There’s no silver bullet to solving the nation’s escalating affordable homeownership problems:

- Growing urban communities can’t add homes fast enough to meet demand.

- Declining rural communities often struggle to preserve and upgrade their existing housing stock.

- Many would-be homeowners can’t save enough for a down payment to buy their starter home.

The holistic approach: The Biden administration has a macro plan to improve housing supply and affordability. But global solutions can’t be applied everywhere.

What works in rural Wisconsin might not move the needle in metro Atlanta.

As former Speaker of the House Tip O’Neill once said of politics, all housing is local, too.

This Capital Commentary examines the Biden plan and then turns to efforts to focus on barriers and solutions at local levels.

1. Biden: Build, Preserve More Homes

The best way to solve housing affordability is to increase housing stock, concludes the Biden administration in a new comprehensive proposal.

The Housing Supply Action Plan aims to close the nation’s housing shortfall within five years.

Zoned for growth: One of the proposal’s features is to reward communities that have adopted land-use policies that are favorable to constructing new homes with higher scores to win federal grants.

New financing options: The plan seeks to overcome barriers to financing manufactured housing, alternative dwelling units (ADUs) and small multifamily units.

- Freddie Mac is studying how it might invest in securities backed by “chattel loans.” These are loans for manufactured homes, which can’t be titled real estate because the property is separate from the land it rests on.

- FHA and FHFA aim to increase financing for the construction of ADUs, including allowing lenders to consider potential ADU rental income when considering loan applications from borrowers purchasing homes.

Much of the President’s plan, including tax breaks for rehabilitating homes in economically struggling communities, is dependent upon the passage of the Build Back Better bill. As currently written, the bill’s passage is a long shot.

2. Rural Wisconsin: Fix the Economy

High inflation, soaring interest rates and supply chain shortages are ruining the dreams of hope-to-be middle-class homeowners in Wisconsin.

- Voice of the People: That was the message local housing industry officials delivered to U.S. Rep. Bryan Steil, R-Wisconsin, at a recent Arch MI Affordable Homeownership Roundtable.

- Arch MI called together representatives of Wisconsin banks, credit unions, real estate brokerages and home builders to advise Rep. Steil, a member of the House Financial Services Committee, on barriers in the region to homeownership.

Slip-sliding away: Right now, affordable homeownership is increasingly out of reach for Wisconsin’s middle class, said John Lyon, CEO of Southern Lakes Credit Union:

“If it’s a low- and moderate-income person, they’re feeling the pinch at the pump … (and) at the grocery store. And they’re really looking at it and making a choice to ask, ‘Is the home going to be affordable long-term?’ With everything else that’s happening for them, it’s going to be a challenge.”

Wisconsin home builder Arney Silvestri (foreground) explains to U.S. Rep. Bryan Steil (center) how labor and supply chain shortages are combining to slow new home construction and increase prices.

Where are the workers? Home builder Arney Silvestri of Silvestri Custom Homes told Steil that labor shortages make affordable construction impossible.

Rough framing in southern Wisconsin and northern Illinois that ordinarily costs $7–$8 per square foot now costs nearly $30, he said.

“There’s no one out there (to do the work), and there’s not a lot of options,” Silvestri told Steil.

Making better public policy choices: Steil welcomed the industry engagement, telling participants that their insights will help guide members of the House Financial Services Committee on “what policies we should be undertaking going forward.”

It is important that candidates for office “go out and talk with people. Let’s get the feedback. Then let’s put forward substantive (housing) policies that actually make sense,” Steil told the participants.

3. Atlanta: Growing Black Homeownership

High-cost housing doesn’t take a holiday. Neither did some federal, state and local government officials on the Juneteenth weekend in Atlanta. Instead, they spent June 20 at Atlanta Metropolitan College attending the first anniversary of the Black Homeownership Collaborative to address barriers to homeownership.

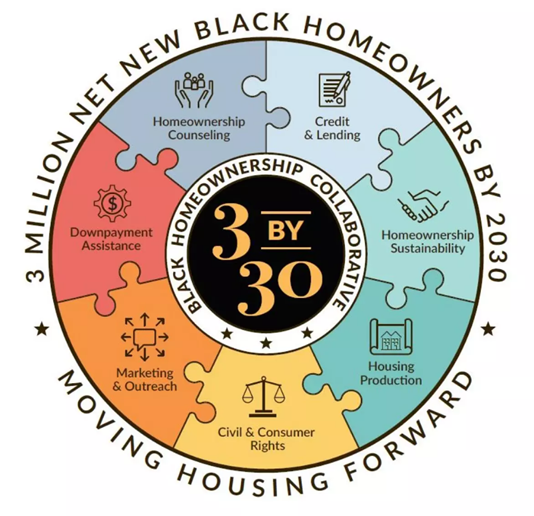

The Collaborative was formed in 2021 by nine national housing organizations with a goal of growing Black homeownership by three million households by 2030.

