1,976 words. Seven-minute read. See item #6 for Capital Commentary Contest.

Anyone who has watched or attended a National Hockey League game in Washington’s Capital One Center is familiar with the battle cry from the fans when the Capitals are racing down the ice: “C-A-P-S, Caps, Caps, Caps!” As much as I enjoy hockey, this issue of Capital Commentary is about another set of caps: Those found in recent amendments to the Preferred Stock Purchase Agreement (PSPA) between the U.S. Department of Treasury and the Federal Housing Finance Agency (FHFA) that limits Fannie Mae and Freddie Mac from buying certain loans. It is causing plenty of new gray hairs for home loan lenders and borrowers. We examine some of those restrictions and what they might mean for the housing market.

1. An Overview of New Restrictions

Treasury and FHFA amended the PSPA in the final days of the Trump administration as a final act to set conditions for guiding Fannie and Freddie out of conservatorship.

Reducing the Government Sponsored Enterprises’ (GSEs) risk to taxpayers is a central theme of the amendments. Specifically, they restrict the percentage of loans the GSEs can buy associated with:

- Higher-risk attributes.

- Second homes and investment properties.

- Loans sold through the GSEs’ Cash Window.

The restrictions have been widely criticized by both participants and observers of the housing finance system.

- Taken together, “these moves are an ineffective means of managing risk and will come at a considerable cost,” write housing economists associated with the Urban Institute and the Massachusetts Institute of Technology (MIT).

- “These restrictions will have a disproportionate impact on minorities,” concludes the Community Home Lenders Association (CHLA).

- The limits “could cause unnecessary disruptions” to the housing finance system, wrote Mortgage Bankers Association (MBA) officials in a letter to Treasury Secretary Janet Yellen and FHFA Director Mark Calabria.

Let’s take a deeper look at each of the new restrictions.

2. High-Risk Cap Poses Risk to Minority Homeownership

The PSPA limits high-risk loans acquired by the GSEs to 6% of their purchase money and 3% of their refinance mortgages.

What is a high-risk mortgage? One with at least two of the following characteristics:

- A loan-to-value (LTV) ratio of 90% or higher.

- A debt-to-income (DTI) ratio above 45%.

- A credit score below 680.

The new constraints would not have impacted lenders or the GSEs in 2020 as less than 6% of their purchase-money loans had two of the three traits. But, as the Urban Institute-MIT paper (click graphic to read the full report) notes, “the COVID-19 economic recession has diminished the prevalence of high-risk loans, as lenders have several incentives to make fewer of them.”

- From late 2017 until January 2020, the limits would have been problematic as lenders selling to the GSEs frequently exceeded the cap on a month-to-month basis.

Going forward, too, the restrictions will likely have enormous implications for lenders and borrowers, the Urban Institute-MIT report warns.

- Of loans sold to the GSEs in 2019, “more than twice the share of Black and Hispanic borrowers versus white borrowers would be considered high risk,” the study reported. “This restriction on high-risk loans would thus further drag down the already low share of Black and Hispanic borrowers who use GSE mortgages.” In 2019, Black borrowers comprised just 3.5% of GSE loans; Hispanic borrowers comprised around 9% of their loans.

CHLA is seeking to have the high-risk loan caps suspended, arguing that they will hurt minorities and “undermine the administration’s focus on racial equity.”

- “These restrictions come at a time … that minorities and other underserved individuals and families have been disproportionately negatively impacted by COVID,” wrote the small-lender group.

What’s ironic, say CHLA officials, is the caps increase the GSEs’ risk.

- “A simple refinance of an Enterprise-guaranteed loan that reduces monthly payments makes a loan more affordable and sustainable, thus reducing the risk of default,” the trade group writes in its letter to Yellen and Calabria.

Will the new caps reduce taxpayer risk? Unlikely, say the authors of the Urban Institute-MIT report.

- “Of the borrowers who fall out of the GSE channel because of this constraint, some would go to the Federal Housing Administration (FHA). Thus, the constraint would not reduce the total risk to the taxpayer; it would merely shift the risk from the GSEs to the FHA.”

