Warmer and longer days are brightening our surroundings and may contribute to a rosier outlook for housing.

So let’s put our troubles behind us (for at least one issue of the Capital Commentary) and laissez les bon temps rouler!

1. Big Thing: Housing’s Looking Up!

Is the worst of housing’s downturn behind us?

Why it matters: Builder and buyer sentiments are critical components of a vibrant housing market, and both are looking up these days.

As the chart below indicates, the Housing Market Index, a monthly calculation of home builder sentiment, has shown rising optimism for three consecutive months. It is now at its highest point in six months.

What they’re saying:

“After bottoming in November, single-family housing starts have picked up a bit — not the surge we saw in mid-2020, but another sign that builders feel like they are in a position to continue building in the current market rather than pulling back even more.”

— Conor Sen, Bloomberg News

Reviewing the state of the nation’s housing economy in a recent weekly Housing and Mortgage Market Review® (HaMMRSM), Arch Capital’s Global Chief Economist Parker Ross wrote:

“The share of homes selling within two weeks has climbed to 46%, 6 percentage points above the typical pre-pandemic level for this time of year. Competition has pushed prices up on a seasonally adjusted basis since the end of 2022, with annualized price growth now well into the double digits.”

The bottom line: The rising optimism among home builders and faster-selling homes suggests that the worst of housing’s downturn may be behind us.

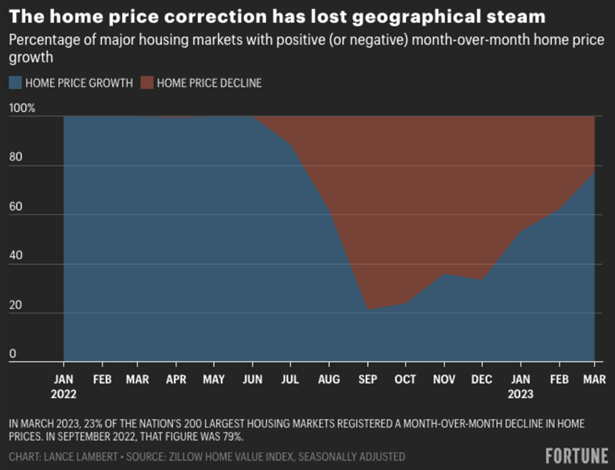

2. Chart of the Week — Home Prices Up

Back in the bleaker housing days of last fall, home prices were declining in most markets. Despite the Federal Reserve continually raising interest rates over the past 12 months, more than 70% of markets showed home prices rising in March.

3. Millennials Move from Rent to Own

Forget asking Millennials when they will move out of their parent’s basements. These days, they are more likely to be refinishing the basements of their new homes.

Why it matters: Millennials have transitioned from being majority renters to majority homeowners (52%), according to Rentcafe.com.

- By the numbers: Millennial homeownership increased by 7 million over the past five years.

- But given the number of U.S. Millennials, this cohort still ranks first among generations in the number of renters at 17.2 million.

The average Millennial bought their first home at 34, slightly older than earlier generations. Baby Boomers purchased their first home, on average, at 33; Gen Xers, at 32.

Go West … and South, young people. According to RentCafe:

- Modesto, California, topped the list of cities with the highest increase in Millennial homeownership over the past five years, up a whopping 2,379%.

- Other cities in the top five were North Port, Florida (804%); Colorado Springs, Colorado (516%); Port St. Lucie, Florida (507%); and Lakeland, Florida (330%).

The bottom line: The days (months? years?) of living in their parents’ homes might have been strategically wise for Millennials.

- It allowed many to save money for a down payment on a home.

- When they were ready to leave, most parents happily said “goodbye” by handing them a check. According to a LendingTree survey, nearly 60% of Millennials received financial support from their parents toward their down payments.

4. Homeownership Plays in Peoria

Thanks to a TikTok influencer, a diverse contingent of Americans is now calling Peoria, Illinois, home.

Why it matters: Peoria has long been a down-on-its-luck city in central Illinois. Once the nation’s leading producer of liquor (until Prohibition) and later the headquarters of Caterpillar, Inc. (until it relocated to Deerfield, Illinois), the city’s population is the same as in 1950.

Then, along came Angelica Ostaszewski and her TikTok channel.

Ostaszewski, a 32-year-old energy efficiency coordinator, moved to Peoria a decade ago from Bloomington, Indiana, in search of affordable housing. She purchased her first home for $33,000 when she was 27.

Ever since, she’s been using TikTok to spread the word about Peoria’s housing affordability and its welcoming spirit, most notably to the LGBTQ community.

- By the numbers: The average price of a Peoria home is $130,000, compared to the national average of $326,800.

People are taking notice of her efforts.In addition to having tens of thousands of social media followers, the Chicago Tribune and New York Times have run recent feature articles on her.

What they’re saying:

“I think Peoria is really special because it’s a large town outside of Chicago in a very progressive state. We have a diverse landscape with bluffs and a large river, but it’s also still small enough that you can find your people but big enough that there’s going to be something to do every weekend. I feel like it’s Goldilocks and the Three Bears, finding the perfect, happy medium of cities.”

— Angelica Ostaszewski

”Tok” about influence: Ostaszewski has persuaded her brother and sister, plus about 300 others, to buy homes in Peoria, according to the New York Times.

About Arch MI’s Capital Commentary

Capital Commentary newsletter reports on the public policy issues shaping the housing industry’s future. Each issue presents insights from a team led by Kirk Willison.

About Arch MI’s PolicyCast

PolicyCast — a video podcast series hosted by Kirk Willison — enables mortgage professionals to keep on top of the issues shaping the future of housing and the new policy initiatives under consideration in Washington, D.C., the state capitals and the financial markets.

Stay Updated

Sign up to receive notifications of new Arch MI PolicyCast videos and Capital Commentary newsletters.