We wanted a different perspective on housing challenges.

So, Arch MI recently took to the road to ask local experts about the causes and ramifications of the limited supply of homes available for sale and what should be done to boost affordable homeownership in their communities.

We could rename this issue “Cincinnati Commentary.”

1. Queen City with King-Size Problems

Why Cincinnati? The city is a good proxy for many regions of the U.S. confronting obstacles to growing homeownership.

By the numbers: While its average home price of $220,000 is considerably below the national average, its homeownership rate of 67.1% aligns with it.

- The region’s chasm in the homeownership rates between those who are white (73%) and Black (34%) is stark, much like the national story.

- Home prices are up 40% since 2019.

The bigger picture: The region is also home to U.S. Rep. Warren Davidson, R-Ohio, the new Chairman of the Housing and Insurance Subcommittee of the House Financial Services Committee. We hosted an Affordable Homeownership Roundtable in Cincinnati, Ohio, with Rep. Davidson and an array of housing industry leaders.

One fun thing: Cincinnati was dubbed the “Queen City of the West” in the early 19th century, “distinguished for order, enterprise, public spirit and liberality” … and Skyline Chili, of course.

The bottom line: Cincinnati is a microcosm of the nation’s housing issues, and understanding the region’s challenges can help inform solutions for the entire country.

2. The Chairman Weighs in on Government’s Role

Chairman of the Housing and Insurance Subcommittee

Don’t expect sweeping housing legislation to pass out of the Housing and Insurance subcommittee, although Davidson is hopeful for National Flood Insurance Program reauthorization during this Congress. Davidson adheres to the adage: “The government that governs the least governs the best.”

“The states created the federal government (to do a limited number of things). And if the federal government only did those things, we could actually afford a government that size. (But) we can’t afford the government, which tells you we’re doing more things than maybe we should,” Davidson said.

The big picture: Excess government spending leads to inflation, which turns into rampant home-price appreciation and soaring rents, Davidson contends. The congressman is critical of the Federal Reserve’s extensive purchases of mortgage-backed securities during COVID-19 that kept mortgage rates artificially low and sent home prices soaring when, “honestly, there was no need to prop up that market.” Homeowners and capital markets loved it, he said. Renters? Not so much.

The bottom line: Davidson asserts there is an important role for the federal government and, for housing, that means enforcing anti-redlining laws, ensuring access to mortgages and protecting the right to live where you want to live.

“First and foremost, to me, good governments defend freedom.”

— U.S. Rep. Warren Davidson, R-Ohio, Chairman of the Housing and Insurance Subcommittee

3. Hammers and Nails Won’t Fix This

Local governments are impeding affordability, too, say southwestern Ohio homebuilders.

Why it matters: Zoning restrictions and “quality” building codes drive prices too high for low- and moderate-income buyers.

Too many jurisdictions define quality as big homes and big lots, said Joe Cristo of Cristo Homes, a builder who focuses on the affordable market.

“I’m not sure where size is quality. What happened to thoughtful development where you can have a nice-sized yard, a community park and walking paths? Some jurisdictions will have no part of it.”

— Joe Cristo of Cristo Homes

Labor shortages are also a contributing factor to unaffordability, said John Henry Homes’ Josh Blatt.

“You’ve got a shortage of skilled labor … [I]t’s just getting worse and worse. For generations, people went to trade schools. It used to be that our concrete guy was out there with his son or (the) framer’s out there with his son. That doesn’t happen anymore.”

— Josh Blatt, john henry homes

The bottom line: This issue of local governments impeding affordability is critical, as it prevents low- and moderate-income buyers from accessing the housing market. It is essential that local governments consider the impact of their zoning restrictions and building codes on affordability.

4. Buyers, Renters Getting Squeezed

Real estate professionals witness the affordable housing challenge in southwestern Ohio daily. When there are no affordable homes to buy, families are stuck paying unaffordable rents for smaller living spaces.

By the numbers: An estimated 45% of area renters pay more than 30% of their income toward shelter, while only 17% of homeowners do.

