We’re a month from spring, which traditionally kicks off homebuying season.

But mounting barriers are delaying or canceling the American dream of homeownership for growing numbers of prospective buyers.

In this issue, we look at prominent barriers.

We also ask for your opinion about pricing changes ordered by the Federal Housing Finance Agency (FHFA) on loans purchased by Fannie Mae and Freddie Mac.

Let’s get started.

1. Buying a Home Gets Harder, Part 1

Nov. 21, 2022

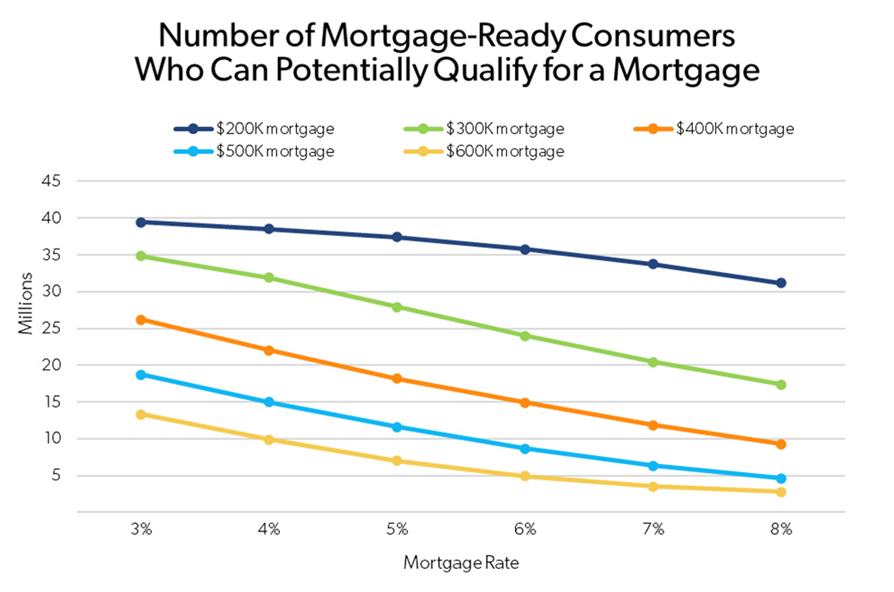

Back in the good old days (circa 2021) when interest rates hovered near 3%, Freddie Mac estimated that 35 million households were financially ready to take out a $300,000 mortgage to buy their first homes.

By the numbers: “Mortgage-ready” potential homebuyers, as defined by Freddie Mac, don’t have a mortgage and:

- Have a credit score of 661 or above.

- Have no foreclosures or bankruptcies in the past 84 months and have no severe delinquencies in the past 12 months.

- Are 45 years old or younger and have an estimated backend debt-to-income ratio of less than 25%.

Oh, how times … and interest rates … have changed.

Mortgage-ready no more: Given today’s 30-year, fixed-rate home loans of about 6%, the number of qualified borrowers for that $300,000 mortgage has fallen by half to 18 million.

- According to the National Association of Realtors®, the median sales price of an existing home in the U.S. was $366,900 as of December 2022.

Meanwhile, the Federal Reserve is expected to continue to raise interest rates until inflation is brought down to the targeted 2% per year range. And that’s fine with Bloomberg’s Conor Sen.

“In December, I anticipated that, given rising incomes and modest declines in home prices, 6% mortgage rates would stabilize the housing market. It turns out I was too optimistic. By the second half of the year, maybe 7% mortgage rates will be the level needed to keep the housing market from running away again.”

2. Buying a Home Gets Harder, Part 2

Feb. 6, 2023

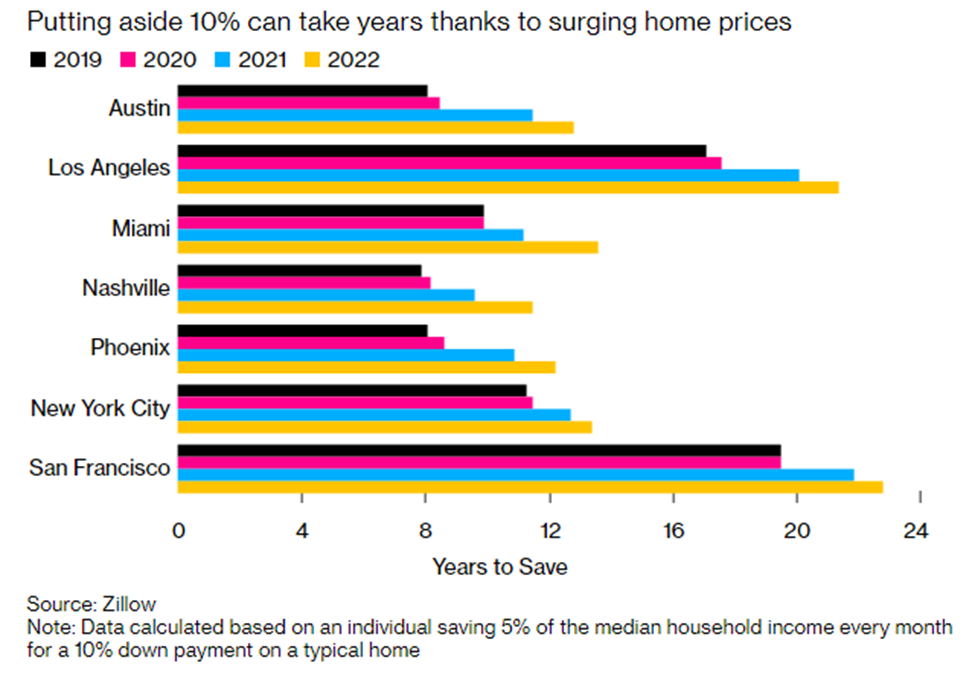

If interest rates weren’t enough of a barrier, it is taking increasingly longer to save enough money to make a 10% down payment across the country.

