Now the work begins for the 118th Congress.

What are the housing problems policymakers will confront over the next two years?

Who better to ask than leading housing trade groups and housing advocates? They shared their insights with Capital Commentary for our second issue of 2023.

1. Big Thing: Eyes on Affordability

Lowering the costs of building homes and financing mortgages will top their housing policy priorities, many advocates told Capital Commentary.

Why it matters: Housing shortages, soaring interest rates and increasing household formation combine to put the cost of buying or renting a home out of reach for millions of Americans.

- Median-priced, single-family homes and condos were less affordable in the fourth quarter of 2022 compared to historical averages in 99% of U.S. counties, according to real estate data firm Attom.

- Attom also reports that the portion of wages required to cover homeownership expenses now exceeds 32%. Housing is considered unaffordable when the ratio of wages to home expenses exceeds 30%.

What’s new: A recognition across the political spectrum that more needs to be done to address home affordability.

- The Trump administration issued its report on eliminating regulatory barriers to affordable housing two days before leaving office.

- The Biden administration issued its own Housing Supply Action Plan in 2022.

“Housing affordability continues to resonate for renters, owners and with members on both sides of the (political) aisle, creating potential for housing legislation focusing on boosting supplies. But it’s not likely to get far absent a clear signal from the White House that … (it) is willing to invest political capital in cutting a deal.”

— Jeb Mason, Partner, Mindset DC

2. Red-Tape Revolt

Decreasing red tape at all levels of government will increase much-needed new home production, contends the National Association of Home Builders (NAHB).

Why it matters: NAHB estimates regulatory costs add more than $90,000 to the price of a new home, making the construction of entry-level homes uneconomical.

- While pleading for red-tape rollbacks, NAHB says it is seeing new and costly regulations further burdening builders and buyers.

“In the zeal to move buildings to the newest (energy and structural) codes, the impact on affordability has been overlooked.”

— James Tobin, EVP, Government Affairs & Chief Lobbyist, NAHB

NAHB will assess the impact of regulatory costs on builders of the revised Waters of the United States (WOTUS) rule, the new infrastructure law and the Inflation Reduction Act. It will also be pressing Congress for more investments in a skilled workforce.

- There are more than 400,000 job openings in the construction trades, causing delays in building and hiking costs.

3. A Flood of Climate Issues

Climate change is the most significant emerging risk for the housing ecosystem.

Why it matters: The frequency and severity of natural disasters are soaring. Climate change is altering residential zoning, construction, lending and insuring practices.

- Between 1988 and 2022, the U.S. experienced an average of 7.9 weather and climate disasters, with damages exceeding $1 billion.

- Over the last three years, there were 60 such events, and annual losses averaged $144.9 billion. (Go deeper.)

Federal regulators and Congress are under pressure to take steps to measure climate change’s impact and mitigate disasters.

- The Securities and Exchange Commission (SEC) issued its Climate Disclosure Rule in 2022, requiring companies to report direct and indirect greenhouse gas emissions and inform the public whether climate risks have a material impact on business.

- The Federal Housing Finance Agency (FHFA) instructed Fannie Mae and Freddie Mac to conduct research to identify at-risk borrowers, properties and communities to inform policy and improve climate-resiliency efforts.

Pete Carroll, CoreLogic’s Executive for Public Policy and Industry Relations, placed climate change and flood mitigation at the top of his company’s policy agenda.

- Carroll is optimistic that Congress will finally enact a long-term National Flood Insurance Program (NFIP).

“We think this year represents a unique opportunity, given recent bipartisan energy on the topic, to advocate for changes … and get the NFIP program reauthorized for five to 10 years.”

— Pete Carroll, CoreLogic

4. Don’t Flub Access to FHLBs

Could worsening economic conditions lock out community banks from accessing Federal Home Loan Bank (FHLB) advances? The Independent Community Bankers of America (ICBA) is determined not to let that happen.