3. Capping Vacation, Investor Homes

GSEs should be prohibited from buying mortgages for investment properties and second homes, Calabria told Congress a decade ago when he worked for the libertarian Cato Institute.

- The PSPA doesn’t quite do that, but it limits second homes and investor properties to 7% of GSE purchases.

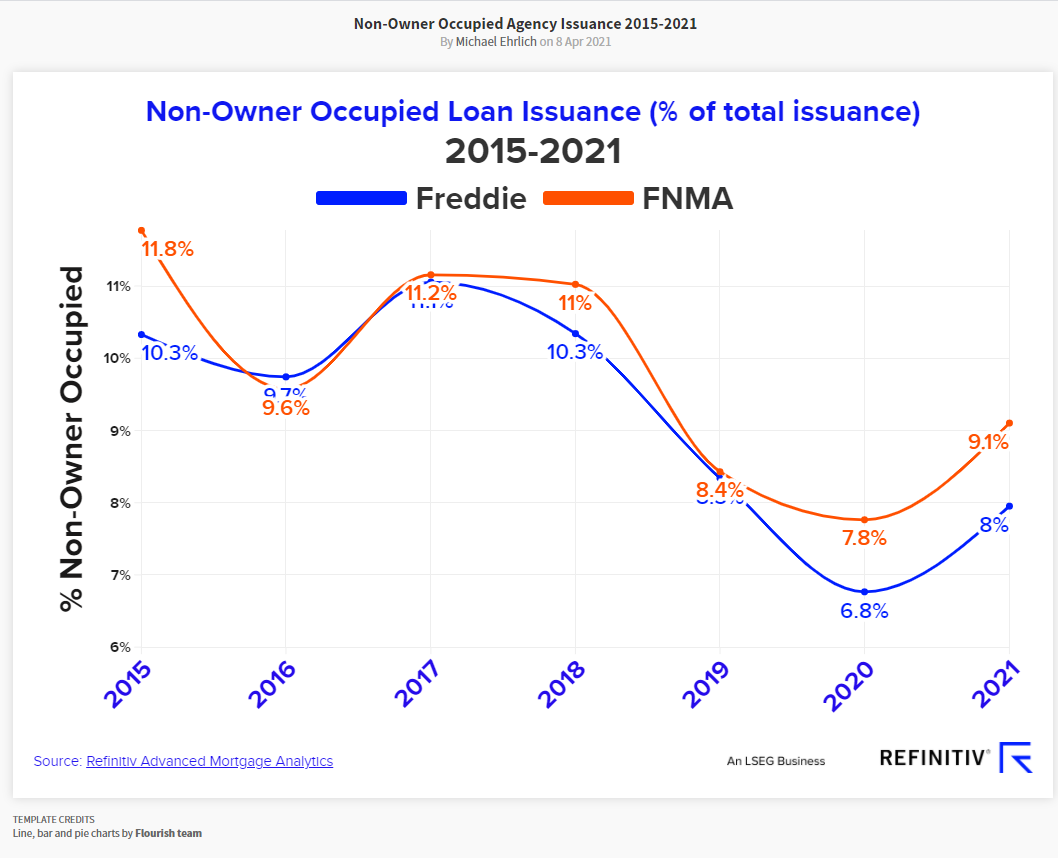

As shown in the table below prepared by Michael Ehrlich, Mortgage Community Manager for Refinitiv, the constraint is already binding and it has lenders tied up in knots trying to figure out what to do next.

- Ehrlich’s research finds that “Looking at YTD conventional issuance, 230 of the top 300 Agency sellers have exceeded that looming 7% cap on (second) Home/Investment Property loans.”

- Mortgage executives are uncertain how far back the GSEs will look to determine whether sellers have exceeded the cap, Ehrlich said, while “Several lenders have mentioned that this quick implementation has little regard for preparedness and the financial impacts to hedges and customers.”

The caps on investor properties, in particular, will have negative consequences for GSEs, lenders and renters, says the Urban Institute-MIT study:

- “Investor properties are a lucrative part of the GSE portfolio. The loan-level price adjustments (LLPAs, a risk-based pricing instrument used by Fannie Mae and Freddie Mac) required on these are well more than the compensation for their risk.”

