The Mortgage Bankers Association’s annual convention, noted for its outsized parties and star-studded concerts, doesn’t start until mid-October, but champagne corks are already flying in industry offices.

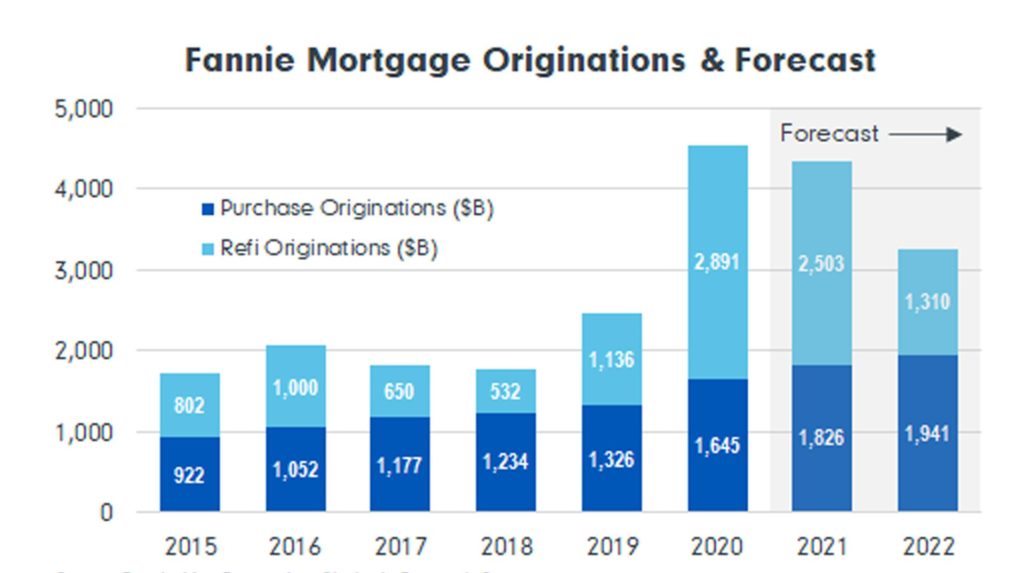

Mortgage production in 2020 set new highs, exceeding $4 trillion for the first time ever. While this year is unlikely to top last year’s production, continued low interest rates will make it the second-highest year in mortgage originations.

But there were some troublesome regulatory headwinds imposed by the Trump administration threatening production in 2022 and beyond: new fees on refinancing loans, restrictions on selling certain loans to Government Sponsored Enterprises (GSEs) and capital requirements intended to shrink the footprints of Fannie Mae and Freddie Mac.

Each would have driven up the cost of loans to borrowers.

But that was so yesterday.

President Trump and his hand-picked choice to lead the Federal Housing Finance Agency (FHFA) have packed up and left office. And much has changed in the three months since Sandra Thompson replaced Mark Calabria as head of the housing agency. Storm clouds are lifting and the industry is celebrating.

1. A U-Turn at FHFA

Appointed Acting Director in late June, Thompson has figuratively turned FHFA housing policy upside down within a few short weeks.

What does it mean? Where Calabria sought to rein in Fannie Mae and Freddie Mac, shrinking their footprints to speed their exits from conservatorship, Thompson takes the opposite tack.

The likely winners include lower-income borrowers, mortgage originators and mortgage insurance companies, says Cowen Washington Research Group’s Jaret Seiberg.

Consider:

- By July, Thompson announced the elimination of a 50 bBy July, Thompson announced the elimination of a 50 basis-point fee on most refinance loans sold to Fannie Mae and Freddie Mac. That dropped the cost to refinance, putting more money in the pockets of lower-income homeowners, who are usually the last to refinance.

- FHFA extended the GSEs’ “First Look” programs by 10 extra days in early September to boost the supply of homes for sale to owner-occupants. Now potential homeowners, public entities and nonprofits will have an exclusive ability to buy Fannie and Freddie Real Estate Owned (REO) properties for 30 days before they are available for investor purchase.

- On September 14, Thompson announced that FHFA and the Treasury Department were suspending caps on GSE purchases of certain loans that had been levied in the waning days of the Trump administration.

- A day later, FHFA announced it was publishing a Notice of Proposed Rulemaking to amend the recently finalized Enterprise Capital Framework for Fannie and Freddie.

In yet another policy reversal, the Thompson-led FHFA encourages the GSEs to transfer their credit risk to private investors. Under Calabria, the agency approved capital standards that reduced incentives to transfer credit risk by lowering the capital relief they would receive.

In yet another policy reversal, the Thompson-led FHFA encourages the GSEs to transfer their credit risk to private investors. Under Calabria, the agency approved capital standards that reduced incentives to transfer credit risk by lowering the capital relief they would receive.

