The manufactured housing (MH) industry bills its product as “the most affordable homeownership option in the market today and the largest form of unsubsidized affordable housing in the country.”

But as housing affordability sinks to record lows, sales of manufactured homes are falling, too.

Can the trend be reversed? Following up on our recent edition on modular homes, Capital Commentary explores the other half of factory-built shelter — manufactured housing. And we end with a note from Germany about the success of modular housing overseas.

1. Big Thing: MH by the Numbers

Seventeen million Americans live in manufactured homes, according to the Manufactured Housing Institute (MHI), the industry’s trade group. So-called HUD-code homes (which meet U.S. Department of Housing and Urban Development design and fabrication standards) represent 6% of the country’s housing supply.

Yes, but: Despite soaring housing costs nationwide, MH’s share of the nation’s housing production is far below its 20% average from the mid-1970s to 1990.

By the numbers (according to MHI):

- The average cost of a new manufactured home in 2023 was $124,300 (not including land) compared to a new site-built home’s price of $514,000 (house and land sold as a package).

- The price per square foot for a new manufactured home is half that of a site-built home ($86.62 vs. $165.94).

- After reaching a recent peak of 113,000 MH shipments in 2022, sales plunged 21% in 2023 to 89,000 units.

Why it matters: An ever-increasing share of Americans pay more than 30% of their income for shelter — the threshold for “unaffordable housing.” These consumers are the MH industry’s prime market.

The typical MH buyer earns $61,000, demonstrating the product’s affordability for low- and middle-income families.

What they’re saying:

“During the homeownership boom of the 1990s, manufactured housing was a critically important point of entry for low-income households. A 2001 analysis of the gains in ownership among low-income households during that period identified manufactured housing as a particularly important pathway into homeownership, accounting for more than a quarter of all low-income homebuyers in 1997. But not long after the period studied, the manufactured housing industry suffered a significant downturn from which it has yet to fully recover.”

Joint Center for Housing Studies of Harvard University

The bottom line: MH’s potential to serve the affordable market is clear. On the other hand, it is also clear that MH is not living up to its potential.

2. Not Your Grandfather’s Mobile Home

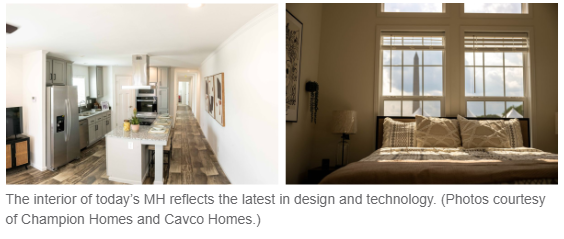

Modern manufactured homes have shed their outdated image with cutting-edge features that rival traditional houses.

- Single-section homes are a minority of factory-built production.

- Even duplexes are growing in popularity.

Why it matters: These innovations are making manufactured homes an increasingly attractive option that is well-suited for more neighborhoods as in-fill or new developments.

The big picture: Over the past two decades, manufactured homes have undergone a dramatic transformation, incorporating advanced technology, improved design and enhanced durability.

Key innovations include:

- Energy efficiency: Superior insulation, ENERGY STAR®-rated appliances and “Smart HVAC systems” for reduced utility costs. Some models incorporate solar panels and battery storage.

- Technology integration: “Smart home systems” for controlling lighting, temperature and security.

- Design flexibility: Open floor plans and vaulted ceilings; customizable exterior facades and high-end interior finishes like granite countertops and hardwood floors.

The bottom line: These advancements are blurring the lines between factory-built and site-built housing, offering homebuyers a compelling mix of quality, affordability and modern features.

3. Why Manufactured Housing Faces Steep Challenges

In his provocatively titled white-paper series (“Manufactured Housing is a Good Source of Unsubsidized Housing … Except When It’s Not”), Donald H. Layton of New York University’s Furman Center explains why MH is not meeting its strongest supporters’ expectations.

Reason No. 1: 40% to 50% of manufactured homes’ owners don’t own the land beneath their houses. They rent the land from someone else.

As Layton explains, land is generally considered a long-term appreciating asset, while a structure is generally considered a long-term depreciating asset.

“Such a situation is rare outside of MH and … it has very significant policy implications. Specifically, it results in those MH residents having a hybrid status, existing somewhere between traditional owner-occupants and traditional renters,” exposing them “to the grave instability of forced removal.”

Don Layton, NYU Furman Center

Reason No. 2: Financing for MH is more expensive than site-built homes. MH-structure-only loans have much higher interest rates and less attractive terms than traditional mortgages. Layton notes there are “three proper reasons” for the disparity:

- The credit risk for structure-only (aka “chattel”) loans is higher since, by definition, only the depreciating structure can serve as collateral.

- The typical structure-only borrower has significantly lower income than the typical mortgage loan borrower, and the structure-only loan has significantly increased credit risk.

