1,332 words. Six-minute read. Don’t miss your chance to win our Capital Commentary Contest #3. Contest information is at the end!

As we near the end of Black History Month, Capital Commentary weighs in on the benefits of an invigorated national policy to increase Black homeownership and highlights some of the places where Black Americans find a welcoming embrace and a robust economy.

Unfortunately, there are still some barriers and risks confronting Black homeowners. And those are so alarming they deserve equal coverage.

1. Racial Justice Glued to Family Wealth

McKinsey & Company provides the latest data on why eliminating racial inequities not only makes social justice sense but financial sense — to people of every race. In short, it is truly “common cents.”

- The upshot: Consumption and investment in the U.S. would soar by $2 trillion to $3 trillion if we closed the wealth gap between white and minority households, McKinsey states in its new report, America 2021: The Opportunity to Advance Racial Equity, released Feb. 17.

- Fatter wallets for everyone. That achievement would mean an additional $6,000 to $8,500 in annual income per capita, says McKinsey. That is, everyone wins through racial equality.

McKinsey is just the latest firm to highlight the array of benefits to the nation’s well-being from greater racial equality. Last year, Citi unveiled a report concluding that “not addressing racial gaps between Blacks and whites has cost the U.S. economy up to $16 trillion over the past 20 years.”

- Citi says more than 770,000 additional Black Americans would be homeowners if they had better access to credit over the past two decades.

- Combined sales and expenditures associated with those new homebuyers would have contributed another $218 billion to the nation’s GDP over that time.

A joint project by the consulting firm FSG and the research group PolicyLink found implicit biases that associate race with risk “stifl[e] consumer and business loans to people of color and leav[e] a market of unbanked customers estimated at $141 billion.”

- Act now before the gap widens: “If the future repeats the past, over the next three decades white household wealth will increase by $46,000 to an average of $186,900, while … Black household wealth will decrease by half to a mere $1,700,” concludes the FSG-PolicyLink report, “Financial Services and the Competitive Advantage of Racial Equity.”

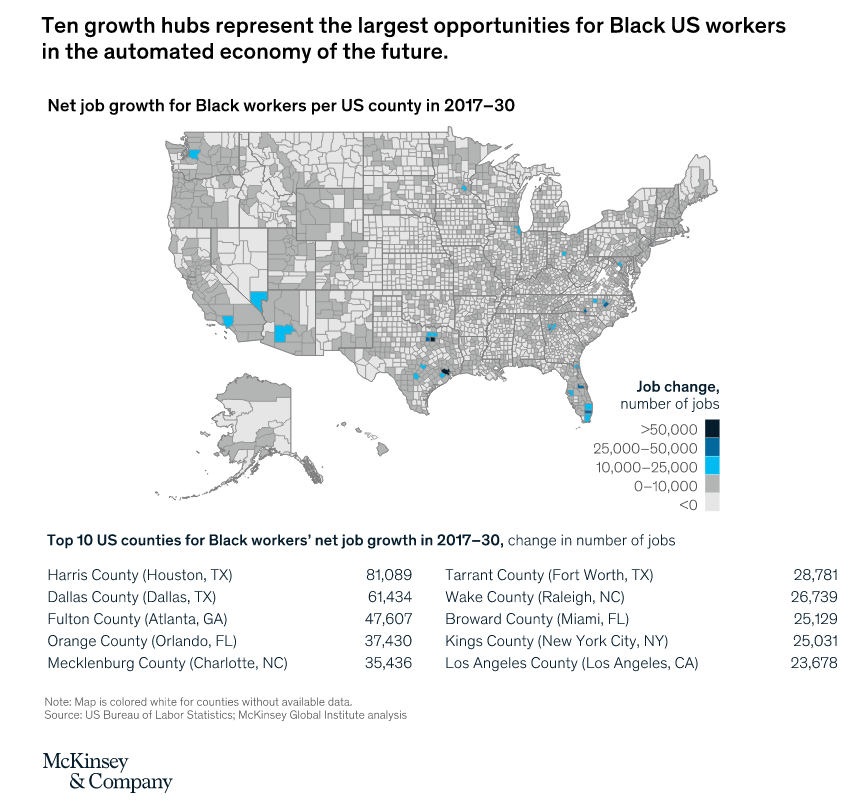

McKinsey, which founded the McKinsey Institute for Black Economic Mobility, suggests helping people “get to where the jobs are” will be critical to achieving racial equality.

- If newspaper editor Horace Greeley were alive today, he’d likely advise, “Go South, young man (or woman).” McKinsey finds 10 American “growth hubs” (see chart) hold the highest potential for Black workers, with all but two located in the Southeast or Southwest.

2. Where Are Blacks Thriving Today?

Two markets in North Carolina, Charlotte and Durham, are among the nation’s best in currently advancing the economic futures of their Black residents, according to a survey by SmartAsset.

- Cities in Texas, Florida and North Carolina dominated the SmartAsset survey much the same way they did in the McKinsey future outlook report.

- Among the key indices were Black household income, Black homeownership rate, percentage of Blacks with bachelor’s degrees and the percentage of business owners who are Black.

The top three cities were Virginia Beach, Virginia; Grand Prairie, Texas; and Aurora, Illinois.

