If you thought redlining was a housing practice found just in history books, think again.

Federal agencies, including the Department of Justice (DOJ) and the Consumer Financial Protection Bureau (CFPB), are putting lenders under a microscope and looking at redlining in a whole new light.

In this issue of Capital Commentary, we do a deep dive on redlining, including its history and recent actions by federal agencies to combat discrimination. Finally, we speak with legal experts who advise clients how to avoid accusations of redlining.

1. A Brief History of Redlining

Redlining, the practice of denying loans in minority neighborhoods, was once endorsed by the federal government.

Now the government is intent in rooting out lending discrimination in sometimes new and unconventional ways.

The Backstory

The Federal Housing Administration (FHA), tasked with insuring “economically sound loans,” began the practice of redlining from the time it was created in 1934.

The housing agency used maps like the one in the image above, designed by the Home Owners Loan Corporation (HOLC), that color-coded neighborhoods from green to blue to yellow to red, indicating the mortgage security of neighborhoods.

Black or minority neighborhoods were more likely to be outlined in red, which indicated a declining or hazardous area.

What they’re saying: A Federal Reserve report on redlining pointed to why FHA justified blatant racial discrimination:

“FHA staff concluded that no loan could be economically sound if the property was located in a neighborhood that was or could become populated by Black people, as property values might decline over the life of the 15- to 20-year loans they were attempting to standardize.”

FHA also subsidized the building of housing developments as long as they were for white families.

In Detroit during World War II, the FHA would not approve one development unless a six-foot-high cement wall was constructed, separating the development from a nearby Black neighborhood.

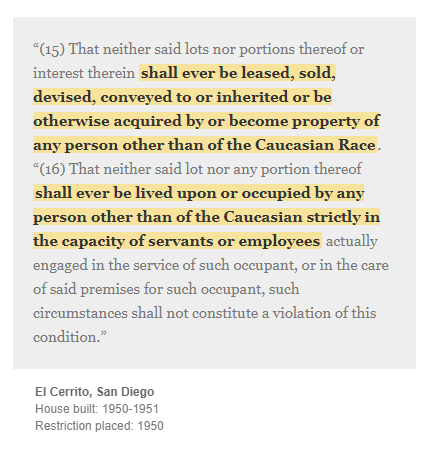

Redlining was prominent in private developments, too.

- Kansas City, Missouri, home builder J.C. Nichols made famous restrictive covenants that included a ban on selling, reselling or renting to non-white families.

- Racial covenants like those in KC were duplicated from coast to coast.

Our thought bubble: Passage of the Fair Housing Act of 1968 put an end to government-sanctioned redlining. It hasn’t yet brought about equitable housing.

- The Black homeownership rate of 44% still lags white homeownership by nearly 30 percentage points.

- Mortgage lenders, mortgage brokers, secondary market agencies and other real estate professionals will be under the gun during the Biden administration to close that homeownership gap.

2. DOJ Ramps Up Anti-Redlining Effort

Ten months into the Biden administration, the DOJ launched the Combatting Redlining Initiative.

What they’re saying: Attorney General Merrick Garland explained the reason for his department’s ramped-up campaign to stop discrimination in home lending:

“When people are denied credit simply because of their race or national origin, their ability to share in our nation’s prosperity is all but eliminated. … We will spare no resource to ensure that federal fair lending laws are vigorously enforced and that financial institutions provide equal opportunity for every American to obtain credit.”

Sixteen months later, the DOJ had seven notches on its belt.

Days after the initiative was launched, DOJ settled with Tennessee’s Trustmark Bank over a complaint that it engaged in a pattern or practice of redlining in Memphis, Tennessee.

- Trustmark agreed to invest $3.85 million in a loan subsidy fund to increase credit opportunities for residents of predominantly Black and Hispanic neighborhoods in Memphis, Tennessee.

- Similar settlements were reached with Philadelphia-area lenders Trident Mortgage and ESSA Bank & Trust; New Jersey’s Lakeland Bank; City National Bank of Los Angeles; Park National Bank of Columbus, Ohio; and Evolve Bank & Trust, a technology financial services firm. In all, lenders have agreed to create funds totaling more than $77 million to help minority borrowers.

3. CFPB Takes Aim at Redlining. And Misfires?

Regulators aren’t batting 1.000% on redlining allegations.