As HousingWire reported, the proposed changes would:

- Replace the fixed prescribed leverage buffer amount (PLBA), equal to 1.5% of an enterprise’s adjusted total assets, with a dynamic PLBA equal to 50% of the enterprise’s stability capital buffer.

- Replace the prudential floor of 10% on the risk weight assigned to any retained CRT exposure with a prudential floor of 5% on the risk weight assigned to any retained CRT exposure.

- Remove the requirement that an enterprise must apply an overall effectiveness adjustment to its retained CRT exposures per the ERCF’s securitization framework.

2. Changes Favorably Received, Mostly

A broad spectrum of financial services industry leaders lauded the FHFA’s decisions and proposals.

- Housing Policy Council President Ed DeMarco, speaking of the proposed capital changes, told HousingWire: “The three things that are being proposed in this rule are absolutely the right three things to be focused on, and directionally this all appears to be quite responsive” to comments that industry participants offered last year.

- Don Layton of the Joint Center for Housing Studies at Harvard University wrote in support of the capital changes in large part because, “The specifics of the risk-based capital requirement (under Calabria), especially with respect to credit risk transfer (CRT), were significantly distorted so they were at odds with the GSEs making good, economically driven risk-reward decisions.”

- American Bankers Association President Rob Nichols supported the suspension of the PSPA caps, saying their elimination “will bolster market stability and allow time for FHFA to consider additional revisions to the conservatorships of the two [GSEs] that can expand affordable housing financing in the country.”

Mortgage industry analyst Christopher Whalen, however, was critical of the moves. In a recent Institutional Risk Analyst report, (“Joe Biden Doubles Down on Housing”), Whalen asks, “After years of FOMC-induced asset price inflation, does the housing market really need more help? Clearly the Biden administration thinks the answer is yes.” Whalen clearly thinks the answer is no:

- “We think that the changes being contemplated by the Biden administration … to make housing credit even cheaper and more easily available will cause the next housing crisis.”

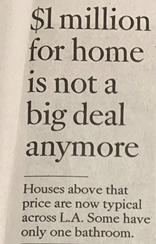

3. Million-Dollar Starter Homes

Even by California standards, the front-page headline from the Sept. 20 Los Angeles Times is jaw-dropping.

- Blame it on the pandemic.

- Blame it on a rising stock market.

- Blame it on a housing shortage.

Whatever the reason, we now have $1 million prices for run-of-the-mill houses in the Golden State.

“Homes worth $1 million or more now dominate communities from Altadena … to South LA. As bidding wars send prices even higher, more people are being priced out of communities where they grew up and homeownership is becoming more out of reach for low- and middle-income Californians,” reported the Los Angeles Times last month.

There are 55 cities in Los Angeles and Orange counties, California, where the price of a typical single-family house is about $1 million, the paper reported.

What does $1 million buy in the LA Basin?

Proximity to the beach adds values to homes in West LA, California, “but if you’re fine with about 1,000 square feet, there are multiple options around $1 million,” reports Jack Fleming of the Times. For instance, there’s a two-bedroom, one-bath bungalow “right down the road from the Santa Monica Airport” (perfect for your private plane!) now on the market for $1.099 million.

Source: MLS

La Cienega Heights, California, is billed as “one of the Westside’s more affordable neighborhoods.” This 95-year-old home is on the market for $995,000. It comes loaded with two bedrooms, a bath and 867 square feet. (That’s roughly $1,148 per square foot.)

Source: MLS

Proximity to the beach adds values to homes in West LA, California, “but if you’re fine with about 1,000 square feet, there are mGentrification is pushing home prices in historically lower-income, minority neighborhoods, such as Boyle Heights (95% Hispanic and Latino), into the stratosphere, too. “But,” notes the Times’ Fleming, in Boyle Heights, “$1 million still goes a long way.” For instance, the home at 1235 Stone Street is “perched on a hill” and “takes in city views from its many windows and upper-level deck.” Its 2,075 square feet contain four bedrooms and three bathrooms. It can be yours for $979,000 unless, of course, a bidding war ensues.

Source: MLS

4. California Math: 9 + 10 = > Homes

If paying a million dollars for a thousand-square-foot home in Southern California isn’t a sufficient indicator that California has housing problems, consider these other facts:

- In July, the median price of a single-family home in California was $828,000, compared to the U.S. average of roughly $360,000.

- There is a housing shortage of up to 2.5 million units, but the state has created just about 100,000 new units annually.

My video podcast series, the Arch MI PolicyCast, tackled these issues earlier this year with guests Conor Dougherty, author of “Golden Gates: Fighting for Housing in America” (Episode 12), and the University of Southern California’s Richard Green, Director of the university’s Lusk Center for Real Estate (Episode 16).

