The housing price squeeze in urban markets is well documented.

- The CoreLogic Case-Shiller Index for major metro areas set new records in March, continuing a trend of new highs in six of the past 12 months.

Less known? There is a housing affordability crisis in rural America, too, and we wanted to learn more about it.

- We set off for Iowa to collaborate with Republican U.S. Rep. Zach Nunn on a roundtable with local housing experts for a deep dive into housing challenges facing his state’s residents.

Iowa’s slogan is the “State of Minds,” and it’s grappling with its own State of Housing. It’s a conversation that demands attention from policymakers.

1-Big Thing: Rural Affordable Housing Crisis Deepens

Affordable housing in rural America faces significant hurdles due to federal funding shortages and a lack of labor for constructing new homes.

Why it matters: Access to affordable housing is crucial for the economic stability and growth of rural communities. Without it, these areas struggle to attract and retain residents.

By the numbers:

- The National Low Income Housing Coalition reports a shortfall of 7 million affordable and available rental homes for extremely low-income renters in rural areas.

- In 2023, the gap between the demand and supply of affordable homes in rural America was estimated at 3.8 million units.

- Construction costs have increased by 15% over the past two years, further straining resources for building affordable housing in rural areas.

The big picture: Labor shortages in the construction industry further delay the building of new affordable homes, leaving many rural families without stable housing options.

What they’re saying:

“The lack of affordable housing in many rural communities reflects the lack of investment in these localities more broadly. Rural renters are more than twice as likely to live in substandard housing compared to people who own their own homes. With lower median incomes and higher poverty rates than homeowners, many renters are simply unable to find decent housing that is also affordable.”

Letter sent by a coalition of 16 housing organizations to leading housing legislators in U.S. House.

The bottom line: The shortage of federal funding, rising construction costs and labor scarcity are exacerbating the affordable housing crisis in rural America, threatening economic stability and growth by hindering the attraction and retention of residents.

2. Congressman Nunn Convenes Housing Experts to Address Rural Affordability

Elected to Congress for the first time in November 2022, Nunn quickly seized opportunities to improve rural economies.

- He was a co-sponsor of the Expanding Access to Capital for Rural Job Creators Act, the Farm Act and the Agriculture Export Production Act early in his term.

But Nunn knows Washington doesn’t have all the answers.

So, the House freshman convened nearly two dozen local housing experts in Des Moines in mid-May to learn more about barriers they face in securing housing for Iowans and adding to the state’s supply of homes.

- Roundtable participants were drawn from credit unions, mortgage and community banks, homebuilders, mortgage insurers and agencies such as Iowa Finance and the Federal Home Loan Bank of Des Moines.

What they’re saying:

“Affordable housing is a true national crisis … but particularly in rural areas, it is painfully acute. The average household income is $10,000 less than the national average in Iowa, and nearly 40% of renters spend almost a third of their income for housing.”

U.S. Rep Zach nunn

First Steps: Nunn hailed the passage of the Promote Affordable Rural Housing Act, which he introduced in the House along with North Carolina Democrat Rep. Wiley Nickel.

- It improves the U.S. Department of Agriculture (USDA) Section 524 loan program by extending the term for rural housing site loans from two to five years and expanding the use of these loans. It was signed into law in March as part of an appropriations package.

A rare win for bipartisanship:

“We were able to get (the bill) through the (Republican) House, through the (Democratic) Senate and signed by the President in 30 days. For a freshman to be able to do this with your support means that you (local experts) provided us the absolute right material to get both sides to sign on to this,” Nunn said.

3. What Nunn Heard from the Experts

Roundtable participants emphasized that government must play a leading role in solving the housing affordability problem in collaboration with private interests.

Insufficient USDA housing funds is one barrier, noted several attendees.

“Funding has been cut by a third and access to that money in the state of Iowa is limited … Pretty much all of the money for the year has been accounted for …. We’ve been instructed to tell buyers that there likely isn’t going to be money (for new homes) even in the next funding rounds.”