- Investor loans allow for cross-subsidization to the rest of the GSE purchases.

- Rental units in single-family properties account for half of all rental units, many of which are rented by low- and moderate-income households.

Meanwhile, new mortgages for vacation homes are soaring. The Wall Street Journal reported that the number of buyers who locked in rates for second homes in February was up 93% from a year earlier.

Regional real estate recession ahead? The restrictions on GSE purchases of vacation homes may have the unintended effect of creating regional real estate downturns, as John Moquin, Senior Vice President-Capital Markets for Residential Mortgage Services, Inc. (RMS), told me recently. RMS is a regional lender based in South Portland, Maine.

- “In Delaware, 22% of the volume we get is second homes,” said Moquin. “You figure Maine, Massachusetts. We’re talking all of the major Eastern Seaboard vacation spots.”

- The Wall Street Journal notes that Vermont, Maine and Arizona are among the states where housing market growth is most dependent on second-home and investment-property sales. “That means the new rules … could take a bigger toll on their home prices.”

RMS’s Moquin emphasized that regional lenders will be most negatively impacted by the limitations on selling loans to the GSEs. Larger lenders are less likely to feel the pinch because they are more geographically diversified.

4. Cash Is King. Or, Rather, Was King

The GSEs’ Cash Window has enabled small and regional lenders to remain competitive in the mortgage marketplace. The midsized lenders are most severely affected by a PSPA amendment restricting the sale of whole loans to $1.5 billion per GSE for any four rolling quarters.

How Do Lenders Sell Loans to the GSEs?

Here’s a primer by Sharad Chaudhary, a partner with fintech company MachineSP.

“There are two methods for securitizing loans in Agency GSE MBS: swapping loans for a security (Swap) or selling the loans outright for cash (Cash Window). The first method is the dominant securitization method used by single originators who are able to assemble a large number of mortgages. Smaller sellers tend to utilize the Cash Window and the loans sold by them through this channel are pooled with those from other small lenders. The pooling process for Cash Window MBS is fully under the control of the GSEs; in effect, they are behaving like a whole loan conduit.”

As the dominance of huge lenders with correspondent channels has waned, the Cash Window now accounts for about half of all loans sold to the GSEs.

- This rule change might reverse that trend.

“Cash has been king since 2012,” Moquin of RMS told me. It has provided RMS with the best execution and the highest price for their loans. But the $1.5 billion cap will force him to look for other outlets or methods to sell his loans.

- “I’m going to have to either issue my own securities or sell to aggregators,” Moquin said. “And aggregators are going to respond by worsening their price,” he predicted.

- RMS isn’t alone, of course. The MBA thinks several dozen mortgage banks will have to stop using the Cash Window and will need to pursue alternative approaches, including ― at significant expense ― the ability to engage in mortgage-backed securities (MBS) swaps.

- MBA argued the Cash Window restrictions would increase GSE concentration risk “if a greater volume of loan deliveries is channeled through a smaller number of institutions with the capacity to engage in MBS swaps.”

- CHLA is seeking to raise the cap “to at least $3 billion and as much as $5 billion for each GSE.”

