In this issue of Capital Commentary, I’d like to invoke a procedure known as a “point of personal privilege.” In parliamentary terms, a point of personal privilege concerns a matter both “timely and urgent.” And, in my case, personal, too.

1. Vote Like Your Country Depends on It

More than once I have been asked how I developed my passion for political affairs.

Quick answer? It started at home.

Growing up the youngest of five children in Bakersfield, California, politics was a constant subject at the dinner table. If I wanted to join in the conversation, I quickly learned I needed to be able to discuss current affairs and political news.

And every four years, in addition to Little League baseball games which dominated my leisure time, summer days included watching with my family gavel-to-gavel coverage of the Democratic and Republican conventions – back in the day when the networks started coverage at 9 a.m. and ran till late in the evening.

But those events paled in comparison to the excitement of Election Day.

My mother was a precinct captain with the Kern County Elections Division, responsible for overseeing fair and honest elections.

She made it easy for herself: The precinct’s elections were held at our house.

Actually, in the living room of our small, one-story rambler.

Early in the morning of Election Day, my siblings and I would walk off 300 feet from our driveway and plant signs warning against “electioneering” any closer to the polling station.

Exactly at 7 a.m., my mother would lean out our front door and holler, “Hear Ye, Hear Ye! The polls are now open.” The neighbors, already lined up on the front stoop, would pour in to cast their ballots.

Our lone TV, a black-and-white Zenith, stood unplugged, like a silent sentry protecting voters from glimpsing last-minute campaign commercials that could sway their decisions.

After I returned home from school, I scurried to my bedroom to turn on my green transistor radio (usually reserved for baseball play-by-play) to tune to a network relaying voting results from the East Coast, three hours ahead of California. I cryptically shared news with my father and siblings, careful not to reveal any trends to my mother or voters still in line.

It was only after my mom proclaimed, “Hear Ye, Hear Ye! The polls are now closed,” that life would return to normal. The ballots were counted, collected and carefully carted to the county board of elections for safekeeping. The kids then took down the signs that had been planted in neighbors’ yards prohibiting politicking.

Unfortunately, I was never old enough to vote while living in that Bakersfield home. Yet the excitement and commitment to exercise that right, shaped in those early days, is as strong now as it was a half century ago.

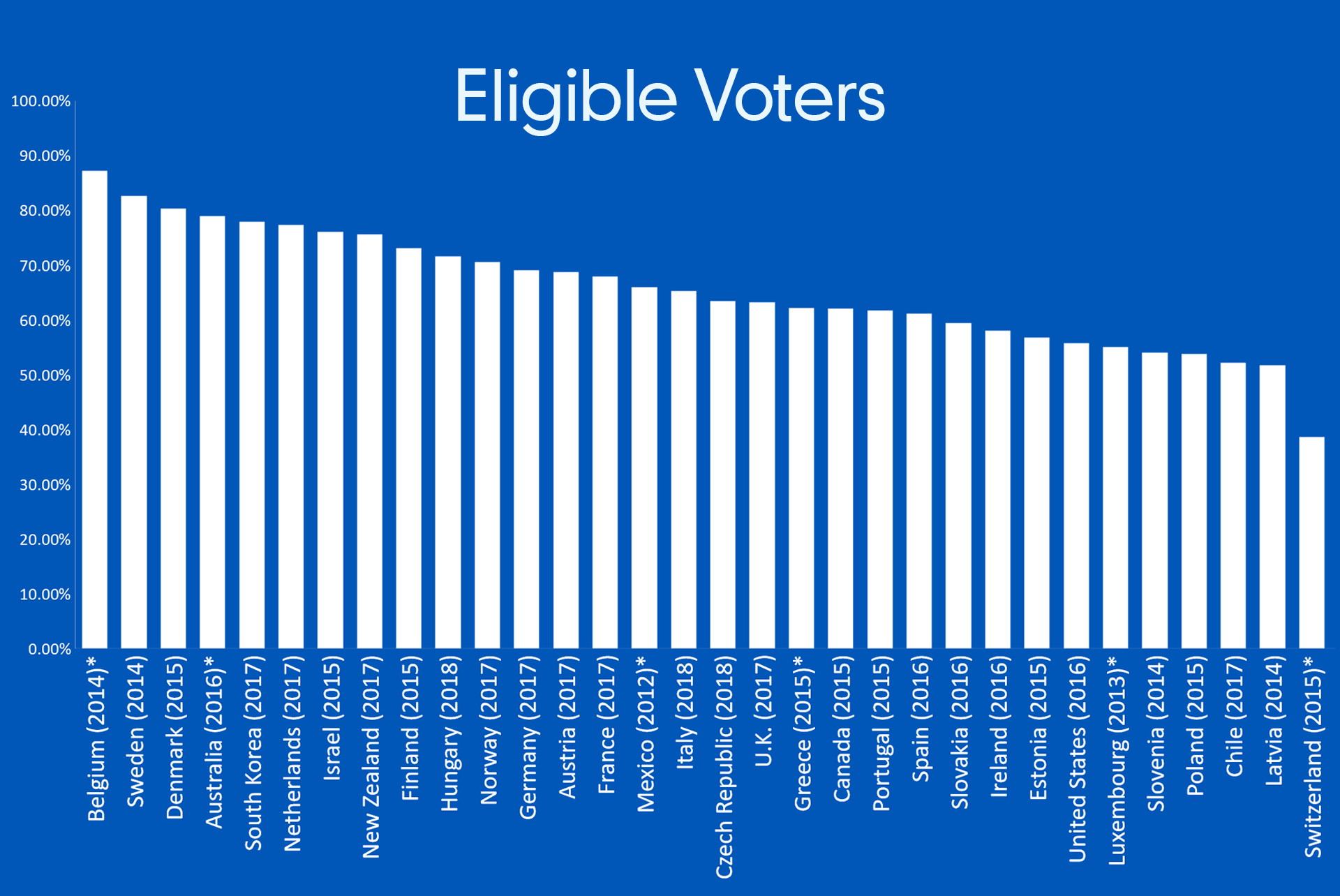

This year, Arch Capital Group joined more than 600 companies nationwide to provide employees time off to vote. It is an opportunity for us to help improve a disconcerting record of casting ballots: The U.S. (at 55.7%) ranks 26th among democratic nations in the percentage of eligible citizens voting, behind such nations as Belgium, Australia, Hungary, Mexico and Estonia, according to the Pew Research Center.