- “Charlotte (6th) and Durham (8th) rank particularly well for our education and metro area business ownership metrics,” reports SmartAsset. “In both North Carolina locales, more than 30% of Black adults have their bachelor’s degree and at least 3% of businesses are Black-owned — compared to study-wide averages of about 23% and 2%, respectively.”

So, are Tar Heels excited about the news? Apparently, not everyone.

- “The plea from some of the (Research) Triangle’s Black residents, particularly in Durham, is ‘please, no more,’” writes Thomasi MacDonald on Durham’s Indyweek.com website.

“Black folk in Durham always knew our city was one of the country’s best-kept secrets. Now with all these damnable ‘best of’ lists, the city is experiencing a housing shortage,” she writes. As a result, home prices are soaring.

3. Wealthy Blacks Pay Higher Interest Rates

Look no further than a study out of the Joint Center for Housing Studies at Harvard University last week to demonstrate how far we still need to go to make lending — and wealth building — equitable.

Research Analyst Raheem Hanifa published a report that found high-income Blacks paid higher interest rates than low-income white homeowners.

- Black homeowners with incomes between $75,000 and $100,000 had higher interest rates than white homeowners with $30,000 or less in household income (4.215% vs. 4.16%), reports Hanifa.

- “Black homeowners have experienced systemic barriers to homeownership and wealth-building opportunities that have limited their ability to access credit, which is a key component in receiving low mortgage interest rates.”

Hanifa acknowledges that many other factors, including wealth, debt, credit score, down payment, mortgage amount and loan duration, affect interest rates.

- He recommends additional research to identify specific causes of Black-white interest rate disparities but contends his study’s results indicate “another reason to address the longstanding and continued history of discrimination in mortgage markets.”

Equity Theft Plaguing Blacks in Atlanta

Cash-poor, land-rich Black homeowners living in Atlanta’s gentrifying neighborhoods are being abused by predatory investors who are often paying less than half of a home’s value when buying property.

That is the conclusion of a four-part series of news reports from Atlanta’s public radio station WABE-FM.

- Targeting Black neighborhoods: Its analysis shows sellers in South and West Atlanta accepted prices that were so low they were less than half the estimated fair market value, according to Zillow’s Zestimate. Homes in these neighborhoods had below-value sales at a higher rate than the rest of the city.

- On the other side of town? In more than a dozen different neighborhoods, mainly on the northern side of Atlanta, there were no sales by owner-occupants that were similarly low-valued.

“We’re really seeing the dirty, evil underbelly of the real estate market,” said Karen Brown, director of the Home Defense Program at Atlanta Legal Aid. She calls the cases “equity theft.”

So how can equity theft be prevented?

Education, for one.

- Think of it like a business, suggests one counselor to homeowners. “It is a business to investors,” said Tia McCoy of the Atlanta BeltLine Partnership. “And so we have to step back and take it the same way. It’s like: ‘it’s business.’”

But Georgia State Professor Dan Immergluck, a housing specialist, believes government must do more to protect home sellers.

- Require homeowners to receive estimates of their home’s value before it can be sold, Immergluck suggests. Use Zillow, Trulia and Redfin. He said it would be like rules in other cities that mandate inspections before sales.

Contest No. 3: Safe at Home!

Mid-February is my favorite time of year. Pitchers and catchers have reported to spring training camps in Florida and Arizona. There’s no more “Wait till next year” because this is next year and hope springs eternal. I can even envision my beloved Philadelphia Phillies winning the World Series (because they haven’t yet played any games that matter.)

- This brings me to the topic of our Capital Commentary Contest No. 3, which I call “Safe at Home.”

- But that baseball theme? I just threw you a curve.

Nevertheless, people are safer at home thanks to the home security system’s invention by a husband and wife in Queens, New York, back in 1966 (three years before the “Amazing Mets” would win their first World Series down the road in Shea Stadium).

Take the Quiz: Name the couple credited with creating the home security system.

Email your answers with the subject line “Capital Commentary Contest #3” to [email protected] by 11:59 ET Friday, Feb. 19, for a chance to win an Arch MI Capital Commentary/PolicyCast mug and saucer.

Answer to Capital Commentary Contest #2: What is the official name of the U.S. Department of Housing and Urban Development and what singular distinction does the honoree hold? Answer: It is the Robert Weaver Building. Weaver was not only the first HUD Secretary but also the first Black cabinet member in any presidential administration.

Do you think Capital Commentary offers valuable information on housing policy and its potential impacts? If you do, share your comments with us. Your feedback will help ensure Capital Commentary covers the stories that have the most impact on your business.

About Arch MI’s Capital Commentary

Capital Commentary newsletter reports on the public policy issues shaping the housing industry’s future. Each issue presents insights from a team led by Kirk Willison.

About Arch MI’s PolicyCast

PolicyCast — a video podcast series hosted by Kirk Willison — enables mortgage professionals to keep on top of the issues shaping the future of housing and the new policy initiatives under consideration in Washington, D.C., the state capitals and the financial markets.

Stay Updated

Sign up to receive notifications of new Arch MI PolicyCast videos and Capital Commentary newsletters.