 287,401), and the situation is forcing homebuyers to look to communities in surrounding areas. Now those places are showing the stress of housing shortages.

- Even in Jefferson, Wisconsin — population 8,000 — homebuyers are going away empty-handed. According to a recent study produced by the University of Wisconsin-Whitewater, their neighboring communities aren’t faring any better. Within Wisconsin, Jefferson has just 2.16 months of housing supply; in Lake Mills, it is 4.59 months; in Waterloo, 3.61 months; and Watertown, 1.47 months. According to the report, communities with under six months of housing inventory are said to be in a state of housing distress.

4. “We Need a Moonshot Program”

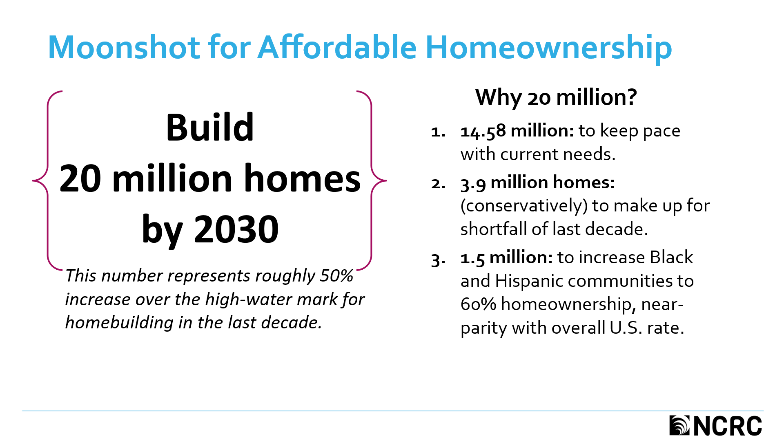

NCRC’s Gorman takes inspiration from President John F. Kennedy’s 1961 challenge to put a man on the moon within a decade when contemplating solutions for the affordable homeownership crisis plaguing America.

Like the space initiative, he suggests the nation must marshal all its resources and talents to address barriers to building homes so that the next generation won’t be mostly involuntary renters. The goal, he says, must be to build 20 million homes by 2030.

That objective is shared by another group NCRC helped shape, the Affordable Homeownership Coalition, a bipartisan alliance of home lenders, builders, real estate professionals, community development groups and civil rights organizations committed to expanding homeownership opportunities for low- and moderate-income families.

Gorman, who recently briefed lender customers of Arch MI in New England, points to three significant obstacles: labor, lumber and land-use restrictions. He also identified two potential keys to overcoming those challenges — innovation and infrastructure funding.

- The construction industry’s immigrant workforce vanished with the start of the Great Recession, Gorman said, and immigration reform is essential to solving the housing crisis. Young Americans also need to be persuaded that construction jobs can offer a career path with sizeable financial rewards.

- High tariffs on Canadian lumber need to be eliminated or significantly reduced. Lumber prices have reached an all-time high and have added about $16,000 to a typical home cost.

- Land-use restrictions such as minimum lot sizes, parking requirements and single-family-only zoning keep needed housing from being built in many of the places closest to jobs and transportation facilities.

Gorman is optimistic that technology and infrastructure funding can lead the way to solutions. He highlighted factory-built homes, 3-D technologies and Accessory Dwelling Units (ADUs) as innovations worth watching. And he called on Congress to fund infrastructure projects such as roads, schools, broadband and utilities that are essential to new home developments so that their cost burden won’t fall solely on builders and homebuyers, making the homes unaffordable.

Contest #4: Building Homes in 27 Steps

At the end of World War II, we built homes rapidly to meet the demand of returning soldiers. One of the era’s home developers revolutionized homebuilding, which had mainly been a cottage industry until the post-war period, by breaking down home construction into 27 steps, from beginning to end. Workers would do the same task hour after hour, day after day. Henry Ford would have been proud.

This assembly line manufacturing technique reportedly was so efficient that 30 four-bedroom homes could be completed each day. The developer bought 4,000 acres of potato fields and built the largest-ever housing development in the United States — consisting of 17,400 homes.

The homes essentially looked the same on the outside. So, too, on the inside, as all the residents were white. The developer would not sell to anyone not Caucasian. The housing development, and others like it, still stands today.

Take the quiz: What was the name of the home builder?

Email your answers with the subject line “Capital Commentary Contest #4” to [email protected] by 11:59 ET Friday, March 12, for a chance to win an Arch MI Capital Commentary/PolicyCast mug and saucer.

Solution to Capital Commentary Contest #3: Name the couple credited with creating the home security system. Answer: Marie Van Brittan Brown and Albert Brown.

About Arch MI’s Capital Commentary

Capital Commentary newsletter reports on the public policy issues shaping the housing industry’s future. Each issue presents insights from a team led by Kirk Willison.

About Arch MI’s PolicyCast

PolicyCast — a video podcast series hosted by Kirk Willison — enables mortgage professionals to keep on top of the issues shaping the future of housing and the new policy initiatives under consideration in Washington, D.C., the state capitals and the financial markets.

Stay Updated

Sign up to receive notifications of new Arch MI PolicyCast videos and Capital Commentary newsletters.