Why it matters: FHLB advances serve as a funding source for various mortgage products, including those focused on very low- and low-to-moderate-income households.

- FHFA capital rules prevent FHLBs from making advances to member banks with negative tangible capital.

- Rising interest rates threaten to cause community bank investment portfolios comprising U.S. Treasury securities, Agency Mortgage-Backed Securities (MBS) and municipal bonds to experience mark-to-market losses that temporarily affect their tangible capital levels.

“It is critical that FHFA and other regulators collaborate to ensure that community banks that are otherwise deemed safe and sound continue to have access to the liquidity the FHLB advances provide.”

— Tim Roy, AVP, Housing Finance Policy, ICBA

5. Survey Says: ‘24 CLL Will Be Stable

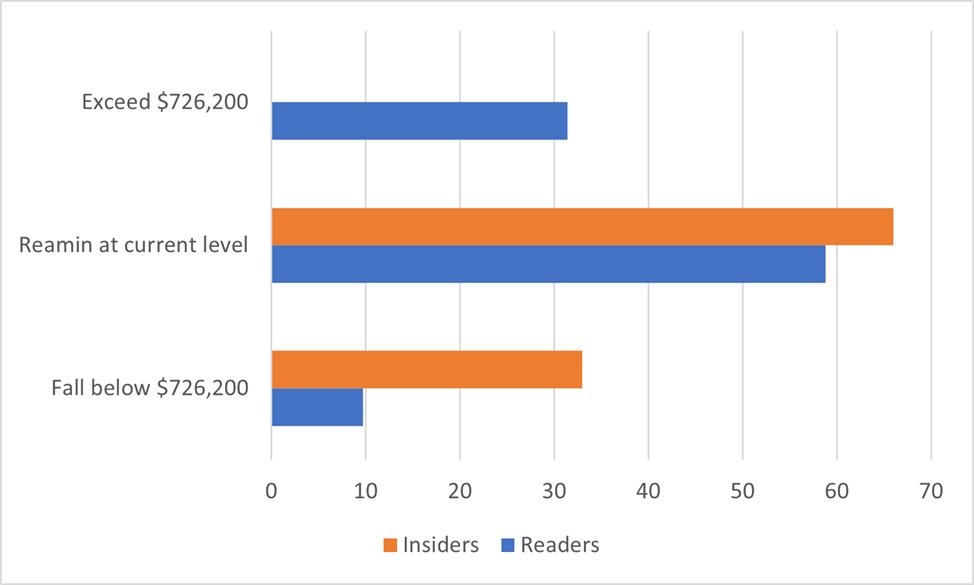

In our first Capital Commentary survey, we asked you to predict whether the Conforming Loan Limits on 1-unit properties would go up, down or stay the same.

- How did your answers compare to those of housing insiders?

By the numbers: Most housing insiders and Capital Commentary readers expect 2024 Conforming Loan Limits for 1-unit properties to remain stable at $726,200, even if home prices drop nationwide this year.

6. Next Up on the PolicyCast Podcast

The big picture: Dave Stevens will kick off the 2023 Arch MI PolicyCast video podcast series with his advice on how mortgage lending executives can best prepare for an uncertain future. Dave is the Mortgage Bankers Association’s former CEO and has served as Assistant Secretary for Housing and Federal Housing Commissioner.

- We will update you as soon as Episode 1 is available.

- Go deeper: You can watch all previous episodes of our video podcast series here.

About Arch MI’s Capital Commentary

Capital Commentary newsletter reports on the public policy issues shaping the housing industry’s future. Each issue presents insights from a team led by Kirk Willison.

About Arch MI’s PolicyCast

PolicyCast — a video podcast series hosted by Kirk Willison — enables mortgage professionals to keep on top of the issues shaping the future of housing and the new policy initiatives under consideration in Washington, D.C., the state capitals and the financial markets.

Stay Updated

Sign up to receive notifications of new Arch MI PolicyCast videos and Capital Commentary newsletters.