1,478 words. Five-minute read. See item #5 for Capital Commentary Contest.

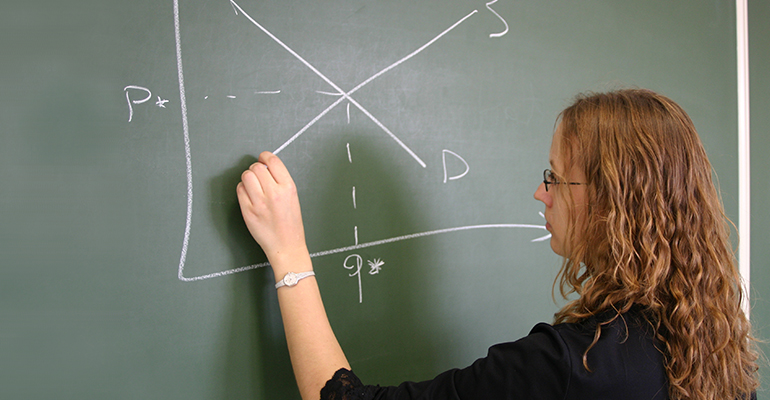

The law of supply and demand can be boiled down to this: As supply increases, prices tend to drop. When supply falls, prices increase. The economy reaches equilibrium when supply and demand are in balance.

That’s the theory. It usually works when a product can be manufactured easily and then be shipped to consumers quickly. Then there is housing, where theory runs headlong into reality. Today, demand for affordable shelter and homeownership far outpaces supply but the manufacturing process can’t add housing stock fast enough or in all the right places to reach true equilibrium. What should policymakers do?

1. More Homes, Please

Start with increasing the stock of homes, including both multifamily rental units and single-family homes for sale.

There is bipartisan agreement that America needs more homes. That, alone, is a bit of a minor miracle in these days of partisan rancor.

- The Trump administration, during its last week in office, published a report on ways to eliminate regulatory barriers to affordable housing.

- The Biden administration aims to both improve existing housing stock and build new housing, particularly for low- and very-low-income renters.

One of the largest obstacles to building new affordable housing, or housing period, is the web of exclusionary restrictions and stringent requirements that add up to onerous burdens on new housing development. When cities require large lawns and ample parking, they drive up the price of new homes. When they zone for single-family housing and ban two-, three- or four-unit homes, they drive up the price of housing. And when cities force builders to go through a byzantine approval process for any new development, they raise the price of housing.

–Jamelle Bouie, New York Times, “Where Are the Least Fortunate Americans Supposed to Live?”

Why it matters: It is an important start toward a solution. It will take a working coalition of Democrats and Republicans in cities, states and Congress to agree to provide more funding and lessen regulations to spur the production of more homes.

2. Housing Is Infrastructure. Or Is It?

Here is where bipartisanship loses the “bi.”

As part of its American Jobs Plan, the Biden administration proposes spending about $2.65 trillion over the next eight years to upgrade and rebuild America’s infrastructure. A little under 10%, or $213 billion, is targeted to produce, preserve and retrofit more than two million affordable housing units. The package includes:

- $40 billion to address the backlog of public housing capital needs (currently estimated at $70 billion by the Public Housing Authorities Directors Association).

- Targeted tax credits, grants and project-based rental assistance for low-income rental units.

- Competitive grants funding to jurisdictions to take steps to eliminate exclusionary zoning and restrictive land-use policies.

Housing industry groups generally welcomed the Biden plan.

- The National Association of Home Builders said, “With the nation facing a housing affordability crisis, the plan recognizes the urgent need to build more affordable housing and retrofit existing homes to increase energy efficiency.” However, the trade group expressed reservations about “troubling” labor and tax provisions in the proposal.

- The National Association of Realtors added, “While a lack of inventory and rising prices continue to limit opportunities for homeownership — especially for younger Americans and minority populations — policies that support nationwide housing affordability are now more important than ever.”

In mid-April, House Financial Services Chair Rep. Maxine Waters (D-CA) held a hearing entitled “Build Back Better: Investing in Equitable and Affordable Housing Infrastructure.” The hearing covered 17 bills, the first of which — the “Housing Is Infrastructure Act” — was introduced by Waters herself.

- High rents cut into future mortgage lending, too. Rent first, own later: That’s the common American progression to homeownership but the staff-authored memo in advance of the Financial Services Committee hearing noted that, “Lack of affordability in the rental market makes it harder for renter households to save enough money to transition to homeownership.”

- Those are future customers lost to mortgage lenders.

Republicans prefer a smaller package. GOP members of the Senate intend to counter Biden with a $568 billion infrastructure package focused on roads and bridges, broadband, public transit, airports and water systems.

- It includes no dollars for improving or building new housing.