Ginnie Mae President Alanna McCargo lamented the fate of Black homeowners in Atlanta since the housing crash 15 years ago:

“(Atlanta) was the worst place” in the country when it came to losing Black homeownership, said McCargo, going from a majority of Blacks owning their homes to dropping 8 percentage points. “Atlanta Blacks are now majority renters.”

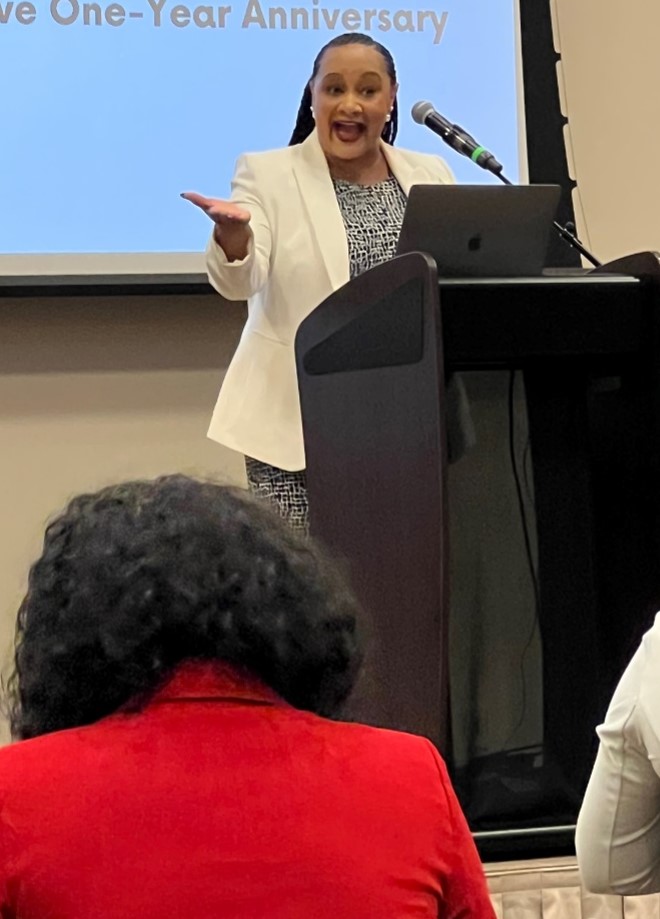

U.S. Rep. Nikema Williams, whose congressional district represents much of Atlanta, argued that Black homeownership won’t measurably increase until policymakers and lenders address unbanked, underbanked and credit-invisible communities.

“I know the struggles because I’ve lived there. There was a time when I didn’t have a bank account, and I lived paycheck to paycheck as a public-school teacher in Atlanta,” she told the assembly. “Each month, paying rent and bills was both challenging and a major accomplishment. I did everything I could with what I had, but much of my hard work was going to remain invisible. And of course, if your financial history is invisible, it’s pretty much impossible to obtain a mortgage.”

One present-day struggle Atlantans face is the rise of the cash buyer, largely investors purchasing single-family homes and converting them to rentals.

The Urban Institute calculated that in April, 43% of homes in Atlanta were purchased by cash buyers. Since the pandemic, about one-third of homes were paid for in cash, the highest share for any metropolitan community in the U.S.

“I know the struggles (of becoming a Black homeowner) because I’ve lived there,” said U.S. Rep. Nikema Williams, D-Ga.

4. Contest #25: Rapid Home Appreciation

It is no secret that home prices have kept climbing even as interest rates have soared. The same “Sand States” that suffered the greatest declines during the Great Recession of 2007–2009 are now leading the way in price growth.

Take the quiz: Which U.S. state had two cities among the nation’s top five in 12-month house-price appreciation, according to one prestigious survey (as of April 2022)?

Click this link to email your answer to enter a drawing for a Capital Commentary mug and saucer. Contest deadline: Midnight, Friday, July 29.

5. PolicyCast Interviews FHFA Director

Be sure to watch the next Arch MI PolicyCast video podcast featuring Sandra Thompson, Director of the Federal Housing Finance Agency, beginning July 25.

The podcast with Director Thompson (beginning Monday) and all previous episodes of the PolicyCast are archived here: mortgage.archgroup.com/mi-insights/policycast.

About Arch MI’s Capital Commentary

Capital Commentary newsletter reports on the public policy issues shaping the housing industry’s future. Each issue presents insights from a team led by Kirk Willison.

About Arch MI’s PolicyCast

PolicyCast — a video podcast series hosted by Kirk Willison — enables mortgage professionals to keep on top of the issues shaping the future of housing and the new policy initiatives under consideration in Washington, D.C., the state capitals and the financial markets.

Stay Updated

Sign up to receive notifications of new Arch MI PolicyCast videos and Capital Commentary newsletters.