In this “timely and urgent” point of personal privilege, in my own way I am calling out, “Hear Ye, Hear Ye, the polls are now open.” My hope is each and every Capital Commentary reader will share both a sense of personal responsibility and passion to make their way to the ballot box, even if you have to go a bit further than your own living room to cast your vote.

2. Calabria Wants CRT to Continue at GSEs

There’s good news for fans of Credit Risk Transfer (CRT) – that’s the practice of Fannie Mae and Freddie Mac transferring a portion of their credit risk to private investors in order to protect taxpayers.

Their regulator will mandate CRT while the GSEs are in conservatorship.

That was the message from Mark Calabria, Director of the Federal Housing Finance Agency (FHFA), during a recent housing finance conference sponsored by MIT’s Golub Center for Finance and Policy. It is notable because FHFA recently issued proposed capital standards for the GSEs that significantly reduce the benefit of CRT. Arch MI has been among numerous companies, trade associations, consumer groups, think tanks and members of Congress that have encouraged the agency to provide more value for transferring credit risk.

Calabria called CRT “an important tool” and added, “as long as the GSEs are in conservatorship, and hence have not built up capital, we will be requiring them to do CRT.”

And after they exit conservatorship?

“I expect that even post-conservatorship … when they become fully capitalized … that they will still do some degree of CRT. I think it’s an important tool but … keep in mind that it’s functioned in a world where there wasn’t going to be an exit from conservatorships. It is necessarily going to be slightly different than in a world (in which) they do have capital.”

3. Want to Grow Homeownership? Address Income Inequality

The future of homeownership in the U.S. depends on addressing rising income inequality, concludes a new report from Barclays.

“Rising inequality exerts significant downward pressure on homeownership,” reports Barclays in its new study, “Housing Finance Reform: Addressing a Growing Divide.”

Barclays’ researchers found that the negative effects of income inequality on homeownership are disproportionately harmful to Black Americans:

“The negative effects … are 2.4 times higher in the states with the highest Black populations than in states with the lowest Black populations.”

GSE Affordable Housing Goals, however, significantly reduced the impact of income inequality, according to Barclays, noting its effect on homeownership fell as much as 60% after the U.S. Department of Housing and Urban Development imposed the goals on Fannie Mae and Freddie Mac in 1992:

“We conclude that these targets (and likely other efforts to improve access to mortgage financing for low-income borrowers) helped the U.S. maintain high home ownership despite rising income inequality.”

Barclays’ Global Head of Research considers it a matter of urgent concern given the continued interest in housing finance reform:

“As we consider options for reform now, amidst both a pandemic that is likely to further raise inequality, and a heightened awareness for racial and social justice reforms, we believe that low-income and minority populations face risks to homeownership through any reform of housing finance that cannot be ignored.”

4. California: Lift Homeownership by Prohibiting Bulk Home Auctions

Under a new law recently signed by Gov. Gavin Newsom, tenants, affordable housing groups and local governments will get the first opportunity to purchase foreclosed homes.

The goal is to prevent another occurrence of hundreds of thousands of foreclosed homes being converted into single-family rental by investors purchasing houses in bulk through auctions. Zillow estimates that, nationwide, five million single-family homes were converted from owner occupied to rental stock.

Between 2006 and 2012, the number of owner-occupied single-family homes in California dropped by 320,000, while the number of renter-occupied single-family homes jumped by 720,000, according to the legislation’s sponsor, State Sen. Nancy Skinner of Berkeley, California.

“It was expected that these houses would return to owner-occupied status once home prices recovered and the investors, largely big hedge funds, could realize a profit. Instead they have found ways to manage the geographically dispersed properties and continue to hold hundreds of thousands of them,” reports Mortgage News Daily.

Sen. Skinner was inspired by Moms 4 Housing, a community group that occupied a vacant house in Oakland late last year to call attention to the issue.

Income inequality and a shortage of homes are just two of the barriers facing minority households when trying to become homeowners. In the latest episode of the Arch MI PolicyCast, “Why the Deck is Stacked Against Minorities,” Alanna McCargo of the Urban Institute talks about an array of such obstacles. In an upcoming episode, Alanna will share potential solutions to these problems.

Do you think Capital Commentary offers valuable information on housing policy and its potential impacts? If you do, share your comments with us. Your feedback will help ensure Capital Commentary covers the stories that have the most impact on your business.

About Arch MI’s Capital Commentary

Capital Commentary newsletter reports on the public policy issues shaping the housing industry’s future. Each issue presents insights from a team led by Kirk Willison.

About Arch MI’s PolicyCast

PolicyCast — a video podcast series hosted by Kirk Willison — enables mortgage professionals to keep on top of the issues shaping the future of housing and the new policy initiatives under consideration in Washington, D.C., the state capitals and the financial markets.

Stay Updated

Sign up to receive notifications of new Arch MI PolicyCast videos and Capital Commentary newsletters.