Happy New Year from Capital Commentary! As we step into 2026, a mid-term election year, we already see an increased focus on housing affordability from an administration hoping to maintain a GOP majority in Congress.

Signaling change: The Trump administration is promising massive reforms to address housing affordability. The president already announced his intention to ban institutional investors from buying homes and spent a portion of his speech at the World Economic Forum in Davos, Switzerland, on housing affordability. I expect it won’t be the last venue he will use to talk on the topic.

What’s in store? In this 2026 inaugural issue, Capital Commentary takes a deep dive into possible solutions to make housing more affordable. We explore what these changes mean for current and future homeowners.

Let’s dive in!

1. Big Thing: Housing Is Broken

We can all agree that housing in America is broken.

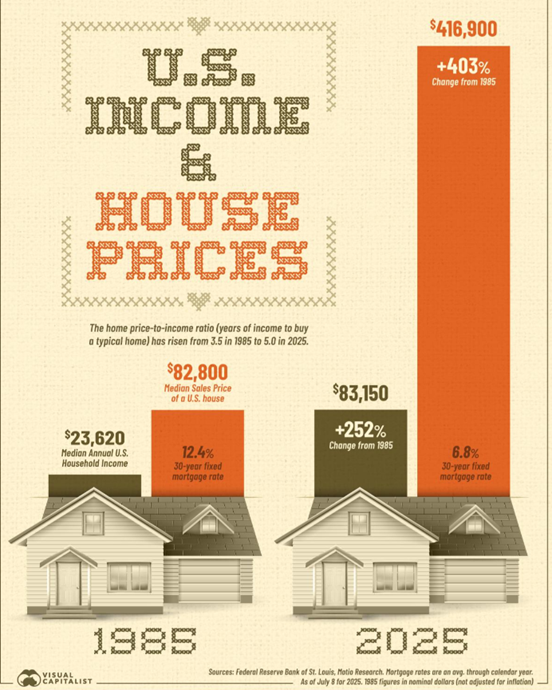

- Homeownership is increasingly out of reach as the gap between average earnings and the income needed to purchase a home widens. As the graphic below illustrates, while incomes have risen 252% since 1985, home prices have soared 403% over the past 40 years.

Why it matters: The American dream turning into a nightmare for so many has real-world implications. Simply put, the frustration of being permanent renters leads many people to give up, conclude researchers Seung Hyeong Lee and Younggeun Yoo in a recent report featured in The Washington Post.

“When housing becomes unattainable, people do not simply stay renters — they often change how they live, work and plan for the future,” the researchers write in “Giving Up: The Impact of Decreasing Housing Affordability on Consumption, Work Effort and Investment.”

On the other hand: They say the disparity suggests that renters who think they will be able to afford a home … are more motivated at work and committed to saving than those who have given up on the idea.

The big picture: Credit the Trump administration for its recognition of the housing crisis and its commitment to gather views from an array of interests — in Treasury and FHFA roundtables, in industry meetings and from constituents — on how to address it.

- As interest rates hover near or above 6%, unemployment ticks up and tariffs on building materials such as lumber, copper and cabinetry push the construction costs of homes ever higher, the time is right for significant corrective action.

2. Will an Investor Ban Boost Housing Stock?

President Trump’s announcement to ban large institutional investors from buying single-family homes sent shockwaves through Wall Street, reigniting a fierce debate on the root causes of America’s housing crisis.

Why it matters: With housing costs dominating voter concerns, Trump framed this move as a way to restore the American Dream. However, economists are divided on whether corporate landlords are genuinely pricing out families or serving as convenient scapegoats for a deeper supply shortage.

The big picture: Institutional investors — firms owning 100 or more homes — control less than 1% of the nation’s single-family housing stock, though they own 2–3% of the single-family rentals’ segment.

Southern exposure: Their holdings are heavily concentrated in Sun Belt metros, with 80% located in just 5% of U.S. counties. Atlanta leads with over 3% institutional ownership, while most markets see rates below 1%.

Markets reacted swiftly to Trump’s Truth Social post.

- Invitation Homes, the country’s largest single-family landlord, tumbled 6%. Blackstone and Apollo Global Management each dropped more than 5%.

By the numbers:

- Build-to-rent developments represented 7.2% of single-family starts in Q2 2024.

- Eliminating all large investor ownership would decrease national house prices by less than 1.7%, according to recent research conducted by Joshua Coven of City University of New York’s Department of Real Estate.

What they’re saying:

White House Advisor Peter Navarro argued that institutional investors wield outsized influence even with modest market share, suggesting that “rents can rise sharply at tenant turnover — at rates far above normal market increases.”

On the other hand:

Housing economist Jay Parsons called the move “not grounded in reality” and ineffective for improving affordability, pointing out that many investor-saturated markets posted rent growth below the U.S. average due to higher construction levels.

Cato Institute economist Scott Lincicome bluntly stated, “Institutional investors are just not the main market movers. It’s mainly a supply issue. This is populism 101.”

Reality check: The proposal faces significant hurdles.

- Similar legislation failed to gain traction recently, and legal challenges are expected if Trump moves forward.

- Fundamental questions remain, such as what defines a “large” investor, the fate of existing holdings and whether the ban would extend to build-to-rent developments.

