Anyone following housing policy knows that one issue has dominated recent headlines: Changes to upfront loan prices paid by borrowers on loans sold to Fannie Mae or Freddie Mac that took effect May 1.

Editorial writers and presidential candidates have pushed back against the changes. Regulators and think tanks have countered the criticism with detailed explanations.

It’s a topic worthy of deep exploration, so Capital Commentary is devoting this entire issue to laying out the arguments for and against the changes.Let’s dig in …

1. Big Thing: Is the (LLPA) Price Right?

The Backstory: Nearly seven months ago, the Federal Housing Finance Agency (FHFA) announced targeted pricing changes to Fannie and Freddie guarantee fees (g-fees). Those changes included eliminating upfront fees for:

- First-time homebuyers at or below 100% of area median income and below 120% in high-cost areas.

- Fannie’s HomeReady® and Freddie’s Home Possible® loans.

- Single-family loans supporting the GSEs’ Duty to Serve program (manufactured housing and rural loans).

More pricing tweaks: FHFA announced additional pricing changes in January benefiting families “limited by wealth or income” by lowering loan-level pricing adjustments (LLPAs) for some borrowers, while raising them for others to achieve “commercially viable returns on capital.” Capital Commentary covered that news in our Feb. 23 issue, including reprinting the new pricing grid for single-family purchases.

Why it matters: In an era of heightened partisanship, every government agency decision is viewed under a political microscope.

- Critics of the new pricing grids accuse the Biden administration of socialism for penalizing lower-risk borrowers to help higher-risk ones.

- Proponents argue critics wrongly conflate low-income and high-risk borrowers. They note that higher-risk borrowers will continue to pay more for mortgage loans than lower-risk ones.

2. “Social Justice Surtax,” Claim Critics

The firestorm of criticism started with a Wall Street Journal editorial that called the pricing changes “the socialization of risk, and it flies against every rational economic model, while encouraging housing market dysfunction and putting taxpayers at risk for higher default rates.”

“The biggest problem here is fairness. Taxpayers already subsidize mortgages for low-income borrowers through the Federal Housing Administration. Now they want to punish those who have maintained good credit while rewarding those who haven’t. In the name of making housing more equal, they are pursuing an inequitable policy.”

— Wall Street Journal, April 22, 2023

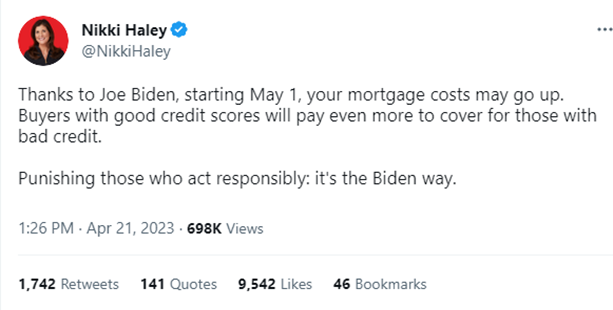

Others soon followed, including presidential candidate Nikki Haley on Twitter:

In its editorial titled, “Biden’s Socialist Housing Scheme,” the Washington Examiner wrote that Biden is punishing “those who have worked hard, spent their money responsibly, and made smart financial choices … in order to prop up ‘the oppressed.’”

The New York Post suggested:

“The new federally mandated penalty for creditworthy borrowers should be explicitly listed on loan documents as a Social-Justice Surtax.”

U.S. Senator Thom Tillis, R-North Carolina, blasted the administration in a letter sent to his constituents:

“The Biden Administration wants to social engineer the housing market,” wrote Tillis. “It’s irresponsible and has the potential of flipping our entire housing financial system upside down with disastrous consequences. … Seriously. You can’t make it up.”

3. “Fundamental Misunderstanding,” Argue Proponents

Sure, loan prices are increasing for certain borrowers, but the criticism lacks balance, argue proponents of the changes.

- What they’re saying: “Higher-credit-score borrowers are not being charged more so that lower-credit-score borrowers can pay less,” contends FHFA Director Sandra Thompson. “The updated fees … generally increase as credit scores decrease for any given level of down payment,” she said.

Going on the record: Thompson took the unusual step of issuing a news release to address the criticism of LLPA changes.

“Much of what has been reported advances a fundamental misunderstanding about the fees charged by the Enterprises, and why they were updated.

“To be clear, the series of steps taken by FHFA to update the Enterprises’ pricing framework will bolster safety and soundness, better ensure the Enterprises fulfill their statutory missions, and more accurately align pricing with the expected financial performance and risks of the underlying loans.”

Moreover, the pricing changes were long overdue, said Thompson.

“Some mistakenly assume that the prior pricing framework was somehow perfectly calibrated to risk — despite many years passing since that framework was reviewed comprehensively. The fees associated with a borrower’s credit score and down payment will now be better aligned with the expected long-term financial performance of those mortgages relative to their risks.”

High-LTV borrowers have additional costs.

- The Urban Institute’s Jim Parrott and Janneke Ratcliffe noted that borrowers making smaller down payments on loans sold to the GSEs are also paying private mortgage insurance premiums, which increase their monthly mortgage payments. In those cases, mortgage insurers are on the hook for first loss, not the GSEs.

“Those who put down less than 20% pose less risk to the GSEs and should pay less in fees to the GSEs. The reason the GSEs’ pricing peaks at loan-to-value (LTV) ratios of 80.01 to 85.00% rather than 75.01 to 80.00% is that borrowers can drop their mortgage insurance when the LTV ratio hits 78%, leaving the GSEs unprotected after only a couple of years of payments.”

Mortgage News Daily’s Matthew Graham offers his own counsel on the LLPA changes:

“The change amounts to a tweak of an existing fee structure in favor of those with lower credit scores and at the expense of those with higher credit scores, but there’s no scenario where someone with lower credit will have a lower fee. In other words, don’t go skipping those credit card payments in the hopes of getting a lower rate.”

4. What’s Next?

The LLPA controversy isn’t going away any time soon.

What’s next: The Subcommittee on Housing and Insurance, chaired by U.S. Rep. Warren Davidson, R-Ohio, is holding a hearing on LLPA changes on May 17.

- The full House Financial Services Committee called Director Thompson to testify at a May 23 hearing.

The big picture: Critics and supporters of the new loan pricing schedule will be sharpening their talking points in the coming days and speaking to a public much larger than the legislators on the dais of the Financial Services Committee hearing room.

- On the other hand: One recent decision by FHFA — to rescind a new fee for when loan payments exceed a 40% debt-to-income (DTI) ratio — is being hailed by mortgage originators. Lenders worried that consumers would misunderstand the charge and accuse loan officers of using bait-and-switch tactics if the rate increased after underwriters determined the DTI was higher than anticipated.

Our thought bubble: Housing is rarely a topic that moves voters in an election, but Republicans see the Biden administration as vulnerable to criticism that it is adopting a far-left political agenda that will increase mortgage costs for many middle-class homebuyers. For an administration that has made expanding homeownership among lower-income Americans a high priority, this will be an important and sizable test in the public arena.

About Arch MI’s Capital Commentary

Capital Commentary newsletter reports on the public policy issues shaping the housing industry’s future. Each issue presents insights from a team led by Kirk Willison.

About Arch MI’s PolicyCast

PolicyCast — a video podcast series hosted by Kirk Willison — enables mortgage professionals to keep on top of the issues shaping the future of housing and the new policy initiatives under consideration in Washington, D.C., the state capitals and the financial markets.

Stay Updated

Sign up to receive notifications of new Arch MI PolicyCast videos and Capital Commentary newsletters.