Now the state legislature and Gavin Newsom have taken concrete steps to increase the state’s housing stock by enacting Senate Bills 9 and 10. The Sacramento Bee provided a summary of those bills.

The new laws will “weaken single-family zoning — if not eliminate it — and make it easier to build multifamily dwellings,” suggests LA Times state capital columnist George Skelton, who adds, “we’ve got to do something about the economics of supply and demand that are turning the California dream into a nightmare for millions.”

LA Times reporters Jon Healey and Matthew Ballinger report that nearly two-thirds of all the residences in California are single-family homes and as much as three-quarters of the developable land in the state is now zoned only for single-family housing.

- S.B. 9 means that many homeowners in single-family zones now have the right to divide their lots into two and build up to three additional homes on them.

- S.B. 10 allows for denser development near public transit corridors.

UC Berkeley’s Terner Center, one of the nation’s foremost academies for real estate studies, estimates that approximately 700,000 new, market-feasible homes would be enabled under SB 9.

The bills passed overwhelmingly in the California Legislature, but already the NIMBY crowd is airing protests.

“Passage of Senate Bill 9 allows my neighbor to build as many as four homes on a single 5,000 square foot lot. Despite flex alerts, long-term drought and a failing infrastructure (e.g., traffic), we are being told that neighborhoods can quadruple in size. … When does the craziness end?” wrote one Encinitas, California resident to the San Diego Union-Tribune.

5. 13 Reasonable People

During my summer hiatus from writing Capital Commentary and hosting the PolicyCast, I received a summons for jury duty for the Fairfax County (Virginia) Circuit Court.

- To be truthful, I fully anticipated being pulled off the jury during voir dire given my regular work with the federal government. And, like so many busy professionals, I was silently hoping “Juror No. 3” would be excused.

Alas, I was impaneled. And I am glad I was. I recommend it to others.

- We were a diverse panel of 13 county residents (one juror was randomly dismissed just before jury deliberations to bring the final number to 12) ranging in age from early 20s to 70s; Black, white and Middle Eastern Americans from all walks of life.

- Jurors took their roles with a seriousness of purpose over the five days, taking reams of notes and studiously avoiding any discussion about the trial (although a few of us did comment the defense attorney was sockless the first day).

The memory I am left with is our remarkable system of justice. Without getting into the case details, it concerned a Bulgarian defendant and a Ukrainian victim. Despite neither being an American citizen, our judicial system provided them all the rights and privileges in the courtroom as if they were. And it was left to random citizens to mete out justice on behalf of the Commonwealth of Virginia.

- Here’s a suggestion: If your number gets called, don’t try to finagle a way out of serving. Work can wait a few days. You might just miss a memorable opportunity to serve your fellow citizens.

6. Contest #11: Guilty or Not Guilty?

Most critics would likely agree that the most famous movie about a jury is the 1957 classic “12 Angry Men” starring Henry Fonda. The star power didn’t end with Fonda: it was directed by Sidney Lumet and co-starred (among others) Lee J. Cobb, Jack Warden, Jack Klugman and E.G. Marshall.

- In the movie, the jurors consider the case of an 18-year-old man accused of stabbing his father to death. At first glance, it seems to be an open-and-shut case until … well, I am not about to give away the plot.

- If you have never seen it, it can be streamed to your television from various sources. It is worth the $4 investment.

12 Angry Men was nominated for an array of Academy Awards, including Best Picture, Best Actor (Fonda) and Best Director (Lumet). Fonda and Lumet won international awards in recognition of their work in “12 Angry Men,” but winning the Oscar for Best Picture proved a bridge too far for this classic.

Take the quiz: Which picture won the Oscar for Best Picture for 1957?

Email your answers to [email protected] by midnight, Oct. 14. All correct entries will be entered into a random drawing for an Arch MI Capital Commentary/PolicyCast mug and saucer.

In Contest #10, I asked readers to provide the height and site of the world’s largest sandcastle. A surprisingly large number of readers are clearly up-to-date on “beach housing.”

The answer: The new record for sandcastle building is a bit above 69 feet in Blokhus, Denmark.

Do you think Capital Commentary offers valuable information on housing policy and its potential impacts? If you do, share your comments with us. Your feedback will help ensure Capital Commentary covers the stories that have the most impact on your business.

About Arch MI’s Capital Commentary

Capital Commentary newsletter reports on the public policy issues shaping the housing industry’s future. Each issue presents insights from a team led by Kirk Willison.

About Arch MI’s PolicyCast

PolicyCast — a video podcast series hosted by Kirk Willison — enables mortgage professionals to keep on top of the issues shaping the future of housing and the new policy initiatives under consideration in Washington, D.C., the state capitals and the financial markets.

Stay Updated

Sign up to receive notifications of new Arch MI PolicyCast videos and Capital Commentary newsletters.