- Neither Fannie Mae nor Freddie Mac purchases chattel loans. Instead, financial institutions originate higher-cost personal loans for these homes.

Reason No. 3: MH is ideally suited for low-density areas such as rural locations, where site-built developments are cost-burdened.

MH isn’t as well suited for urban areas, writes Layton.

“Working-class families are unlikely to use their limited funds to purchase high-cost land and then put on it a low-cost MH structure to live in.”

4. Will There Be an MH Renaissance?

Tom Heinemann sees a brighter future for manufactured housing encapsulated in a 239-unit development in Western Maryland.

Heinemann, an industry consultant, joined Next Step Network, a nonprofit housing organization focused on factory-built homes, to launch Kilpatrick Woods this past May in Hagerstown, a largely rural city of 43,000 people.

All 239 units will be MH, but the lots and homes will be titled together as real property, just like a single-family, site-built community.

- The homes target borrowers earning between 80% and 120% of the average median income.

- The units meet all requirements to qualify for conventional financing from the GSEs.

Are Fannie and Freddie supportive of Heinemann’s efforts?

“Oh, absolutely. They sponsored our big (opening) events. Both of them were instrumental in helping us identify construction financing. When we’ve run into issues with potential lenders, their teams have been very helpful.”

Tom Heinemann, Principal, MH Advisors, LLC

Yes, but: MH advocates are excited about the promise of Kilpatrick Woods but insist the GSEs need to do more under their Duty to Serve (DTS) responsibilities.

During a recent Federal Housing Finance Agency listening session concerning the GSEs’ DTS plans for the next three years, MHI CEO Lesli Gooch called for several changes at Fannie and Freddie, including:

- Eliminating a 50 bps loan-level pricing fee on MH loans purchased by the GSEs.

- Permitting the purchase of single-section cross-mod homes, which offer features associated with site-built homes such as roofs with an elevated pitch, covered porches and permanent foundations. GSE purchases are now limited to multi-section homes.

- Begin purchasing personal property loans backed by MH. Gooch said the passage of the Housing and Economic Recovery Act (HERA) of 2008 required the GSEs to consider buying personal property loans as part of their Duty to Serve requirements, but “neither GSE has (bought) a single personal property loan since HERA was adopted 16 years ago.”

The bottom line: The GSEs are unlikely to start purchasing personal property loans, at least while in conservatorship.

If the industry is to significantly increase its contribution to solving housing shortages, developments like Kilpatrick Woods will need to become the norm.

Heinemann is at work on similar efforts in two Virginia cities, Petersburg and Harrisonburg.

5. Modular Housing: Postscript

Capital Commentary is making waves across the globe!

Our recent issue on modular housing caught the eye of Dr. Ansgar West, the Global Head of Financial and Entrepreneurial Risks at Munich Re, the world’s largest reinsurance company.

Why it matters: Munich Re isn’t just any player; they’re a major investor in mortgage risk, including credit risk transfers at Fannie Mae and Freddie Mac. They’re laser-focused on the U.S. housing shortage — something that’s got this mammoth reinsurer’s full attention.

What they’re saying:

“As you rightly pointed out, in other countries this is not ‘fantasy’ but reality,” West wrote. “In Germany, ‘modular housing’ is pretty popular (especially for mid-income families) and is called ‘Fertighaus’ (translated to English, a pre-fabricated home).”

By the numbers:

- One recent study pegged the market share of Fertighaus at a staggering 23% in 2023.

- The pre-fab market is skyrocketing, growing twice the overall new residential construction rate.

West’s insights continued:

“You can design your own house (either detached single family, semi-detached or even multifamily). So, it is not really ‘mass production’ of the same design but an industrial production of something very modular with a lot of options. This modularity has also elevated Fertighaus from the ‘cheap’ or ‘only for lower-class’ category.”

What’s next: German construction firms are revolutionizing the old with cutting-edge modular techniques:

“Germany is utilizing prefabrication to renovate outdated apartments and achieve net zero targets. One of the German factories is employing robots to assemble panels and mold them to fit precisely over the walls of an old apartment building. These panels come with built-in insulation, drastically cutting down energy usage.”

Our perspective: Modular housing should be pivotal in addressing the U.S. housing shortage. The notion of American exceptionalism does not encompass advancements in housing. Industry leaders in Europe offer valuable insights into reducing housing costs while maintaining diverse and stylish design options.

About Arch MI’s Capital Commentary

Capital Commentary newsletter reports on the public policy issues shaping the housing industry’s future. Each issue presents insights from a team led by Kirk Willison.

About Arch MI’s PolicyCast

PolicyCast — a video podcast series hosted by Kirk Willison — enables mortgage professionals to keep on top of the issues shaping the future of housing and the new policy initiatives under consideration in Washington, D.C., the state capitals and the financial markets.

Stay Updated

Sign up to receive notifications of new Arch MI PolicyCast videos and Capital Commentary newsletters.