It’s February — officially the shortest month of the year. Unofficially, it’s the longest if your job is reading the thousands of pages of comment letters submitted in response to the banking agencies’ Basel III Endgame proposal.

- Case in point 1: The Bank Policy Institute and the American Bankers Association submitted a 314-page joint letter.

- Case in point 2: When I asked ChatGPT to summarize individual letters, many were too long — even for AI.

Numerous letter writers worry that homeownership for low- and moderate-income borrowers will become even more out of reach unless the proposed rules are changed.

- We highlight ways to improve the rule so it won’t unduly burden banks or borrowers.

1. There Goes the House

Think buying a home is expensive now? Wait until banks have to boost their capital levels thanks to the Basel III Endgame, the U.S. bank regulators’ spin on international capital standards for depository institutions.

Why it matters: U.S. regulatory agencies propose raising capital requirements on bank assets by up to 20 percentage points. It promises to send bank mortgage rates soaring and drive many to flee the mortgage origination business.

- The big picture: Borrowers unable to make a large down payment will bear the burden of the rule change because high-LTV loans would be considerably more expensive for banks to hold in portfolio than they are today.

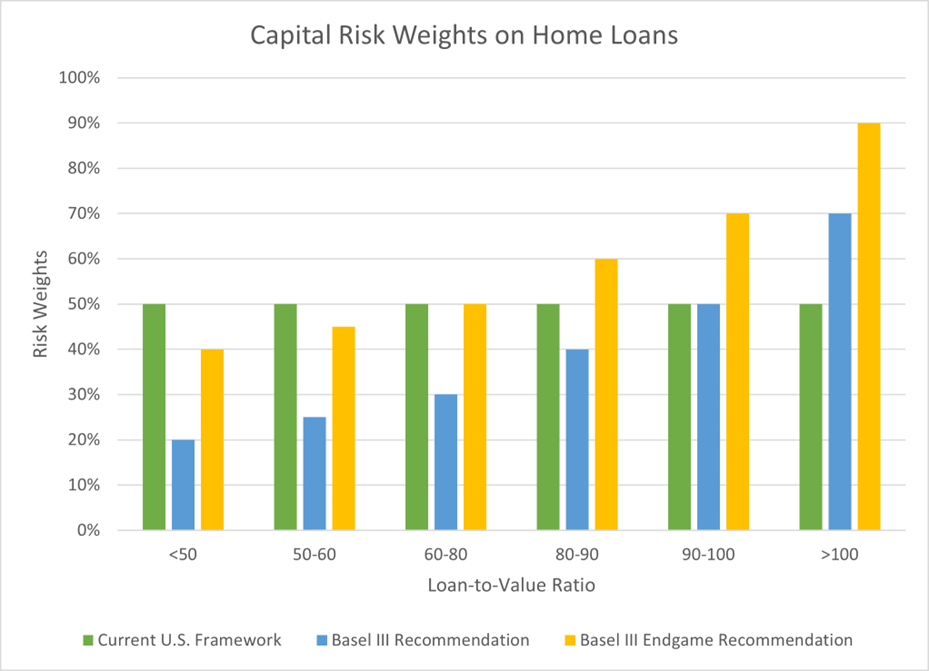

The current U.S. and Basel III (International bank regulations) capital frameworks enable banks to reduce the risk weights on high-LTV (above 80%) home loans if they are covered by mortgage insurance (MI). However, the proposed Basel III Endgame does not consider MI in risk-weight calculations.

- By the numbers: 52% of bank-originated home loans are produced by the 31 large banks covered by Basel III Endgame.

The bottom line: Industry and housing advocates are apprehensive about the ramifications of the U.S. regulators’ proposal on low-wealth borrowers.

What they’re saying:

“[The proposal] threatens irreparable harm to low-wealth borrowers and people of color. In fact, the Proposal will likely eliminate high-LTV lending at large banks altogether.”

— Arch Capital Group

“[Basel III Endgame] would produce excessive capital charges for mortgage credit that discourage[s] mortgage lending … and increase the costs of mortgage credit for consumers.”

— Housing Policy Council

The negative impact will fall primarily on first-time homebuyers who are disproportionately low and moderate income and people of color.”

— Center for Responsible Lending

“Our concerns are amplified by the fact there is little economic impact analysis to support the need for many of these provisions.”