5. The Big Picture

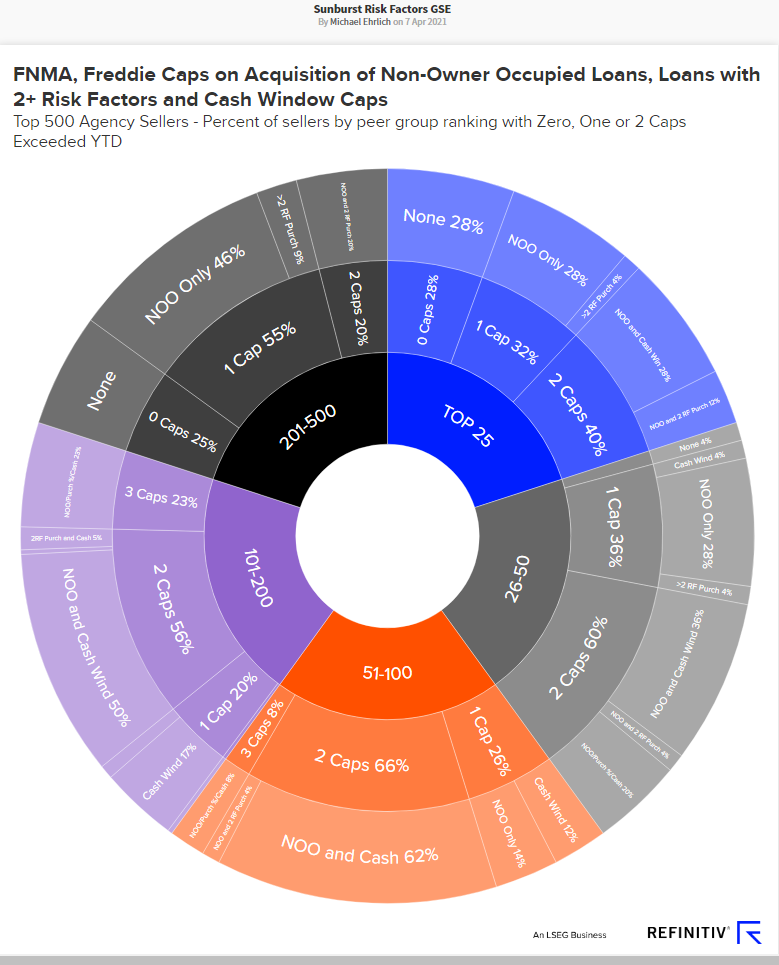

The cumulative impact of the PSPA caps appears to fall mainly on small to mid-sized lenders. Ironically, it is those lenders the GSEs are designed to serve so that mega lenders do not dominate the mortgage market.

• Refinitiv’s Ehrlich has prepared another graphic demonstrating the caps’ impact on lenders of differing sizes.

Lobbying is intensifying from mortgage industry groups to suspend or amend, again, the PSPAs. Given a new Biden administration Treasury Secretary and the possibility of a new FHFA director (depending on the Supreme Court’s upcoming decision in Collins v. Mnuchin), there is real hope that improvements will be made before the market is significantly disrupted.

- Add the Main Street Coalition to the list calling for changes.

The collection of groups representing smaller lenders, housing advocates and civil rights groups criticized the PSPA changes in a letter to Yellen and Calabria because they “represent a fundamental change to the functioning of the nation’s secondary mortgage market and it is clear that these changes were designed to shrink the Enterprises’ business going forward. Yet neither FHFA nor Treasury have provided data or analysis that address the impact of these changes on the Enterprises or key stakeholders.”

Given a new Biden administration Treasury Secretary under the new and the possibility of a new FHFA director (depending on the Supreme Court’s upcoming decision in Collins v. Mnuchin), there is real hope that improvements will be made before the market is significantly disrupted.

