Welcome to Year Five of Capital Commentary!

Situational awareness: What began as a newsletter to a few hundred Arch MI employees now reaches more than 150,000 mortgage professionals, trade and housing group executives and policymakers at various levels.

Reader feedback: Continuous input on problems, people and policies impacting housing’s present and future helps shape and improve Capital Commentary. Keep those comments coming!

Let’s dive into the first newsletter of 2025!

1. Big Question: After the Fires, What Now?

The recent Los Angeles fires are a stark reminder that Mother Nature’s power cannot be ignored.

Why it matters: Natural disasters are exacerbating challenges in a housing market already strained by shortages, rising interest rates and skyrocketing insurance premiums.

By the numbers:

- CoreLogic® reports the Eaton and Pacific Palisades fires in Southern California could cost between $35 billion and $45 billion, damaging over 17,000 structures with average insured losses nearing $1.9 million per structure.

- Zillow values the average home in the Pacific Palisades ZIP code at $3.4 million; in Altadena’s ZIP code, it’s $1.3 million.

- Hurricanes Helene and Milton, which hit the Southeast in late 2024, accounted for damages exceeding $100 billion, according to the National Oceanic and Atmospheric Administration.

What they’re saying:

“Rents will increase, especially near the epicenter of massive fires around Pacific Palisades and Altadena. Those planning to rebuild their homes will face intense competition for contractors. And impacts on wavering home insurance markets could lead to greater costs for all Angelenos.”— Liam Dillon, Los Angeles Times

Yes, but: Los Angeles Mayor Karen Bass issued an executive order to speed the rebuilding of homes and minimize dislocation of residents. It will:

- Create a toxic debris removal plan, which is essential before rebuilding can start;

- Instruct city departments to review building plans concurrently and complete them within 30 days of submission; and

- Permit homeowners to set up recreational vehicles, tiny homes or other temporary residences to remain on their land for up to three years.

Rebuilding woes: Bloomberg notes that property owners seeking to rebuild will be hampered by higher material costs and new insurance and property tax burdens.

- And labor will be in short supply. Tens of thousands of construction workers are committed to building facilities for the 2028 Los Angeles Olympics, leaving fewer to rebuild homes.

The bottom line: Returning to normalcy, of course, is a welcomed state. The bigger question, however, is whether homes should be rebuilt in areas so at risk for disasters.is whether homes should be rebuilt in areas so at risk for disasters.

Survey: Are You in Good Hands?

2. The Year(s) of Living Dangerously

Are we our own worst enemy when it comes to heightening the risks of hurricanes, tornados and wildfires?

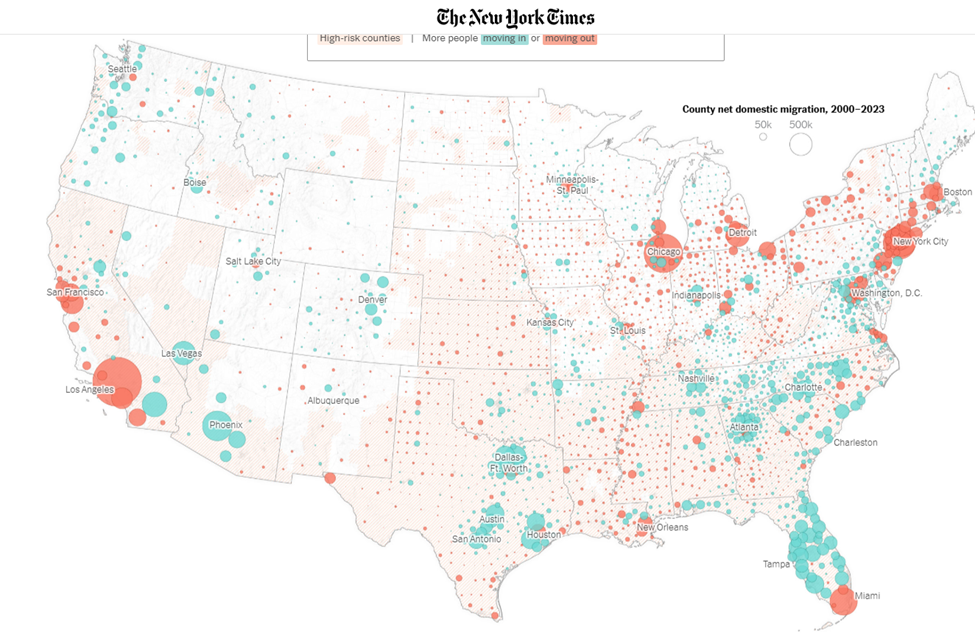

Data from the U.S. Census Bureau and CoreLogic show Americans are increasingly calling the moving vans and relocating to areas of the country with a propensity for destructive storms, fires and heat waves.