The CFPB lost a high-profile case this spring against Townstone Financial, a nonbank home lender in Chicago.

The Trouble with Townstone

CFPB alleged that Townstone violated the Equal Credit Opportunity Act (ECOA) and its implementing regulation, Regulation B, because the lender:

- Drew almost no applications for properties in majority-Black neighborhoods.

- Engaged in discriminatory acts, particularly on its weekly radio show, that discouraged Black applicants from applying for loans.

- Discouraged prospective applicants in other areas from applying for mortgage loans for properties located in Black communities.

Why it matters: It is difficult to dispute the allegations, said attorney Robert Maddox of Bradley Arant Boult Cummings LLP, pointing out comments made by loan officers on the Townstone’s own radio show.

“They spoke of the Southside of Chicago as someplace you don’t slow down. A ‘war zone.’ … You can see it’s not too hard to say they’re not focused on growing African-American applicants.”

Yes, but: The U.S. District Court for the Northern District of Illinois still ruled in favor of Townstone.

The court ruled that a redlining claim may not be brought under the ECOA because the statute only applies to applicants, not prospective applicants.

Risky Appeal?

What’s next: CFPB is appealing to the U.S. Court of Appeals for the Seventh Circuit.

The bureau argues that, in interpreting ECOA, the court should consider language in Regulation B that stipulates a “creditor shall not make any oral or written statement, in advertising or otherwise, to applicants or prospective applicants that would discourage on a prohibited basis a reasonable person from making or pursuing an application.”

The big picture: CFPB might win the battle but lose the war, suggests Ballard Spahr attorney Richard J. Andreano, Jr. Even if CFPB comes out on top in the Court of Appeals, Townstone would likely appeal to the Supreme Court.

“If the [Supreme] Court agreed to hear the case, the CFPB would likely face an uphill battle given the Court’s conservative majority.”

4. So What’s a Lender to Do?

If lenders want to avoid redlining investigations, they should listen to the advice of some of the nation’s top fair lending lawyers, who warn of increasingly aggressive regulatory actions.

Why it matters: Redlining investigations are costly to lenders in time and money and the resulting negative publicity (even if the lender prevails) creates significant reputation risks.

Rule No. 1 is “Know thy peers,” suggests Tori Shinohara of Mayer Brown:

“The Office of Comptroller of the Currency … has taken the position that any statistically significant difference (between alender and its peers) in market penetration requires a corrective-action plan, which is a very strict interpretation because there’s no way that lenders can achieve full parity in every single market.”

To overcome that risk, Shinohara said regulators are telling lenders to create Special Purpose Credit Programs to “target certain areas based on otherwise prohibited characteristics.”

Rule No. 2 is “Be diligent in your marketing,” recommends Nanci Weissgold of Alston & Bird:

“You have to have diverse LOs (loan officers). You have to figure out where your branches are located. Really pay attention to marketing —and whether your materials could be viewed as discouraging certain borrowers or communities. And it’s not just company authorized marketing, but what your LOs or branches may be doing independently that aren’t getting subject to approval.”

Testing HMDA data can help lenders know how they are doing, said Weissgold, but that provides only a look backward in time. “Once you have (the testing results), now you have an obligation to do something.”

Rule No. 3 is “Don’t rely too much on technology,” warns Bradley’s Maddox.

Artificial Intelligence can be useful, “but like anything else, it’s garbage in, garbage out. And if a human being touches it, then it has an imperfection and … one way or another, it has bias.”

The challenge of using AI is compounded, said Maddox, because “ironically, there’s a strong bias by our regulatory community against AI.”

Maddox hopes government agencies and lenders can collaborate to develop AI systems to improve fair lending outcomes.

About Arch MI’s Capital Commentary

Capital Commentary newsletter reports on the public policy issues shaping the housing industry’s future. Each issue presents insights from a team led by Kirk Willison.

About Arch MI’s PolicyCast

PolicyCast — a video podcast series hosted by Kirk Willison — enables mortgage professionals to keep on top of the issues shaping the future of housing and the new policy initiatives under consideration in Washington, D.C., the state capitals and the financial markets.

Stay Updated

Sign up to receive notifications of new Arch MI PolicyCast videos and Capital Commentary newsletters.