1,210 words. Six-minute read. See Item #6 for the Capital Commentary Contest.

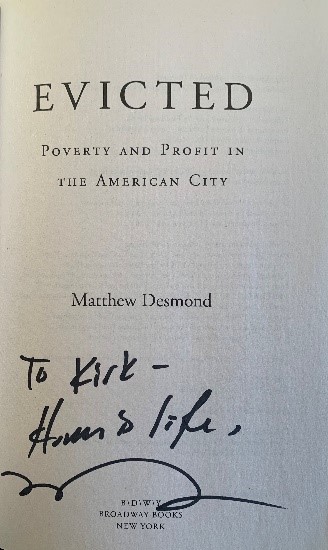

The headline of this issue of Capital Commentary comes from a recent hearing of the U.S. Senate’s Banking, Housing and Urban Affairs Committee, “Home = Life: The State of Housing in America.” (The title was drawn from how Pulitzer prize-winning author Matthew Desmond autographs the cover page of his book “Evicted: Poverty and Profit in the American City.”)

Committee Chairman Sherrod Brown (D-OH) used the event to set the table for the committee’s housing agenda. The ideas discussed were reminiscent of a wedding: something old, something new, something borrowed … (something blue? Well, the Democrats control the committee). Capital Commentary examines some of the more pertinent discussion points.

1. Buy Down Rate, Build Up Equity

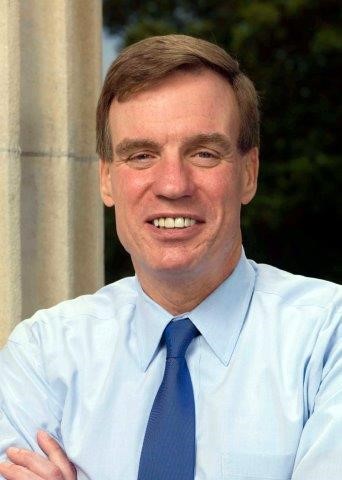

Subsidize wealth building, not debt, to grow sustainable homeownership, recommends moderate U.S. Sen. Mark Warner (D-VA) and conservative think-tank leader Ed Pinto of the American Enterprise Institute (AEI), who directs the group’s Housing Center.

They’ve formed a new alliance to promote the idea.

How would they do it?

- Offer low-income, first-generation homebuyers a government subsidy to lower interest rates on a 20-year fixed-rate mortgage (FRM) so the monthly payment is roughly equivalent to that of a 30-year FRM.

What is the attraction?

The 20-year amortization schedule doubles homeowner equity over five years compared to a 30-year loan, which would strengthen the ability of lower-income homeowners to weather future market downturns.

- “We all agree we need to expand the housing market without increasing the credit risk or, frankly, inflating home prices,” said Warner, who is working on legislation to create the interest-rate subsidy.

- “For many low-income buyers, homeownership has not been effective in building generational wealth,” Pinto told the committee. He noted that housing market downturns have historically hurt low-income and minority buyers (who frequently have little home equity) more than higher-income white homeowners.

The Warner-Pinto partnership may be new, but Pinto told me a day after the hearing that the idea goes back to 2014. He started socializing the concept during the annual American Mortgage Conference in Raleigh, North Carolina, nearly seven years ago. The seeds are only now bearing fruit.

The proposal was endorsed by another hearing witness, Housing Policy Council Executive Director Ed DeMarco:

- “What you are doing is structured in a way not to bring a new subsidy into the market at a time when house prices are already inflated,” DeMarco told Sen. Warner. “That’s a very thoughtful feature, as well as is your focus on supporting equity building as opposed to supporting families becoming highly leveraged.”

2. Focus on Rural America, Too

According to four Senate panel members, rural towns are borrowing the housing woes of their big-city brethren. And the situation is growing worse.

- Expect bipartisan efforts to address the growing crisis.

Sen. Tina Smith (D-MN), the new chair of the Senate’s Housing Subcommittee, said she and Sen. Mike Rounds (R-SD), the panel’s ranking GOP member, want to make rural housing a priority. The housing concerns in rural areas were also shared by Montana Sens. Jon Tester (D) and Steve Daines (R).

Smith says some Minnesota employers are striking out when hiring new employees because there is no housing.

- “I think about communities like Thief River Falls in northwestern Minnesota where (electronics manufacturer) Digi-Key is struggling to fill the jobs they have because they can’t find places for them to live.”