What they’re saying:

“The ability to find a house in our market that an entry-level buyer can purchase is nearly zero. There’s nothing in the sub-$200,000 range. Meanwhile, I appraised a house (for rent) in Hamilton County that was 800 square feet, built in 1930, and the lease starts at $1,375 a month. That’s a lot of money for not much of a house.”

— Steve Papin, Papin Appraisal, Inc.

“The market in Ohio has been underbuilt and under-invested for the last three decades.”

— Steve Brown, 2014 President, National Association of Realtors®

The racial homeownership gap figured prominently in discussions.

“I look at what’s happening in our neighborhoods, and it’s sad. (Look at) Cincinnati’s West End where you have the stadiums and great development going on, and it’s not inclusive. There’re no resources … (to help residents) when developers buy their homes.”

— Jerry Isham, President of Ohio Realtist Association

5. Buyers, Renters Getting Squeezed

Higher interest rates are making it more difficult to buy a home, but starting May 1, higher upfront fees on loans sold to Fannie Mae and Freddie Mac will compound the difficulties for many borrowers. The biggest culprit, said Cincinnati-area lenders, is the new fee on loans exceeding a 40% debt-to-income ratio.

What they’re saying:

“We’re all struggling with that. How do we (calculate) it? Ratios change after application.”

— Ed Hensley, EVP, WestBanco Bank

“That DTI over 40% really does hit the wrong population” and hurts affordability.

— Tina Surface, Area Sales Manager, Fifth Third Bank

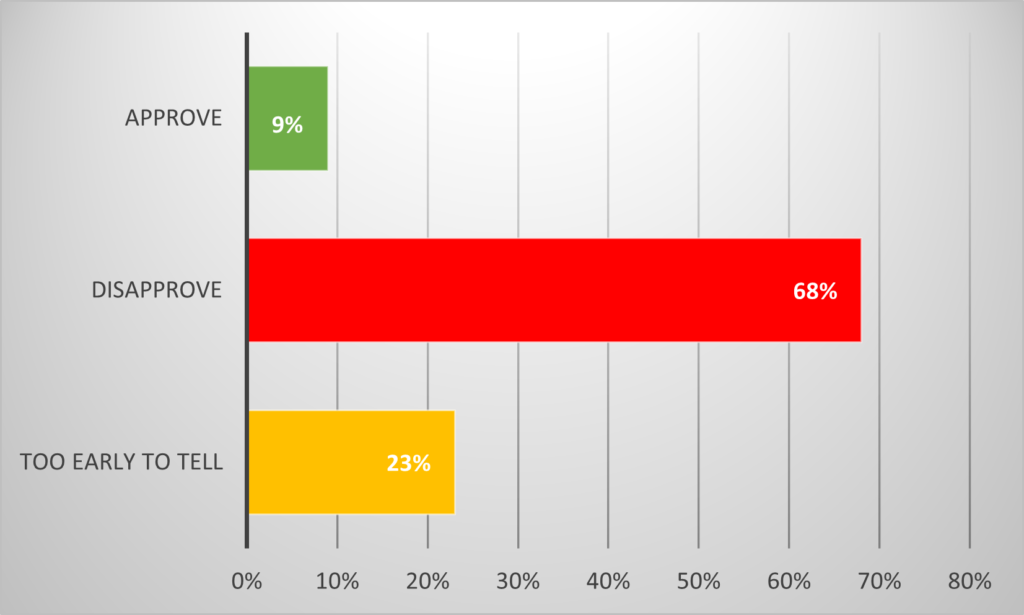

6. Survey Says: Few Fans of New GSE Pricing Structure

Readers largely booed the new upfront fee pricing grid announced by Fannie Mae and Freddie Mac that we asked about in our Feb. 23 issue.

About Arch MI’s Capital Commentary

Capital Commentary newsletter reports on the public policy issues shaping the housing industry’s future. Each issue presents insights from a team led by Kirk Willison.

About Arch MI’s PolicyCast

PolicyCast — a video podcast series hosted by Kirk Willison — enables mortgage professionals to keep on top of the issues shaping the future of housing and the new policy initiatives under consideration in Washington, D.C., the state capitals and the financial markets.

Stay Updated

Sign up to receive notifications of new Arch MI PolicyCast videos and Capital Commentary newsletters.