In June, the Federal Housing Finance Agency (FHFA) released the long-awaited Equitable Housing Finance Plans (EHFPs) from Fannie Mae and Freddie Mac. They will guide much of the GSEs’ home loan purchasing decisions over the next three years.

For this issue, Capital Commentary takes a high-level look at the plans. Fannie Mae and Freddie Mac were ordered in late 2021 to produce forward-looking proposals for reducing the racial homeownership gap. They were initially submitted to FHFA at the end of the year.

We’re pausing the Capital Commentary Contest for this edition. In its place, instead, is a tribute to a friend of so many of us in the housing industry.

1. Fannie Mae: The Black Housing Journey

Setting the tone:

“Black people were free to want the American Dream, but largely denied the means to have it. … Ignoring this truth is not defensible, nor is failing to redress it.”

– Fannie Mae’s Equitable Housing Finance Plan

Fannie announced in its 64-page report that its focus over the next three years will be the needs of Black homeowners and renters, “a population where … inequities are particularly profound.”

The report builds on an early study at Fannie called “The Black Housing Journey,” which views housing challenges from a Black perspective. Fannie’s solutions will aim to address three areas:

- Housing preparation.

- Removing obstacles to renting or buying.

- Improving services to sustain homeownership.

A top priority will be to “construct and launch a pilot project to evaluate the liability and effectiveness of having multifamily landlords report rental payment data to credit bureaus.”

Better credit scores will help more Black renters transition to becoming Black homeowners.

Not everyone is enthused: Fannie Mae’s proposed subsidies for Black homeowners were the target of harsh criticism from the Wall Street Journal’s editorial board, which suggested they may be unconstitutional:

“Making home ownership affordable is a worthy goal, but more subsidies that endanger taxpayers aren’t the answer. Housing costs are high because of inflationary monetary policy and regulatory and zoning limits on supply. No economic good, and much social harm, will come from turning Fannie and Freddie into agents of progressive racial division.“

2. Freddie Mac: Historical Inequities

“The history of housing in the United States is one of wealth and opportunity — and inequity and exclusion. From the start of the modern American housing market in the early 20th century, homeownership and wealth-building were granted overwhelmingly and intentionally to white households.”

– Freddie Mac’s Equitable Housing Finance Plan

Take Five: Freddie outlined five long-term obstacles to equitable housing:

- Redlining.

- Deed restrictions and restrictive covenants.

- Discrimination in access to housing subsidies.

- Exclusionary zoning.

- Urban renewal.

Freddie Mac’s efforts to address inequities over the coming three years will target Black and Latino renters and homebuyers.

Learn a new acronym: Both GSEs will rely on the use of Special Purpose Credit Programs, or SPCPs, to rectify inequities. These programs enable credit providers to offer special products, services and pricing to people who comprise a protected class or live in an underserved geographic region.

Capital Commentary and its companion video podcast series, The Arch MI PolicyCast, will dig deeper into the GSEs’ plans in the coming weeks.

