Game Changer: The MI Tax Deduction Lowers Annual Housing Costs …

The mortgage industry just received a significant boost for borrowers with the passage of the One Big Beautiful Bill Act, which President Trump signed into law July 4, 2025. For mortgage loan officers, this legislation creates compelling new talking points and genuine value propositions for homebuyers, particularly those using conventional, FHA or VA loans with a down payment of less than 20%.

… and Now It’s Permanent

The tax code previously allowed qualified homeowners to deduct mortgage insurance (MI) premiums, but the provision expired after the 2021 tax year. Now it’s permanently restored for the 2026 tax year, covering:

- Private mortgage insurance (PMI) on conventional loans.

- FHA mortgage insurance premiums (both upfront and annual).

- VA funding fees.

- USDA guarantee fees.

During its previous existence, the MI deduction was claimed 44 million times, with 4 million homeowners claiming a combined $65 billion in deductions annually. The average benefit was substantial — qualified homeowners deducted an average of $2,364 in tax year 2021.

Share the News with Aspiring Homebuyers

It’s a great opportunity for mortgage loan officers to highlight this substantial tax benefit when talking to homebuyers. Guide your discussions using our Mortgage Insurance Tax Deductibility page, which includes an MI deductibility flyer, FAQs and application details for Arch MI products.

The timing is particularly important for borrowers who are “on the fence” — wondering whether they should wait and save for a larger down payment. With MI now permanently tax-deductible, the effective cost of low-down payment financing has decreased significantly, making homeownership more accessible and financially attractive. This legislative victory represents a meaningful win for both the industry and borrowers, providing MLOs with concrete evidence that low-down-payment loan programs offer genuine long-term value, beyond just helping clients purchase homes sooner.

Income Limits and Qualification Requirements

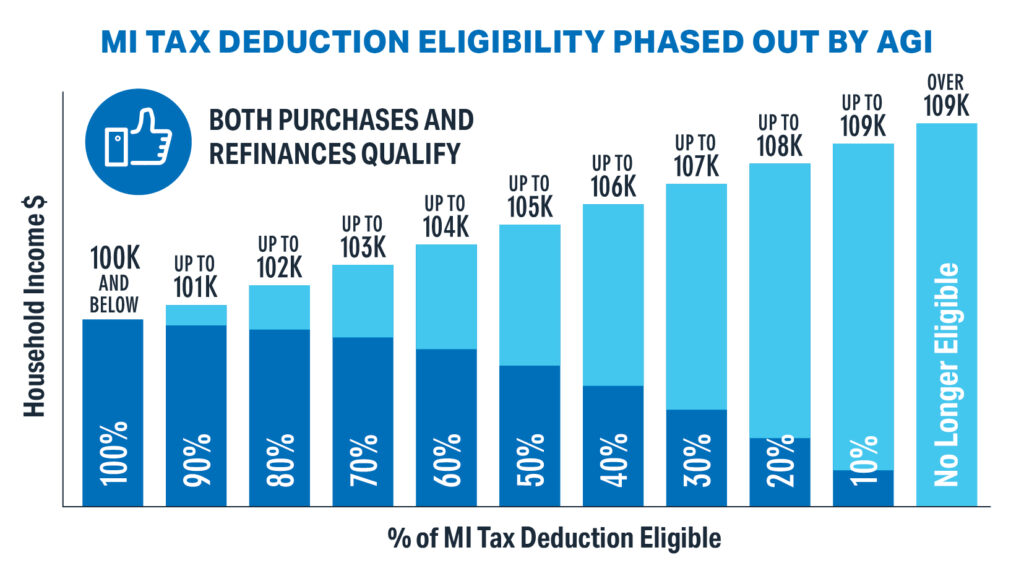

The deduction is available to borrowers with an adjusted gross income (AGI) below $100,000 ($50,000 for individuals), with benefits gradually phasing out for incomes in the $101,000–$109,000 range. This targets the deduction squarely at middle-class borrowers — exactly the demographic that benefits most from low down payment loan programs. Admittedly, the mortgage finance industry was defeated in its efforts to double the income limits to $200,000 for joint filers and $100,000 for individuals. Expect another run at that change in a future Congressional session.

Borrowers must itemize their tax returns to claim the deduction, which may encourage more clients to work with tax professionals and potentially discover additional tax savings opportunities.

Enhanced Value Proposition for Low-Down-Payment Loans

This development transforms how MLOs can position loans with MI. Rather than waiting years to save up large down payments, PMI allows homebuyers to begin building household wealth decades sooner, and now the tax deduction further reduces the effective cost.

In 2024, the MI industry helped more than 800,000 borrowers secure mortgage financing, with first-time homebuyers representing approximately 65% of purchasers with private MI, according to the industry trade group U.S. Mortgage Insurers (USMI). With the restored tax benefit, these loan products become even more attractive.

Mortgage Interest Deduction Also Secured

The legislation also makes permanent the current $750,000 mortgage interest deduction limit ($375,000 for single filers), which was set to expire after 2025. Without this action, the cap would have reverted to the previous $1 million limit, but the new law provides certainty for borrowers and eliminates this potential complication.

Beginning in tax year 2026, MI will be treated as deductible mortgage interest, streamlining the tax treatment and making it easier for borrowers to understand and claim.

SALT Deduction Boost Helps High-Tax State Borrowers

For clients in high-tax states, the legislation temporarily increases the state and local tax (SALT) deduction cap from $10,000 to $40,000 for tax years 2025–2029. This change could be especially impactful for homeowners in high-tax states like New York, New Jersey and California, where property taxes alone often exceed the previous cap.

Positioning This with Clients

MLOs should emphasize that this isn’t a temporary promotion; it’s a permanent change to the tax code. Originators can inform borrowers about permanent MI insurance deductibility for their low-down- payment clients.