Spring is in full bloom here in Washington.

That means blossoms and buses full of school-age kids filling the streets of the Nation’s Capital. Best of all, it brings the return of baseball season (and a chance for my Fightin’ Phillies to squeeze out two more wins this season to become 2023 World Champs).

Let’s play ball.

1. Big Thing: Will Climate Change Housing’s Future?

We are reminded of the personal costs and rising risks posed by a changing climate nearly every night on the news.

- Californians are learning all about atmospheric rivers and bomb cyclones after seasons of catastrophic wildfires.

- Mississippians are again recovering from a deadly tornado, the 354th twister to strike the state since 2020.

- Floridians along the Gulf Coast are still picking up the pieces from Hurricane Ian, a “once-in-a-generation” storm last fall.

Why it matters: Zeroing in on climate change’s long-term implications for housing is harder to assess but impossible to ignore. Government agencies, think tanks and Wall Street investors are now trying to put a price on risks and policies in place to account for a new reality.

- POLITICO wrote about it back in 2020 in a special report titled “How climate change could spark the next home mortgage disaster.”

- Within her first six months as Acting Director, Sandra Thompson of the Federal Housing Finance Agency ordered Fannie Mae, Freddie Mac and the Federal Home Loan Banks she supervises to consider the effects of climate change in their decision-making.

- The White House is now warning of the extraordinary costs facing the federal government, including the federal flood insurance program, Fannie Mae and Freddie Mac, if growing risks aren’t mitigated.

What they’re saying:

“The growing damage from hurricanes, storm surges and wildfires has implications for defaults, recoveries and other key cost drivers — and, by extension, for Federal loss exposure. There is evidence that private lenders are shifting climate-exposed loans into the GSEs, which may bear a substantial share of the increasing climate risk in the absence of policies that manage Federal exposure.”

— Economic Report of the President, March 2023.

Washington-based investor analyst Jaret Seiberg of TD Cowen predicts the report could throw another wrench into the debate over exiting the GSEs from conservatorship.

“This is injecting Fannie and Freddie into the broader political fight over climate change, which further complicates efforts to end the conservatorships and return the enterprises to shareholder control. It may mean any push to end the conservatorships will include a fight over their role in battling climate change.”

2. Higher Temps = Higher Home Costs

Lenders and investors aren’t the only ones that need to worry about rising temperatures. So do homeowners.

Why it matters: A new report from Rocket Mortgage warns that higher temperatures increase the carrying costs of owning a home.

What they’re saying:

“Higher temperatures mean more people using electricity for fans and air-conditioning, putting a strain on the electrical grid. Hot weather also means more water must be used to keep lawns and landscaping alive. Basic economics comes into play here: the higher the demand for electricity and water, the more the price will rise for these utilities.”

Quicken® notes that rising risks mean many homeowners will face higher insurance premiums for flood and homeowners insurance.

- In some states, private insurers have pulled out of markets.

- Homeowners are increasingly having to turn to their state’s Fair Access to Insurance Requirements (FAIR) plan to obtain needed coverage.

The bottom line: Housing prices are certain to reflect the higher risks and higher costs of a changing climate on homeownership. Every sector of housing needs to prepare for its impact or face dire consequences.

“At some point, it’s going to crystallize and everyone’s going to pull out” of homes facing climate risks, said Ed Golding, a former Freddie Mac executive who ran the Federal Housing Administration during the Obama administration. “It will be a crisis that will have to get everybody to react.”

— POLITICO.

3. Now It’s Your Turn: Smart or Not?

Property and casualty insurance premiums are one way of assessing a changing climate’s costs on homeownership.

- Recent storms pelting Gulf States and the frequency of wildfires in the far West might lead one to suspect that homeowners in those regions pay the most for homeowners’ insurance.

But according to PropertyCasualty360.com, it’s the residents of the heartland who bear that burden. Is there a common denominator in states with the highest average home insurance premiums?

Hail, yes!