Why it matters: Want to buy a home in San Francisco, California? Zillow calculates it will take the average worker putting aside 5% of their paychecks every month for 23 years to save enough to make a 10% down payment for a house there.

The news isn’t much better in other expensive markets:

- Austin, Texas: 12.8 years.

- Nashville, Tennessee: 11.5 years.

- Phoenix, Arizona: 12.2 years.

The bottom line: Mortgage insurance (MI) will become more important than ever to home purchases, since most borrowers will still need it without at least a 20% down payment. That’s particularly true for first-time homebuyers, who comprise 60% of MI users.

- It now takes 12 years for the typical family to save 20% of the purchase price of a median-priced U.S. home, according to Arch Mortgage Insurance Company. That’s 50% longer than a year ago.

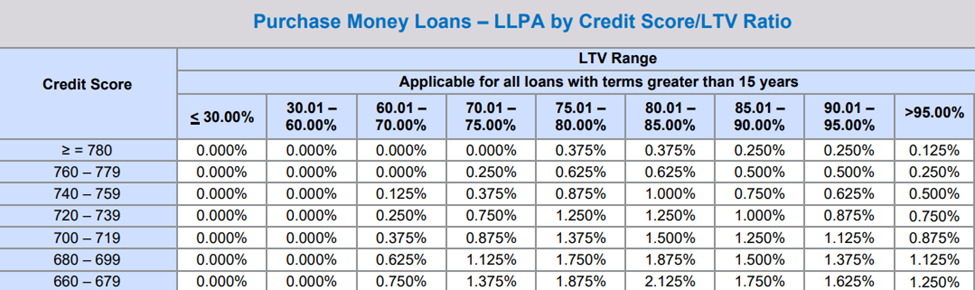

3. New Loan Pricing: Grid and Bear It?

Source: Fannie Mae

What’s new: With new pricing adjustments announced last month, FHFA took another step toward boosting GSE purchases of loans from low- and moderate-income borrowers.

Why it matters: Since taking office, FHFA Director Sandra Thompson has been steadfast in her commitment to boost homeownership opportunities for lower-income and minority families.

This follows FHFA’s October announcement that it was eliminating upfront mortgage fees for most lower-income, first-time homebuyers as well as for Fannie Mae’s Home Ready® and Freddie Mac’s Home Possible® loans.

“The pricing changes clearly ramp the cross-subsidization that serves as the GSE special sauce. If we look solely at the base grid for purchase loans … then we see that comparatively weaker credits — lower credit score and higher LTVs — will enjoy the largest fee reductions.” — Isaac Boltansky and Isabel Bandoroff, BTIG, LLC.

“But there are some losers, too,” reports HousingWire. “There are big increases in LLPA fees for most ‘cash-out’ loans, and investors will pay higher fees as well, per the new pricing matrix.”

- Borrowers whose debt-to-income ratio exceeds 40% will also face higher loan-level pricing adjustments (LLPAs).

What they’re saying: David Battany, Guild Mortgage’s Executive Vice President for Capital Markets, told National Mortgage News “[FHFA’s] intentions were definitely good,” adding that some of the new distinctions could be helpful to lenders and investors.

Yes, but: Others are expressing concern with certain aspects of the changes.

- The National Association of Realtors said, “In the wake of a three-percentage point increase in mortgage rates, now is not the time to raise fees on homebuyers.”

- The Mortgage Bankers Association (MBA) called on FHFA to raise the area median income threshold for the GSEs’ low-down-payment products “to expand eligibility for borrowers who can meet the monthly obligation of a mortgage payment but do not have significant savings to make a large down payment.”

- Dave Stevens, CEO of Mountain Lake Consulting, applauded FHFA’s efforts to expand minority homeownership in a recent Arch MI PolicyCast, but in a LinkedIn newsletter now contends the DTI cap is “the wrong way to get there.”

American Enterprise Institute Senior Fellow Edward J. Pinto argues it is a mistake to lower mortgage costs when the nation faces a housing supply shortage. Pinto told me a better alternative would be a government subsidy for a 20-year home loan that would build wealth faster without raising home prices.

4. Now It’s Your Turn: New LLPAs

Capital Commentary wants to know what you think of the new LLPAs announced by FHFA.

Which of the following best describes your views of the pricing changes announced by FHFA in January?

About Arch MI’s Capital Commentary

Capital Commentary newsletter reports on the public policy issues shaping the housing industry’s future. Each issue presents insights from a team led by Kirk Willison.

About Arch MI’s PolicyCast

PolicyCast — a video podcast series hosted by Kirk Willison — enables mortgage professionals to keep on top of the issues shaping the future of housing and the new policy initiatives under consideration in Washington, D.C., the state capitals and the financial markets.

Stay Updated

Sign up to receive notifications of new Arch MI PolicyCast videos and Capital Commentary newsletters.