Chris Herbert, Managing Director of the Joint Center for Housing Policy at Harvard University, shared Smith’s concerns:

- “One of the challenges rural communities face is that our current (housing subsidy) delivery systems, primarily the Low-Income Housing Tax Credit, ended up requiring a certain scale of investment in order to make those deals work because of their huge complexity. So, we need to think about other channels … that are more effective at reaching rural communities.”

3. “Solutions Are Simple. Fix Is Complex.”

The truth about housing economics principles is that they might work in theory, but not reality, explained DeMarco.

“As an economic principle, unmet demand should lead to higher prices and higher prices should induce more supply,” he testified. “However, building housing in most communities requires navigating a labyrinth of approvals, restrictions and building requirements.”

- The solution to this problem is simple, he said, but “politically complex. It primarily requires thousands of local jurisdictions to evaluate land-use restrictions, zoning laws, building codes and other requirements to ensure that home construction is encouraged, not discouraged.”

4. Housing Finance Reform, Once Again

Not a new idea, for sure. Housing reform is being repackaged by U.S. Sen. Patrick Toomey (R-PA), top Republican on the Senate Banking, Housing and Urban Affairs Committee, to create a competitive secondary market and end the conservatorships of Fannie Mae and Freddie Mac.

Toomey argued that market competition and increased private investment are the best ways to address housing inequities.

- “Folks, government is the problem here, not the solution,” said Toomey while reviewing a litany of government programs that over “50 years — and countless hundreds of billions of dollars in federal housing support — have had no meaningful impact on homeownership rates.”

His “framework for legislation” to reform the housing finance system, released the day before the Senate committee hearing, closely mirrors the Trump administration’s reform plans. Among Toomey’s goals are:

- Establish a level playing field for other sources of private capital that bear mortgage credit risk;

- Foster a liquid secondary mortgage market that promotes the continued availability of affordable 30-year and other long-term fixed-rate mortgage loans across the U.S. and throughout the economic cycle;

- Protect taxpayers by ensuring that significant first-loss private capital stands in front of any government support and that taxpayers are appropriately compensated for that support; and

- Promote equitable access to the secondary mortgage market by mortgage lenders of all sizes, business models, charter types and locations.

5. PolicyCast: Looking Backward, Forward

Arch MI’s latest PolicyCast video podcast featured David Brickman, Freddie Mac’s former CEO and now Executive Chairman of Meridian Capital Group. Brickman discussed the GSEs and his transition from heading Freddie’s Multifamily Division to running the whole organization until stepping down in January.

The next episode of the PolicyCast (April 5) will focus on how leaders at the local level can tackle emerging problems. John Tecklenburg, the Mayor of Charleston, South Carolina, will share his plans to address three pressing crises challenging his city: affordable housing, racial inequity and climate change. You can watch all the PolicyCasts on Arch MI’s Housing Policy Insights page.

6. Contest #5: Gaining Strength, Losing People

When the Democrats won the necessary 50 seats to capture control of the U.S. Senate (thanks to Vice President Harris having the ability to cast tie-breaking votes), it turned the world of Washington upside down.

In one sense, small became huge.

The elected official considered to be the most powerful member of the U.S. Senate by political pundits also represents the only state to have lost population, overall, since 1950.

Take the quiz: Who is the Senator and what is the state?

Email your answers to [email protected] by 11:59 p.m. ET Monday, April 5, for a chance to win the Arch MI Capital Commentary/PolicyCast mug and saucer.

Solution to Capital Commentary Contest #4: Name the developer who used assembly line techniques post-WWII to build up to 30 homes a day. Answer: Levitt & Sons, who developed Levittown on Long Island, New York.

Do you think Capital Commentary offers valuable information on housing policy and its potential impacts? If you do, share your comments with us. Your feedback will help ensure Capital Commentary covers the stories that have the most impact on your business.

About Arch MI’s Capital Commentary

Capital Commentary newsletter reports on the public policy issues shaping the housing industry’s future. Each issue presents insights from a team led by Kirk Willison.

About Arch MI’s PolicyCast

PolicyCast — a video podcast series hosted by Kirk Willison — enables mortgage professionals to keep on top of the issues shaping the future of housing and the new policy initiatives under consideration in Washington, D.C., the state capitals and the financial markets.

Stay Updated

Sign up to receive notifications of new Arch MI PolicyCast videos and Capital Commentary newsletters.