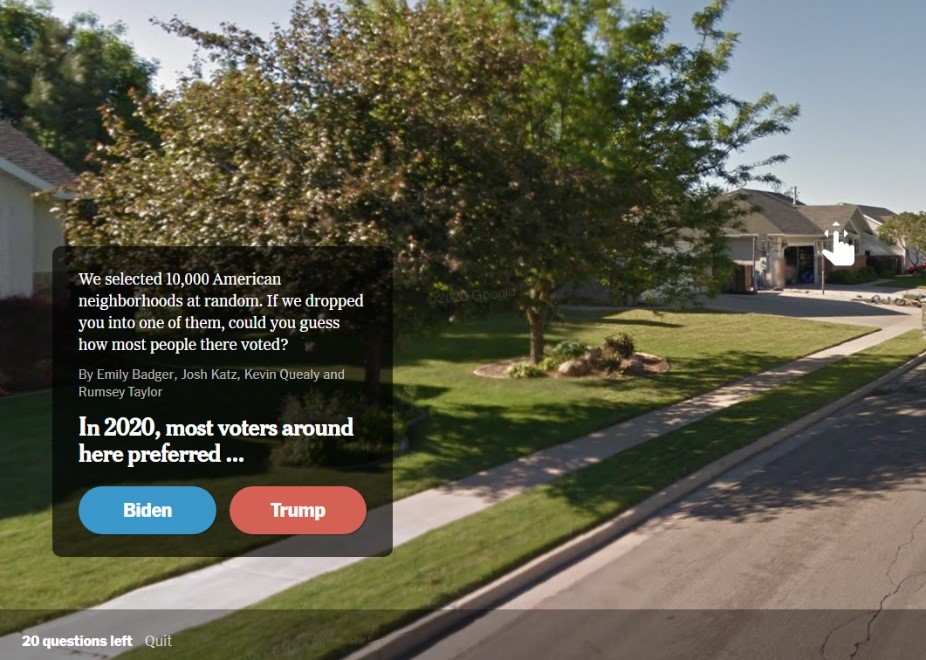

6. Contest #6: Trumptowns and Bidenvilles

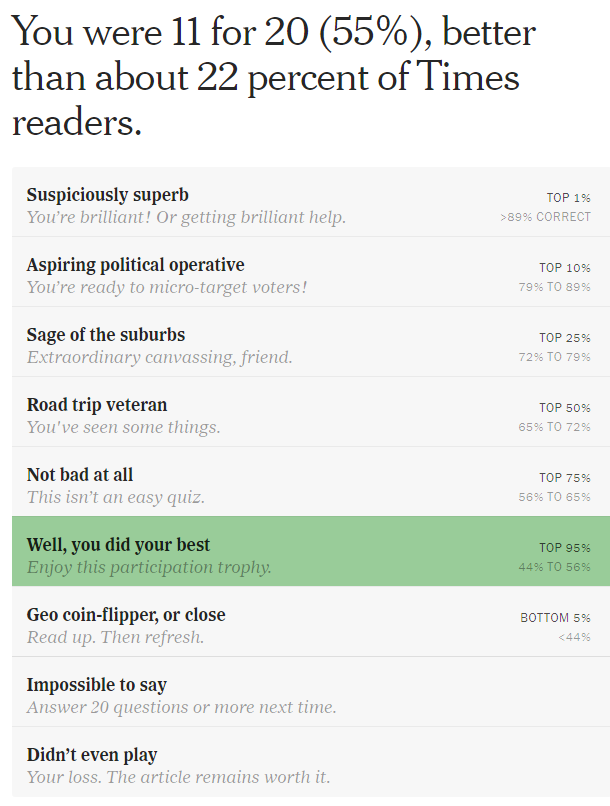

Up to now, I’ve asked trivia questions about readers’ knowledge of housing and politics. I’ve taken a bit of a twist for Contest #6.

The New York Times recently posted 10,000 photos of communities throughout America and asked readers to identify whether most residents voted for Donald Trump or Joe Biden for President.

It is a challenging ― but quick ― game featuring 21 questions with photos like you see below. It will take about two minutes.

Click “quit” after question 21 and you will get a report like you see below. (Hopefully, you will do better than my winning “a participation trophy!”)

Hit “Print Screen” on your computer and paste your score into an email addressed to [email protected] by 11:59 p.m. on Monday, April 19. Arch MI Capital Commentary/PolicyCast mugs will be sent to both the best and the worst scores. Why the worst, too? Because it takes courage to show a lousy score like mine and that deserves recognition.

Solution to Capital Commentary Contest #5: The elected official considered the most powerful member of the U.S. Senate by political pundits also represents the only state to have lost population, overall, since 1950.

Take the quiz: Who is the Senator and what is the state?

Answer: Sen. Joe Manchin of West Virginia.

Do you think Capital Commentary offers valuable information on housing policy and its potential impacts? If you do, share your comments with us. Your feedback will help ensure Capital Commentary covers the stories that have the most impact on your business.

About Arch MI’s Capital Commentary

Capital Commentary newsletter reports on the public policy issues shaping the housing industry’s future. Each issue presents insights from a team led by Kirk Willison.

About Arch MI’s PolicyCast

PolicyCast — a video podcast series hosted by Kirk Willison — enables mortgage professionals to keep on top of the issues shaping the future of housing and the new policy initiatives under consideration in Washington, D.C., the state capitals and the financial markets.

Stay Updated

Sign up to receive notifications of new Arch MI PolicyCast videos and Capital Commentary newsletters.