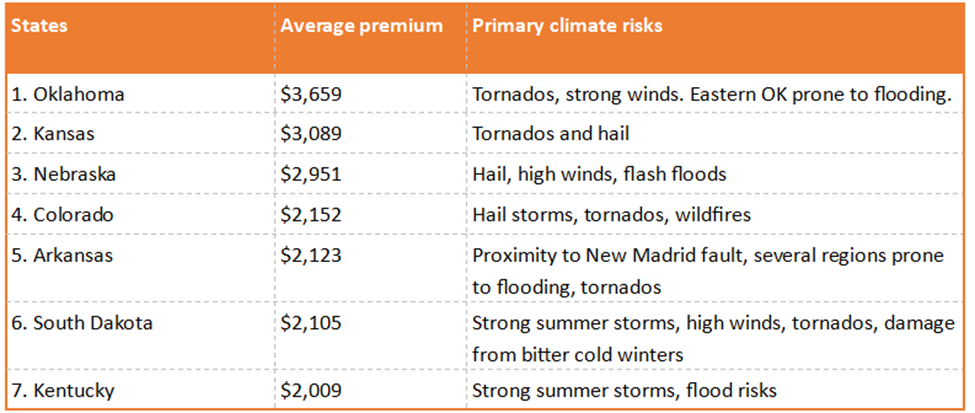

By the numbers: The top seven states where homeowners pay the most for homeowners’ insurance are:

4. Survey Says: Wrong to Lift FDIC Cap

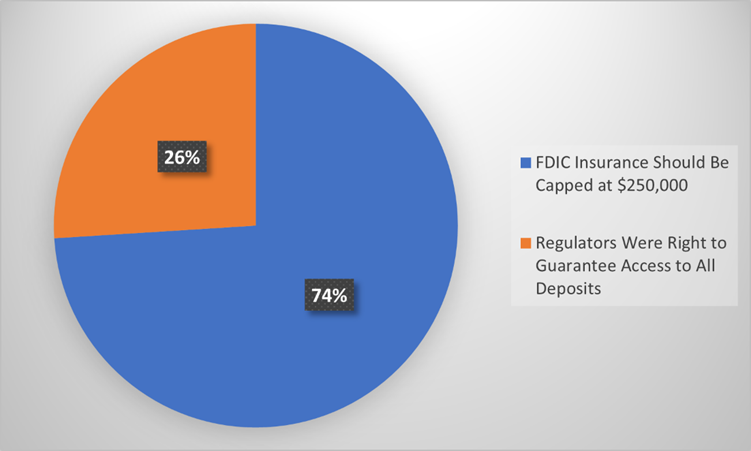

Our March 22 issue of the Capital Commentary asked whether bank regulators were right to guarantee all depositors of failed Silicon Valley Bank — or should the federal insurance cap of $250,000 per deposit have been retained.

There wasn’t much debate among readers. Three of every four readers responding wish regulators had kept the cap in place.

5. Well, Which Is It?

Ralph Waldo Emerson penned his famous line about “a foolish consistency” being the “hobgoblin of a feeble mind” more than 150 years ago.

- Still rings true today.

Here’s proof: Capital Commentary spotted these two headlines side-by-side on the Mortgage Bankers Association’s NewsLink for March 27:

“Work From Home Endures Despite Pushback from Bosses Like Dimon”

“Work-From-Home Era Ends for Millions of Americans”

The bottom line: Whether you work from home or are perusing this in your office, I am glad to have you as a reader of the Capital Commentary!

About Arch MI’s Capital Commentary

Capital Commentary newsletter reports on the public policy issues shaping the housing industry’s future. Each issue presents insights from a team led by Kirk Willison.

About Arch MI’s PolicyCast

PolicyCast — a video podcast series hosted by Kirk Willison — enables mortgage professionals to keep on top of the issues shaping the future of housing and the new policy initiatives under consideration in Washington, D.C., the state capitals and the financial markets.

Stay Updated

Sign up to receive notifications of new Arch MI PolicyCast videos and Capital Commentary newsletters.