Rachel Flint, Hubbel Homes

Rural residents transitioning from rental to ownership in cities such as Des Moines or Cedar Rapids face significant affordability burdens, said Neighborhood Finance Corp.’s Terry Gearhart. They might want a new home, but that’s not realistic, he said.

“Farmers can’t do that. Any (home) in the $200,000 range is going to need work. The housing stock has aged. These homes are probably built in the 1950s and before. So there are things that need to be done to the house and borrowers don’t have the money to put into it.”

- Neighborhood Finance will arrange repairs for their clients and provide up to $12,500 in loans that can be forgiven.

Old homes might sound quaint, but they can be problematic, too, noted Hubbel Homes’ Flint.

“People say, ‘They don’t build homes like they used to,’ and I say, ‘Thank God for that.’”

The bottom line: Housing affordability challenges are immense, yet housing experts express a cautious optimism about the future.

“I came here to collaborate and drive affordability. I’ve talked to a lot of people that are actually looking at coming to Iowa from even higher-cost states like Washington and California. I’m still optimistic that Iowa is more affordable than a lot of areas.”

Dane Eischeid, New American Funding

4. Nunn Has the Final Word

Nunn posted a video on the social media site X recapping the housing roundtable.

5. Survey Says: No Love for Credit Report Fees

We asked. You answered.

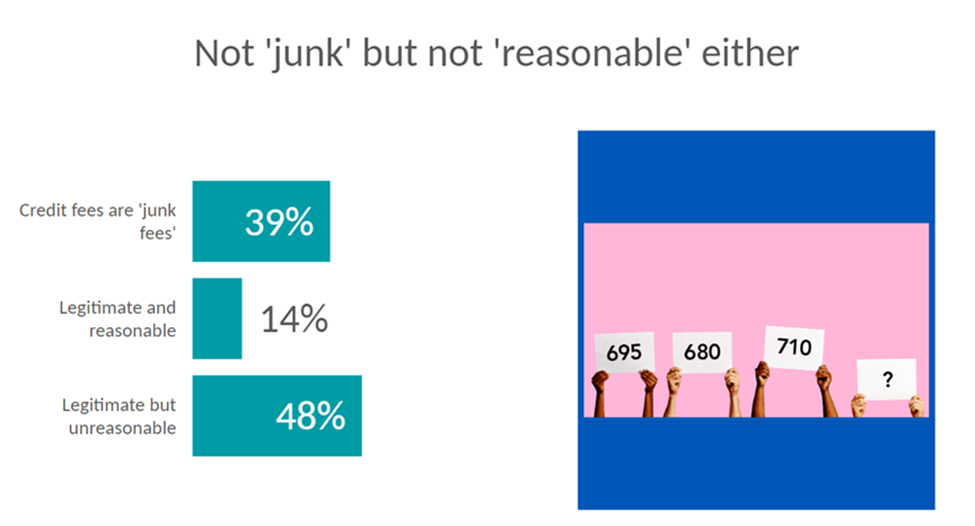

Readers aren’t fans of paying more money to credit reporting services, but a majority still disagreed with Consumer Financial Protection Bureau (CFPB) Director Rohit Chopra that they meet the definition of a “junk fee.”

Why it matters: The CFPB released a Request for Information (RFI) in late May seeking public comment about mortgage closing costs. The seven-page RFI presented nine questions about closing costs’ impact and how they relate to borrowers and the mortgage market.

Key questions include:

- Are there particular fees that are concerning or cause hardships for consumers?

- Are there any fees charged that are not or should not be necessary to close the loan?

- Would lenders be more effective at negotiating closing costs than consumers?

What’s next: Comments are due to the CFPB by Aug. 2, 2024.

About Arch MI’s Capital Commentary

Capital Commentary newsletter reports on the public policy issues shaping the housing industry’s future. Each issue presents insights from a team led by Kirk Willison.

About Arch MI’s PolicyCast

PolicyCast — a video podcast series hosted by Kirk Willison — enables mortgage professionals to keep on top of the issues shaping the future of housing and the new policy initiatives under consideration in Washington, D.C., the state capitals and the financial markets.

Stay Updated

Sign up to receive notifications of new Arch MI PolicyCast videos and Capital Commentary newsletters.