Our thought bubble: Trump’s proposal may not be successful in Congress but in the court of public opinion, it is very popular, particularly among Millennials and Gen Zers who are struggling to buy homes.

Engage with Capital Commentary

Share your thoughts: We invite you to click here and share your insights on this issue.

Explore Arch MI Insights: Want to dive deeper? Click here to access past issues and listen to previous episodes of the Arch MI PolicyCast podcast.

3. Will New Loan Products Help?

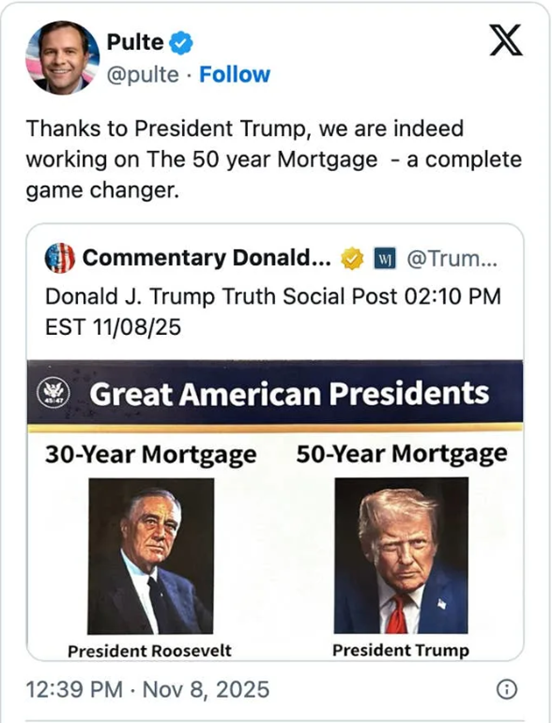

The 50-year fixed-rate mortgage was touted by President Trump and Federal Housing Finance Agency (FHFA) Director Bill Pulte to much fanfare late last year as a way to lower monthly mortgage payments for strapped borrowers.

What they’re saying: Pulte called the 50-year mortgage, “A complete game changer.” The idea was championed by academics from both sides of the economic aisle.

Eric Zwick, an economist at the University of Chicago Booth School of Business, said “Honestly, I kind of think it’s a fine idea. It’s not obviously so different from a 30-year fixed mortgage.”

Meanwhile, in New England:

John Campbell, an economist at Harvard, said “It’s not quite as outlandish as it sounds.”

Of course, not everyone shares those views.

Moody’s Economist Mark Zandi told Newsweek that borrowers taking on a five-decade loan would struggle to build equity — with most payments in the first decade being on interest rather than principal. With limited equity, homeowners would have less of a financial cushion should a shock occur.

Longer mortgage, higher prices? Joel Berner, senior economist at Realtor.com, warned that a 50-year mortgage would only spur demand, at the expense of borrowers.

“The result of subsidizing home demand without increasing home supply could be an increase in home prices that negates the potential savings.”

During a recent Arch MI PolicyCast, former Freddie Mac CEO Don Layton argued that cost projections for this proposal typically assume rates on 50-year loans will match 30-year rates.

- He suggested that higher interest costs in the loan’s initial period will outweigh other benefits.

Two other conventional products, assumable and portable loans, are also being promoted by the administration to spur home sales.

- Loans backed by the FHA and VA are assumable, meaning buyers could assume the seller’s mortgage at its existing interest rate. Loans purchased by the GSEs are neither assumable nor portable.

The bottom line: In the case of new products, the administration risks driving home prices and loan costs higher in the name of making housing more affordable.

- As one industry veteran told me, “It is clear they are looking for short-term silver bullets, but those don’t exist.”

4. Should Buyers Tap into Their 401(k)?

The administration wants potential homebuyers to have the option to tap into 401(k) retirement funds without penalty for early withdrawal as a source for a down payment on a new house.

Why it matters: With median home prices exceeding $420,000, even buyers putting just 5% down could need up to $40,000 to cover down payment and closing costs. Tapping into 401(k)s could make that possible.

But it isn’t without risks.

By the numbers:

- Nearly half (46%) of Gen Z workers have withdrawn funds from their 401(k) investments to pay down debt or cover emergency expenses, according to Payroll Integrations, a payroll software firm.

- Only about half of Americans have retirement accounts and fewer still have a 401(k), according to Federal Reserve and Congressional Research Service data.

What they’re saying:

“For something like this to really take hold and take shape, No. 1 is it’s got to come with an education component around it. What are the risks?” asked Sergio Altomare, CEO of Hearthfire Holdings. “What are the ramifications of hitting your 401(k) early? Maybe (we should add) some limits to it so people don’t deplete it to buy their dream home too soon.”

About Arch MI’s Capital Commentary

Capital Commentary newsletter reports on the public policy issues shaping the housing industry’s future. Each issue presents insights from a team led by Kirk Willison.

About Arch MI’s PolicyCast

PolicyCast — a video podcast series hosted by Kirk Willison — enables mortgage professionals to keep on top of the issues shaping the future of housing and the new policy initiatives under consideration in Washington, D.C., the state capitals and the financial markets.

Stay Updated

Sign up to receive notifications of new Arch MI PolicyCast videos and Capital Commentary newsletters.