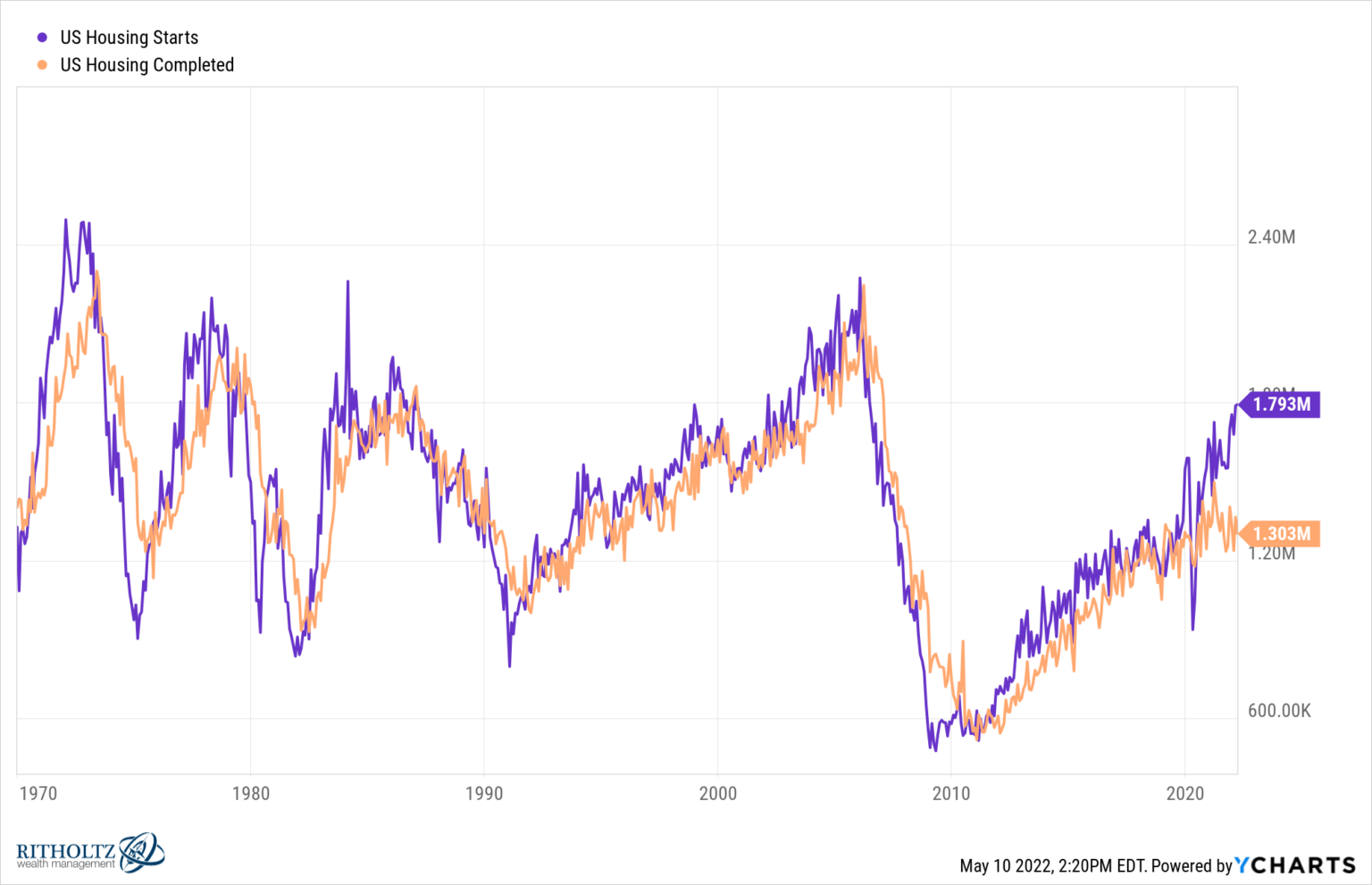

3. Builders Start, Can’t Finish Homes

This chart provides one explanation for the gap between demand for homes and their limited supply. The purple line reflects new housing starts; the orange line equates to the number of homes completed.

The nearly 500,000 home gap is primarily attributable to the severe labor shortage that has plagued the homebuilding industry for several years, coupled with problems in the supply chain for building products.

4. Everything but the Kitchen (and Sink)

Every day, there’s a new example of the craziness of our housing markets.

Today’s comes from west Charlotte, North Carolina.

The details: This 985-square-foot bungalow in Charlotte, North Carolina, just sold for $265,000, or $15,000 above its asking price. For that, the buyer gets two bedrooms, one bathroom and, um, no kitchen.

Future Uber Eats customer? Maybe that’s not such a bad deal after all. According to realtor.com, the average price of a home in its Enderly Park neighborhood is $521,600. You could eat out a lot with the $256,600 in savings.

5. Contest Answer: Affordable Cities

Last month, I asked readers to rank four metro areas – Greensboro-High Point, NC; Philadelphia-Camden-Wilmington; St. Louis, MO; and Memphis, TN – in order of their homeownership affordability based on the percentage of average media income required to pay a mortgage.

- The most affordable? St. Louis, the only one of the four where the average homeowner would pay less than 30% of income on a mortgage payment.

- Next in line: Greensboro-High Point, NC, is second-most affordable; the Philadelphia market, third.

- The most expensive of the four metro areas is Memphis.

6. Let’s Be Frank: He Was the Best

This month’s sudden passing of Dr. Frank Nothaft, chief economist of CoreLogic, shocked and saddened the housing industry.

Simply put, Frank was the best. The best economist. The best colleague. The best friend one could have.

And no one wore a bow tie better than Frank.

Accolades rolled in on social media and news columns from the likes of:

- Former FHFA Director Mark Calabria: He “set the standard for housing economists.”

- Fortune magazine’s Lance Lambert: Frank was “passionate … insightful.”

- Freddie Mac’s Len Kiefer: He “taught me much about analyzing housing markets.”

- USC’s Richard Green, director of the Lusk Center for real estate: “He knew housing data better than anyone.”

More impressive than the comments on Frank’s professional attributes, everyone noted his kindness and how he treated people. As CoreLogic tweeted, “he was admired by everyone lucky enough to know him.”

I was one of the lucky ones. Frank was my colleague for 14 years at Freddie Mac, lived in my town of Vienna, Virginia, and became a lifelong friend.

Frank, 66, collapsed while running in a local 5k race on June 5and passed away soon after. Coincidentally, I ran the same race. Sadly, I missed seeing him before the race. Now, we will all miss Frank. RIP, my friend.

About Arch MI’s Capital Commentary

Capital Commentary newsletter reports on the public policy issues shaping the housing industry’s future. Each issue presents insights from a team led by Kirk Willison.

About Arch MI’s PolicyCast

PolicyCast — a video podcast series hosted by Kirk Willison — enables mortgage professionals to keep on top of the issues shaping the future of housing and the new policy initiatives under consideration in Washington, D.C., the state capitals and the financial markets.

Stay Updated

Sign up to receive notifications of new Arch MI PolicyCast videos and Capital Commentary newsletters.