— Mortgage Bankers Association

2. The Fix? Transfer Bank Risk

There’s nothing new about transferring risk to investors and insurers. Since the 1950s, private mortgage insurance companies have put themselves in a first-loss position on mortgage defaults at banks, credit unions and Government-Sponsored Enterprises, such as Fannie Mae and Freddie Mac.

- What is new: Basel III Endgame proposes eliminating the benefit of banks using mortgage insurance to reduce the effective loan-to-value (LTV) ratio on mortgage loans (which lowers the amount of capital needed to cover the loan).

Why it matters: Mortgage insurance is essential to grow homeownership. More than 60% of borrowers with MI are first-time homebuyers.

By the numbers: MI is also proven to reduce losses. GSE losses on mortgages with LTVs between 90% and 97% are the same as losses with LTVs between 75% and 80%.

- That’s because MI firms, not Fannie Mae or Freddie Mac, take the first loss on loans above 80% LTV.

The National Fair Housing Alliance contrasted the treatment of MI by the Federal Housing Finance Agency (FHFA) with that of bank regulators:

“FHFA, which oversees the purchase of the vast majority of mortgages in the United States, determined that the credit risk to the GSEs decreased for mortgage loans with an LTV of 80 percent or greater, and, therefore, the guarantee fee should also decrease.”

The National Housing Conference similarly weighed in:

“There is now a wide gap between the risk weights determined by this proposal and FHFA’s, which recognized the importance of PMI in its analysis. This difference between the regulatory capital structures creates a capital arbitrage.”

- It is a mystery why bank regulators are so out of step with the federal agency overseeing most residential mortgages.

The solution isn’t complicated, say critics of the proposed rule. Bank regulators should recognize that MI reduces a bank’s risk and, in turn, provides capital relief on MI-covered loans held in portfolio.

Bank regulators should recognize that MI reduces a bank’s risk and, in turn, provides capital relief on MI-covered loans held in portfolio.

“Banks should … be incentivized to manage their losses by ceding credit risk to third-party insurers and investors. Importantly, to ensure bank participation in the higher-LTV lending space, capital regulations should allow MI to reduce the LTV used to calculate the risk weight assigned to residential mortgage exposures.”

— Arch Capital Group

3. Gone Too Soon. Never Forgotten.

David H. Stevens, left, and Michael Gill, right.

The housing industry lost two shining lights early in 2024 with the sudden passings of Dave Stevens and Mike Gill.

Stevens had a lengthy career in housing, as a loan officer, GSE executive, FHA Commissioner and Mortgage Bankers Association CEO. In his post-MBA career, he served as a mortgage industry consultant and all-around ambassador for the industry.

I first met Dave 24 years ago when he was asked to recruit me to Freddie Mac and dissuade me from accepting a similar job with Fannie Mae.

- After an hour with Dave, I was ready to sign my Freddie offer sheet. Who could say “no” to him?

Dave’s impact on the mortgage and housing industries is immeasurable. But so, too, is the legacy he leaves for helping future generations cope with prostate cancer.

- Over the course of his own eight-year battle with cancer, Dave raised several million dollars for the Brady Urological Institute through the #StevensStrong campaign.

Mike Gill was Senior VP for Capital Markets at the Housing Policy Council (HPC) when he lost his life to gun violence in Washington, D.C. Before joining HPC, Gill was an executive at Common Securitizations Solutions, the firm that created the common security for GSE mortgage-backed securities.

Mike and I first crossed paths a decade ago when we both served on a lay leadership council of our parish in Washington’s Georgetown neighborhood.

- We worked closely together, again, when he joined HPC in 2021. In all his endeavors, he led with passion, poise and a contagious sense of humor.

Dave and Mike will be sorely missed. RIP, my friends.

About Arch MI’s Capital Commentary

Capital Commentary newsletter reports on the public policy issues shaping the housing industry’s future. Each issue presents insights from a team led by Kirk Willison.

About Arch MI’s PolicyCast

PolicyCast — a video podcast series hosted by Kirk Willison — enables mortgage professionals to keep on top of the issues shaping the future of housing and the new policy initiatives under consideration in Washington, D.C., the state capitals and the financial markets.

Stay Updated

Sign up to receive notifications of new Arch MI PolicyCast videos and Capital Commentary newsletters.