It is anyone’s guess as to what the ultimate bill will contain. Democrats could choose to compromise with Republicans on a smaller, standalone infrastructure package, then use the reconciliation process (without GOP support) to add both projects and money for infrastructure purposes.

- It is no sure thing that billions of dollars for housing will make it all the way to President Joe Biden’s desk for his signature.

3. Boosting Housing Demand Cautiously

Many Capital Commentary readers will recall the Biden campaign’s proposal to provide up to $15,000 in tax credits to be used for down payments on home purchases.

- A broadly structured tax credit for many appears to have wisely fallen victim to economists’ concerns about the dangers of further increasing demand for homes where too few homes are for sale.

Instead, measures are being proposed to narrow beneficiaries of government assistance to first-generation homebuyers.

- We reviewed one such idea — to buy down the interest rate on a 20-year fixed rate mortgage so that the monthly loan payment was equivalent to a 30-year FRM — in a previous edition of Capital Commentary.

- A new proposal, the Downpayment Toward Equity Act, could provide first-generation home buyers a grant of up to $20,000, to be used toward down payment or closing cost assistance and interest-rate buydowns. The benefit would be further restricted to borrowers earning no more than 120% of an area’s median income (slightly higher for high-cost areas).

The Urban Institute estimates that more than 2.5 million people could benefit from the first-generation grant.

- “Renters say that coming up with enough savings for a down payment and closing costs is the biggest obstacle they face to buy a home,” wrote Urban Institute’s Jung Hyun Choi and Janneke Ratcliffe. “First generation buyers … often take on greater debt to do so or delay homeownership for years, making it difficult for homeowners of color to build wealth at the same pace as white homeowners.” Down payment assistance, they say, can break that cycle.

HUD Secretary Marcia Fudge delivered a demand-tamping decision when she announced FHA would not cut its premiums any time soon. Fudge indicated there is too much uncertainty about the health of the FHA’s Mutual Mortgage Insurance Fund, given the large number of borrowers still under forbearance programs.

- Fudge’s decision took some industry and investor analysts by surprise as they had anticipated a 25 basis-points cut in premiums early in the Biden administration.

- The Mortgage Bankers Association and the Housing Policy Council, however, lauded her announcement.

And, in another rare act of bipartisanship, three former leaders at HUD during the Trump administration, Brian Montgomery, Keith Becker and Michael Marshall, wrote an op-ed endorsing Secretary’s Fudge’s choice. Montgomery is the only person in history to serve as FHA Commissioner in two different administrations.

But not everyone is convinced the administration can avoid boosting demand and further driving up prices.

- “It seems … Team Biden is not fully committed to boosting supply,” wrote Jaret Seiberg of Cowen Washington Research. He noted that at a recent Congressional hearing, Secretary Fudge said she could not support using funding threats to force local governments to relax zoning rules to build affordable housing.

- “To us, the problem is one builds bubbles when you use government policy to boost demand when there is not already an excess of supply,” Seiberg wrote.

4. PolicyCast: Builders Face ‘LLLL’ of a Test

PolicyCast: Daunting Barriers to Growing Homeownership

Homebuilders face the quadruple challenge of land, labor, lumber and loan barriers in their effort to add to the nation’s housing stock. On the latest Arch Mortgage Insurance PolicyCast, I chatted with Jerry Howard, Chief Executive Officer of the National Association of Home Builders to learn how the industry is adapting to new realities. To watch our conversation, click the graphic.

5. Contest #7: Who Are Those Guys?

One of Howard’s great laments, he told me on PolicyCast, is that the Congress has not enacted a comprehensive evaluation of the nation’s housing policy since 1990 with the passage of the Cranston-Gonzalez National Affordable Housing Act. He says his top priority is to persuade Congress to begin a “holistic reevaluation” of housing, “containing everything from an examination of all the HUD programs to Fannie and Freddie reform to banking reform to whether or not the mortgage insurance deduction is a good expenditure of American tax dollars.”

Take the Quiz: What made Cranston and Gonzalez worthy of having their name on the Act and which states did they represent in Congress?

Email your answers by midnight, May 4, to [email protected] to be entered into a drawing for the prized Capital Commentary/PolicyCast mug and saucer pictured below.

Do you think Capital Commentary offers valuable information on housing policy and its potential impacts? If you do, share your comments with us. Your feedback will help ensure Capital Commentary covers the stories that have the most impact on your business.

About Arch MI’s Capital Commentary

Capital Commentary newsletter reports on the public policy issues shaping the housing industry’s future. Each issue presents insights from a team led by Kirk Willison.

About Arch MI’s PolicyCast

PolicyCast — a video podcast series hosted by Kirk Willison — enables mortgage professionals to keep on top of the issues shaping the future of housing and the new policy initiatives under consideration in Washington, D.C., the state capitals and the financial markets.

Stay Updated

Sign up to receive notifications of new Arch MI PolicyCast videos and Capital Commentary newsletters.