What they’re saying: The New York Times wrote,

“Florida, which regularly gets raked by Atlantic hurricanes, gained millions of new residents between 2000 and 2023.

“Phoenix has been one of the country’s fastest-growing large cities for years. It’s also one of the hottest, registering 100 straight days with temperatures above 100 degrees Fahrenheit (in 2024).

“The fire-prone foothills of California’s Sierra Nevada have seen an influx of people even as wildfires in the region become more frequent and severe.”

The race to warm-weather locations parallels the emerging homeowners’ insurance crisis facing much of the country. Residents of Florida, Texas, Louisiana and California confront soaring insurance rates and fewer providers of property and casualty coverage.

By the numbers:

- Sixteen insurance companies left Florida in recent years.

- Eleven insurers in Louisiana have gone bankrupt, while another dozen have withdrawn from the state.

- The California Department of Insurance permitted Allstate® to increase rates by nearly 35% due to wildfire risk (and that was before the LA-area fires).

Why it matters: The combination of stiffer premiums and fewer providers is causing more households to lose insurance coverage, according to a new study issued by the U.S. Treasury’s Federal Insurance Office.

The bottom line: In more than 150 ZIP codes nationwide, insurers canceled at least 10% of home insurance policies in 2022.

Insurers dropped nearly 70% of policyholders in the Pacific Palisades in July 2024. As a result, more than 10% of homeowners there were insured by the California FAIR (Fair Access to Insurance Requirements) plan, the insurer of last resort.

Cancellation rates were highest in coastal areas in the Carolinas, including Hilton Head, Charleston and Myrtle Beach, which are exposed to hurricanes.

3. State’s FAIR Plan Financial Strain

California’s FAIR plan has expanded dramatically over four years and is now teetering on a financial edge.

Why it matters: Dwelling policies have surged by 123% and commercial policies by 161% since September 2020, placing the FAIR plan in a precarious position.

By the numbers:

- FAIR Plan’s exposure has ballooned to $458 billion, a 61.3% increase since September 2023.

- The reserves stand at $377 million, with $5.78 billion in reinsurance at risk, reports The Los Angeles Times.

The bottom line: The plan may need aid from member companies, leading to higher premiums for Californians. Under state law, excess losses are shared among all policyholders, regardless of wildfire risk.

Real-life impact:

- As the insurer of last resort, the FAIR plan’s coverage is less comprehensive than that of private insurers. After being dropped by State Farm, Jewlz and Terry Fahn told the Los Angeles Times that they saw a drastic reduction in coverage for their Pacific Palisades home.

- They obtained similar dwelling coverage, but personal property coverage plunged from $1.55 million to $153,000, and loss-of-use insurance dropped from $620,160 to $153,000.

The trend: California’s population has declined due to unaffordable housing. Rising insurance costs may further accelerate this trend..

4. A Tale of Two States

Thirty-four states and D.C. offer FAIR plans when private insurance options are unavailable.

Why it matters: While some states, like California, face financial challenges, North Carolina exemplifies robust public insurance planning, which is crucial in a state prone to wind storms.

By the numbers:

- North Carolina’s two nonprofit associations provide $205 billion in coverage for more than half a million risks.

- They effectively handled major events, paying $1.7 billion in claims after Hurricane Florence in 2018.

Success factors:

- Gina Hardy, CEO of NC’s insurance associations, credits success to adequate rate settings and stringent litigation controls.

- North Carolina subsidizes installations of Fortified Roof™ systems. These systems use higher-strength materials to prevent damage during severe weather, reducing insurer and policyholder costs.

Noteworthy impact:

- North Carolina State University found a 35% reduction in claims and a 22% reduction in loss amounts on properties with Fortified Roof systems.

The bottom line: The Tar Heel State’s proactive measures offer a blueprint for sustainable insurance solutions.

Go deeper: Watch my PolicyCast podcast interview with Gina Hardy below.

Click below to share your thoughts on this issue with me.

Did this issue of Capital Commentary get forwarded to you? Click below to have future issues sent to your email box.

Want to read past issues of Capital Commentary or watch previous episodes of the Arch MI PolicyCast podcast? Click the button below to go to Arch MI Insights.

About Arch MI’s Capital Commentary

Capital Commentary newsletter reports on the public policy issues shaping the housing industry’s future. Each issue presents insights from a team led by Kirk Willison.

About Arch MI’s PolicyCast

PolicyCast — a video podcast series hosted by Kirk Willison — enables mortgage professionals to keep on top of the issues shaping the future of housing and the new policy initiatives under consideration in Washington, D.C., the state capitals and the financial markets.

Stay Updated

Sign up to receive notifications of new Arch MI PolicyCast videos and Capital Commentary newsletters.